Business owners must consider the pricing of their products before they sell them. When you ignore pricing, you risk:

- Low profit margins

- Pricing goods too high

But one additional thing to consider is VAT and GST. If you don't create a VAT forecast or understand the three types of VAT GST, we're going to cover many of these topics in the following sections.

What is a VAT and GST?

VAT and GST are different things, but they're also very similar in nature.

What is VAT?

VAT is short for value added tax. Businesses must calculate VAT because it is a consumption tax on services and goods. The tax is applied at each stage in the supply chain. You can calculate VAT by:

- Calculating the cost of production

- Minus cost of materials

You'll find VAT used in 160 countries, with a major focus on the European Union.

What is GST?

GST stands for Goods and Services tax. Services and goods sold domestically for consumption may have GST attached to them. In most cases, the tax is a flat rate across all goods and services.

The GST in the countries that use this tax method is included in the final price of the product.

For example, if you see a store selling a shirt for 23 euros in Italy, you can be confident that GST is added in the price. In the United States, a $23 shirt doesn't include the tax in the final price. You'll pay more for the good or service, and taxes are levied on the state level for these goods.

How is GST different from VAT?

GST and VAT seem exactly alike – a tax – but they're different. Depending on the country, the main differences between the two are:

- Rate of taxation. VAT is often higher than GST. VAT is 20% in some countries, while GST can be 5% or lower.

- Certain goods are exempt from these taxes, but the exemption depends on the country and goods.

You also need to register for these taxes, which depend on two different thresholds. There are also multiple types of GST taxes:

- IGST for integrated goods

- SGST for goods and services

- CGST for central goods and services

- UTGSY for union territory goods and services

Working with an accountant as a business owner is crucial to ensuring that you're charging consumers the right amount for your goods and services.

How does Cash Flow Frog calculate VAT and make your life easier?

Cash Flow Frog can help you calculate both VAT and GST. When a new bill, projection or invoice is created, we use the current rates to calculate both VAT and GST. As a business owner, you have peace of mind in knowing that our automatic calculations are accurate and don't require user input.

Cash Flow Frogwill use the rate in your accounting software, such as in QuickBooks, to make these calculations. Since we integrate into these leading solutions, you never have to ask, "Is vat going up in 2022?"

The software will take care of the calculations for you.

Additionally, the tax will be included in your overall cash flow forecast. You'll know just how much money your business has in cash to make the smartest business decisions possible.

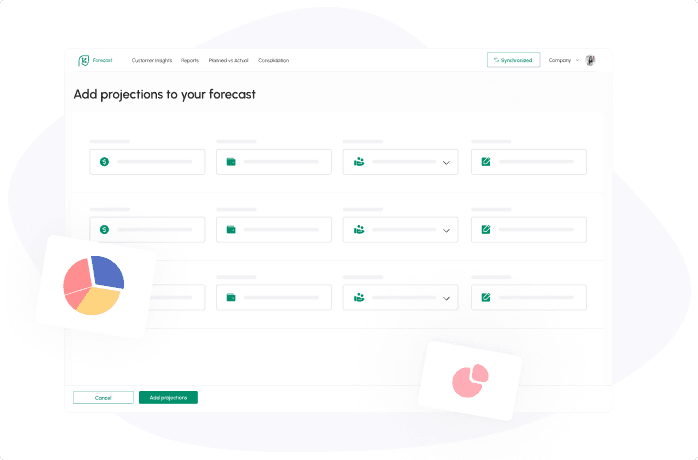

How to set up automatic calculation and forecasting of VAT?

Cash Flow Frog will ask questions when signing up for your account and then integrate neatly with your accounting software. We have an entire article on how to set up VAT cash flow forecasts and also GST returns.

Click here to view our article on VST/GST return setup in Cash Flow Frog.But the process involves:

- Clicking on the VAT or GST number in the status bar

- Slide the tab to your default country

- Save the settings

Once you save the settings and choose to add VAT or GST into your forecast, that's it. Your setup is done. Cash Flow Frog takes care of all additional steps for you. But the guide linked previously will walk you through this process with images that go through each individual step.

Who is this feature available to?

Cash Flow Frog allows users of all levels to calculate VAT/GST. However, the feature is only available in specific countries, such as:

- Australia

- New Zealand

- United States

If you're outside of these countries, you may not be able to calculate these taxes. Sign up for Cash Flow Frog today to start calculating and forecasting GST and VAT tax for your business.

Related posts:

You may be interested:

New: