If an account states “your business is in the red,” it means that your company’s financial health is in jeopardy. Being in the “black” is another term that you may hear, and it’s the polar opposite of being in the red.

What does in the red mean?

It means that your business:

- Owes money

- Is in debt

Financial Implications of Being in the Red

Red-line meaning in business means that you risk financial breakdown in your company. If you do not make drastic changes to rectify your finances, you risk going out of operation.

Why?

You'll have an entire accounting period of data to comb through to understand why your company isn’t profitable. If your accounting team states that you’re in the red, it is because you have not been profitable over the last accounting period.

The Red Zone Explained: Causes and Consequences

If your company is in the red, it’s a result of the following:

- Sales are declining, or

- Expenses are rising

Sales must exceed expenses for you to go from being in the red to being in the black. You can be in the red due to:

- Rising debt, which may need to be restructured

- Hiring new employees with the hopes of the hire’s activity driving future revenue

- Poor decision-making not considering the expenses of the business

- Product costs rising and failing to raise your prices to cover the expense

- Overstocking too many inventory items, causes you to run low on cash flow

Decision-making in the business is often the cause of the company going into the red. Your decisions must consider the revenue coming into the business and make choices that consider the cash flow of the company.

For example, HR may see the need to hire a new employee and do it without consulting with the accounting team.

In this scenario, there may not be enough revenue coming into the business to cover existing expenses and hire a new employee. Poor financial decisions can cause you to be in the red, but you can take this time to secure more financing for the company.

One study in the UK found that nearly 50% of SMEs were running in the red.

Many of these companies do not see the signs that they’re in the red until it’s too late. However, the signs below can help you navigate this challenging period.

Signs Your Business Might Be in the Red

A few signs that you may be a business in the red are:

- Customer payments are often late due to a lack of cash

- Paying suppliers is a challenge

- Profit margins are shrinking

- Growth has stalled, yet expenses are rising

- Sales are contracting without a cash surplus to cover expenses

If your business is often struggling to pay the bills and relies on the next invoice to cover expenses, it’s a good sign that your company is either in the red or teetering on the line.

Debt may also signify being in the red or being close to it.

Businesses that need to secure more debt to cover expenses without growth may be in debt in the very close future. Eventually, you’ll need to repay the debt that you take out, which may put you in the red or cause you to have difficulty getting back into the black in the future.

Navigating Financial Turbulence: Strategies for Businesses in the Red

Your financial health is a top priority at this time, and if you want to navigate the turbulent water, you can implement the following strategies:

- Reduce expenses that are unnecessary. You should have accounting tally up all of your expenses and find ways to “trim the fat.” Review subscriptions that you may have that are unused or eliminate duplicate subscriptions that are redundant. Consider staffing levels and if they need to remain at the same level.

- Increase the prices of your products or services if they haven’t been increased in recent years or if they’re well below market value.

- Restructure debt to avoid paying high interest rates. Pay off any debt that you can to keep more money in your business’s bank account and less money in the banks of your lenders.

Smart financial decisions are crucial for you to turn the tide. A lot needs to be done to become profitable again, but the steps below will allow you to slowly make the shift to profitability.

Turning the Tide: Getting Out of the Red

If you want to move from being in the red to being in the black, you can follow the steps below:

The Road to Recovery: Steps to Revitalize Your Business

What does in the red mean in business? You're spending more than you’re taking in during an accounting period. You'll want the accounting department to provide you with your income statement, balance sheet and cash flow statement.

You can use this data to better understand your business’s finances.

View this as step one.

Next, you’ll want to:

- Review your finances to find expenses that you can reduce

- Restructure your debt and reduce it where possible

- Secure low interest loans when no other options are available

- Put items or services on sale to push more inventory out of the business and increase cash reserves

- Eliminate products or services that do not offer high profit margins

- Work with stakeholders to find new ways to increase revenue or reduce expenses

Financial recovery is a long and tedious road, but it’s one that is necessary for businesses that are in or close to being in the red.

Preventing the Red Zone: Financial Tips for Businesses

If you want to improve or maintain the financial health of your business, it’s important to avoid going into the red. There are several things your business can do to keep your business in the black.

Managing Cash Flow Wisely: Tips for Sustainable Finances

One of the best things you can do to avoid putting accounting in the red is to manage your cash wisely.

With the right strategies, you can maintain positive cash flow, ensuring your business has enough funds to pay its bills.

Here are some tips to help improve your cash flow management:

- Offer discounts for early payments to encourage clients to pay on-time

- Wait until the due date to pay vendors and utilities

- Choose the longest possible amortization on loans

- Send invoices immediately after the work is complete

- Clearly state your payment terms on invoices

- Build an emergency cash reserve

- Offer a variety of payment options, including an online payment portal

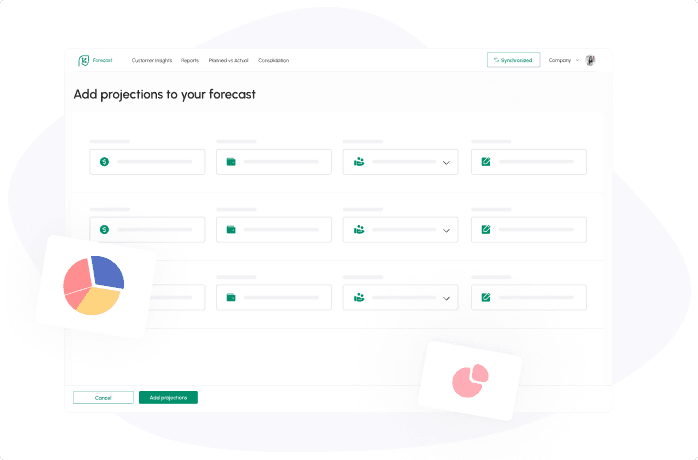

- Create cash flow forecasts regularly to prepare for the future

- Reduce unnecessary expenses to free up immediate cash

- Hold sales or special promotions to boost revenue and move inventory

Make sure that you’re keeping a close eye on your cash flow to ensure that your business is heading in the right direction.

Budgeting for Success: Strategies to Avoid Going Red

Every business should have a budget. Following that budget can help your business avoid going red.

Here are some strategies to consider:

Maintain a Slush Fund

A slush fund is, essentially, an emergency fund for your business. If there is an economic downturn or sales don’t pan out as expected, a slush fund can help prevent your business from going into the red.

Review Your Budget Regularly

The global economy is in a constant state of flux. It’s important to review your budget regularly to ensure that it aligns with the current environment and forecasts.

Reviewing your budget doesn’t have to be complicated. Compare your income with actual spending and identify the cause of any shortfalls or overspending you find. Then, make adjustments to ensure your budget is more accurate moving forward.

Implement Purchasing Controls

Implement documented purchasing procedures for employees that state:

- The person who authorized the purchases

- The maximum value of orders employees may place

Additionally, make sure that you have a process in place for approving purchase orders and invoices.

Without procedures and systems, employees may inadvertently spend more than allocated in the budget.

Diversification and Risk Management: Shielding Your Business from the Red Zone

An economic downturn or slump in sales can easily put a business into the red. One way to protect against these types of scenarios is to invest in risk management and diversification.

When done properly and strategically, diversification can help ensure that your business is still generating some revenue even when times get tough. How? By expanding into new, unrelated markets, products, services or industries.

Let’s say that your business expands into international markets. If the domestic market faces an economic slump, the international market will still generate revenue and may even outpace the domestic market for growth.

This simple example demonstrates how diversification can help shield a business from going into the red.

Conclusion

The last thing any business owner wants to hear is that their company is in the red. It’s important to understand the signs that your business’s financial health is in jeopardy and take steps to get back into the black as soon as possible. Implementing changes that help prevent you from going into the red in the future will help you build a sustainable business.

Related posts:

You may be interested:

New: