A cash flow statement is an important financial statement that every business should be creating every month or quarter. If you’re a business owner, it’s important to understand the basics of a cash flow statement, what it contains, how it’s calculated and how it differs from other financial statements.

What Is a Cash Flow Statement?

Before we discuss the components of a cash flow statement, let’s answer an important question: what is a cash flow statement?

A cash flow statement is a financial statement that summarizes your business’s cash inflows and outflows. The data it contains gives you a clear picture of how well your company is managing its cash position.

It lets you know:

- Whether you have enough cash to cover operating expenses

- Where your money is being spent

- Where your cash is coming from

A cash flow statement is one of the three primary financial statements, with the other two being the income statement and balance sheet. It’s often used by lenders and investors to determine whether a company is financially sound.

Structure of the Cash Flow Statement

A statement of cash flows has three main components: Cash from Operating Activities, Cash from Investing Activities and Cash from Financing Activities.

Each of these components provides detailed information about where your cash is coming from and going to.

Cash From Operating Activities

The first section on a business cash flow statement is “cash from operating activities,” or CFO. The CFO section outlines the money generated from regular business activities, such as the sale of goods or the delivery of services.

Cash from operating activities does not include:

- Investment revenue and expense

- Long-term capital expenditures

It focuses only on the core business and provides insight into your operations' financial success.

CFO can include:

- Income tax payments

- Receipts from sales of goods and services

- Salary and wage payments

- Rent and utility payments

Cash From Investing Activities

Cash from investing activities, or CFI, is also included in a cash flows statement. It outlines how much money has been generated from or spent on investing activities, such as:

- The sale of assets or securities

- The purchase of a physical asset

- An investment in securities

Investing activities play an important role in growth and capital, so lenders may look at this section with greater scrutiny.

Cash From Financing Activities

Cash from financing activities, or CFF, outlines the cash used to fund the company. Financing-related activities can include loans, dividends and equity.

Changes in CFF are considered cash-in whenever capital is raised and cash-out whenever dividends are paid.

It’s important to note that while interest is considered a cash-out expense, it is not reported as a financing-related activity. Instead, it is reported as an operating activity.

CFF provides insight into how a company raises the cash it needs to grow or maintain its operations.

How Cash Flow Is Calculated

Now that you understand what a cash flow statement is and its components, let’s look at how to calculate cash flow. There are two primary methods: direct and indirect.

Direct Cash Flow Method

When calculating cash flow using the direct method, you do not modify your operating cash flow using the accrual method.

The direct method uses only the cash that has been received and accounted for, which provides a clearer picture of your cash position.

Indirect Cash Flow Method

The indirect cash flow method does take into account cash that has not landed in your business bank account yet, such as:

- Credit payments that have yet to be received

- Check payments that have not been cleared yet

While useful, the indirect method accounts for cash flow that may never actually be realized. Payments that have yet to land in your bank account may never make it there. The customer or client may go out of business or fail to pay their invoice. In this way, the indirect method is considered less accurate.

Cash Flow Statement vs. Income Statement vs. Balance Sheet

A cash flow statement definition doesn’t make it easy to differentiate between the following:

- Cash flow statement

- Income statement

- Balance sheet

We're going to provide you with basic statement examples so that you have a full understanding of what each type of statement offers and their key benefits.

Cash Flow Statement

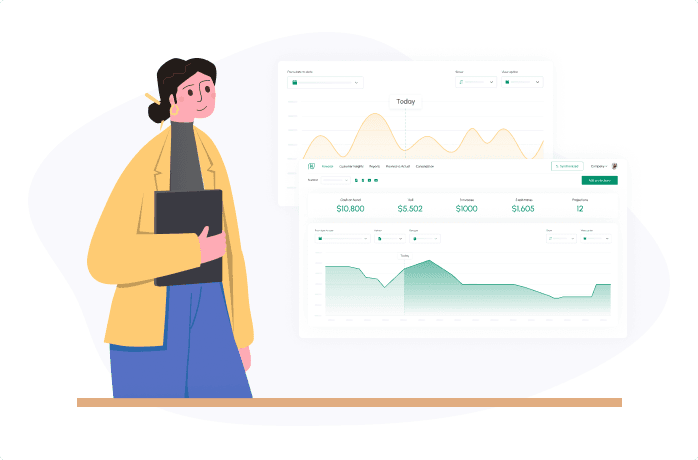

Your cash flow statement shows the crucial metric of:

- How cash enters the business

- How cash leaves the business

Cash flow statements do not include depreciation or similar non-cash income because it is not a form of liquidity that you can leverage if you need to invest in your business.

Your cash flow statement may be broken into:

- Operations

- Investing

- Financing

- Overall cash flow

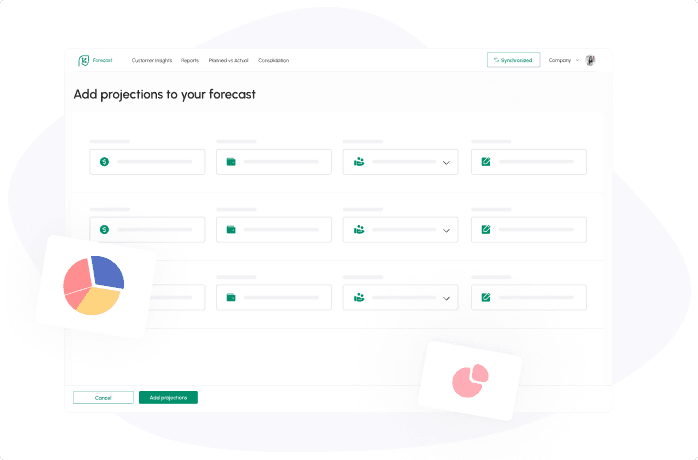

Projections and forecasts can be created using historical data so that your company has a better understanding of where your cash flow will be in one week, a month, a quarter or further ahead in the future.

Additionally, you’ll be able to view your cash flow statement to learn when you may need to secure additional funding because your cash flow is too low.

Cash flow is the life blood of your business. If you don’t have positive cash flow, you’ll either need to secure more financing or reduce your expenses. Most businesses fail because they lack cash flow to remain operational.

However, your cash flow statement shows just a portion of what’s occurring internally within your business.

Income Statement

A business’ income statement is all about income. Calculating your income is:

- Net sales

- Minus costs

Four income metrics are added to the cash flow statement to have a better understanding of your company income:

- *Gross income – offers an understanding of your company’s product creation efficiency. Your gross income is derived from totaling your sales and subtracting depreciation and cost of goods sold.

- Net income – your best indicator of your company’s profitability over a specific period of time. Your net income is the sum of your pre-tax income minus your income taxes.

- Operating income – the cost of operation is subtracted from your gross income. You will need to sum your income and subtract your rent, expenses, R&D and other fixed expenses.

- Pre-tax income – an indicator of your income before taxes, minus interest payments on debt and interest income.

Your income statement will also show the value of each individual company share. Businesses rely on income statements to have a better understanding of their income at multiple stages of their operation.

Balance Sheet

Your business needs a balance sheet. A simple balance sheet will provide you with a full understanding of your financial health through three main assets:

- Assets

- Equity

- Liabilities

Assets are listed in order of liquidity. For example, on the sheet, you’ll often see cash and equivalents first because they’re able to be used immediately. Securities are next, followed by accounts receivable (AR).

Your AR is less liquid than cash because there’s always a risk that the accounts will not be paid.

Inventory may be a bit lower on the sheet because you’ll need to either sell the inventory or use it to create products to sell. In both cases, there is a time delay between the final sale of the product, meaning that the inventory is less liquid than something like cash.

Long-term assets are also listed on your balance sheet, and a few of the items that will make it on this list are:

- Equipment

- Land

- IP

- Etc.

Balance sheets provide a robust overview of your business’ financial health and are a way to have a “check and balance” for your company. The company’s assets must equal out to your liabilities + equity, or something is amiss with your financials and must be sorted out.

You can view a cash flow statement example below – or sign up for Cash Flow Frog to create your own.

Conclusion

A simple cash flow statement can help you better manage your business and make financial decisions with less risk. You can use one of these reports through all stages of your operations:

- Startups

- Mid-sized business

- Enterprise

Running forecasts and projections will better help you position your company for the future. Your forecast will allow you to know when your free cash flow is too low and you need to make strategic changes, such as laying off workers or securing capital.

If you want to generate your first cash flow financial statement, we can help.

Related posts:

You may be interested:

New: