The Real Impact of Inflation on Business and How to Minimize Risks

Inflation doesn’t feel like a chart in an economist’s report; it feels like showing up to work and realizing the budget that covered everything last week suddenly doesn’t stretch far enough. The team’s running lean. Customers are hesitating. And every new invoice asks for more.

For many businesses, especially smaller ones, the impact of inflation on small businesses isn’t abstract; it’s felt in real time. It reshapes daily operations, hiring decisions, and long-term planning. But while the pressure is real, it’s not unbeatable. Let’s look at what inflation changes and where you still have control.

What Is Inflation and Why It Matters to Businesses

Inflation is the gradual rise in the cost of goods and services, meaning your money doesn’t go as far as it used to. For consumers, that might mean a higher grocery bill. For businesses, it’s the courier invoice that quietly jumped 12%, the supplier updating prices every two weeks, or the employee who knocks on your door to talk about their rising rent.

While it’s often treated as a macroeconomic issue, the mechanics of inflation quickly show up in day-to-day operations. Reflectively, inflation moves prices and alters decision-making style and timing. Even a slight rise in raw material prices may postpone the launching of a product, necessitate a pricing policy reevaluation, or require renegotiation of a supplier, which was not on the monthly agenda in the previous quarter. All the budgeting and other aspects, like hiring, become difficult to plan.

Dig deeper into how inflation moves through different sectors, and it’s clear why so many businesses feel pressure to act quickly. Even routine decisions can carry more weight and less certainty in a high-inflation environment. Understanding the impact of inflation on business allows one to place the context of high stakes in forecasting, pricing, and decision-making. With inflation gradually increasing and business leaders attempting to keep up with the competition, learning how inflation affects a business is the initial step towards making improved, stress-free decisions.

Key Ways Inflation Affects Businesses

You won’t feel the same effects of inflation on your expenses, prices, and customers immediately. The first steps in changes in cost, prices, and product/service demand demonstrate how does inflation impact business operations apart from balance sheet results, including strategy, flexibility, and customer dealings.

Here are some of the most common and immediate effects of inflation on business that leaders need to stay ahead of:

1. Cost Increases

You’ve seen it already, maybe in your materials order, utility bill, or delivery costs. If your margins are tight, every percentage point bites harder. Even small increases add up fast.

According to the Office for National Statistics, over 70 percent of companies in some industries, such as manufacturing and logistics, may have had a raw input cost rise of over 10 percent in 2023. This trickled down to everything from carrier bags to point-of-sale systems in retail. Such inflation in prices places daily trade-off choices on whether to absorb the price, postpone, or pass the price.

None of the answers is simple, but they each have long-term consequences.

2. Pricing Instability

If you raise prices too often, customers may lose confidence. If you don’t raise them, margins shrink. Either way, pricing becomes a balancing act. For small businesses, every pricing decision feels loaded too much and you risk churn, too little and risk survival. And customers notice, especially when prices rise without context.

Some businesses introduce price tiers or limited-time guarantees to ease the transition. Others resort to value bundling: providing something more at a slightly higher price to cushion the feeling against inflation. A pricing strategy based on the transparency of value and the openness of increasing prices is much more sustainable than one that assumes the consumer's attention deficit.

That is among the most transparent manifestations of the impact of inflation on business in real time, making it obligatory to make uncomfortable pricing decisions and find ways to talk to customers.

3. Shifts in Consumer Demand

People buy differently during inflation. They look for value. They delay non-essentials. That shift affects what you sell and how you market it.

For example, service businesses report clients resisting optional add-ons or extended timelines. Meanwhile, physical product companies are more interested in mid-range offerings than premium or luxury tiers. In response, businesses adapt with simplified product lines, seasonal pricing, or temporary value offers to align with buyer behavior.

Discover how our cost forecasting tools can help you stay ahead of rising costs.

See how it worksRising Operational Costs: The First Impact

Operational costs are the first place inflation hits. Rent, supplies, fuel, and energy often rise with little warning. You may not be able to renegotiate every contract or switch suppliers. That means your business absorbs the cost—unless you make changes elsewhere.

Start with a review. What are your highest recurring expenses? Which ones have increased in the last six months? Now ask: which of these still serve you, and which are habits? Which ones are locked in and which are flexible?

These questions don’t solve the problem, but give you a clear place to begin.

Pressure on Wages and Labor Retention

One of the less visible but deeply felt impacts of inflation is on your team. As the cost of living rises, so do employee expectations and hiring challenges, creating real pressure on wages and retention.

Employee Expectations

Inflation affects your team, too. Groceries, transport, housing, everything’s more expensive. Naturally, staff expect pay to keep up. If it doesn’t, they may look elsewhere.

Talent Acquisition During Inflation

Hiring also gets harder. Candidates want more security and higher pay. Businesses that don’t adapt risk long vacancy gaps or paying more later to catch up.

The most effective approach is to communicate transparently, even when you’re unable to meet every compensation expectation. People value transparency as much as compensation.

Reduced Consumer Purchasing Power

Inflation doesn’t just affect businesses; it directly impacts your customers. Due to a decrease in their purchasing power, the mode of buying changes in a way that is capable of altering the pattern of demand and revenue. The impact of inflation on business not only underlies financial aspects, but it also underlies strategic planning, like in marketing, inventory maintenance, etc.

Change in Customer Priorities

Inflation turns wants into luxuries. Essentials stay, and extras wait. This changes what customers value and what they’re willing to pay for.

For your business, it’s a signal to refocus messaging. Are you positioned as essential, helpful, or discretionary? Even minor tweaks to your frame value can help.

Slower or less Spending

Customers might still desire your product, but it will take longer to commit, changing the revenues, inventory planning, and cash flow. Be realistic and be patient. Clients, even ones who are loyal, will take more time, talk to others, and visit the alternatives systematically before buying. What used to be an easy sale will become an uncertain cycle with many steps. Take this opportunity to solidify long-term relations, despite taking a hit in the short term in sales.

Profit Margin Compression

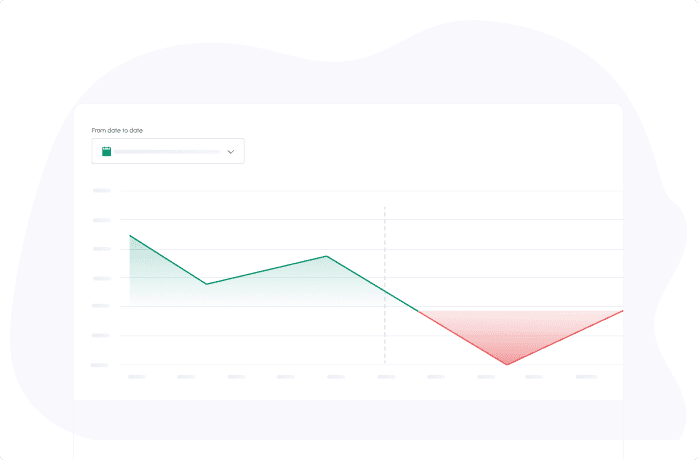

Although revenue may not be an issue, inflation may not be obvious, but it can gradually decrease what is essential: profit. Once the cost increase exceeds price manipulations, businesses will experience pressure on margins. This gradual leak in the profit is indeed a hidden, vital aspect of the overall impact of inflation on business activities, and one that most people do not realize until it has been eroded. The impact of inflation on a small business is especially sharp here, as thinner margins leave less room to absorb rising costs or delays in passing them along.

Revenue Growth ≠ Profit Growth

Sales may stay steady or even grow during inflation. But rising costs can wipe out gains. You’re not making less; you’re keeping less. And that subtle shift keeps you awake at 3 a.m., doing mental math on next month’s payroll.

Many fall into the trap of celebrating revenue wins without watching net profit. Inflation doesn’t always shrink top-line numbers; it hides its impact further down. That’s why tracking operating margins is critical when evaluating the effects of inflation on a business’s profitability.

A strong reporting rhythm, weekly or monthly instead of quarterly, gives you faster signals when margin erosion starts.

Fixed Costs vs. Variable Margins

Your rent doesn’t change. Your insurance premium likely doesn’t either. But your costs for materials, freelancers, or logistics might. That imbalance narrows your margins sometimes more than you expect.

Small businesses selling physical goods might face a $5–$7 increase in packaging costs per unit, an amount that can severely impact profit margins if unmanaged. If profit per sale was already slim, this slight shift may reduce margin by 25–40%.

This is where having dynamic cost models helps. If you know your breakeven point and watch costs closely, you can adjust pricing or cut scope before it becomes urgent.

Financing and Borrowing Become More Expensive

Higher inflation usually means higher interest rates. That affects:

- Loans

- Lines of credit

- Refinancing options

Debt becomes more expensive, and access to credit may tighten. If you plan to borrow, factor in a longer horizon and higher costs.

Difficulties in Financial Forecasting and Budgeting

Forecasting used to be annual. Now, it might need to be monthly, another example of how does inflation affect a business in practical, day-to-day ways.

Inflation adds unpredictability to every financial model. Instead of relying on fixed projections, consider:

- Rolling forecasts

- Scenario planning

- Cost tiering (need-to-have vs. like to have)

Such tools do not ensure accuracy, but they provide you with the dexterity to change gears when circumstances move much quicker than your spreadsheets. Go through our real-time cost tracking tools to be abreast of price changes. Learn more about our features.

Business Strategies to Mitigate Inflation Risks

Here’s how to deal with inflation in a business way that’s measured, not panicked:

- Review vendor contracts. Look for renegotiation opportunities or discounts for longer terms.

- Rethink pricing. Minor, precise adjustments are better than big, sudden hikes.

- Prioritize cash flow. Speed up receivables. Delay non-urgent expenses.

- Cut friction. Streamline workflows to reduce wasted time and labor.

In addition, consider:

- Forward purchasing agreements. Secure pricing now to avoid future spikes.

- Reevaluate your break-even analysis. Know the new numbers and how far you can stretch.

- Consider switching to local or regional suppliers to minimize inflation-driven logistics costs and reduce dependency on volatile international freight rates.

- Create a pricing review team. Involve finance, operations, and customer success to align changes.

If you’re looking for a practical guide to mitigating inflation risk in business, ask, "What’s creating avoidable cost and can I change it?"

Tailored for SMEs, accountants, and finance teams

Explore our solutionsDigitalization as a Response to Inflation

Technology isn’t a silver bullet, but it helps, especially when used with clear intent.

- Automate repeat tasks

- Track expenses in real time

- Use CRM tools to stay connected with customers

You can track cash flow daily with tools like Xero, QuickBooks, or Zoho Books. Inventory programs such as TradeGecko or Katana avoid too many and too few orders. It is also easier to retain customers via routine email traffic, feedback loops, or even clever CRMs that detect the signs of churning early enough. Digitalization saves time and visibility and allows one to operate faster without expanding the number of employees.

Scenario Planning: Preparing for Different Inflation Outcomes

Planning becomes even more critical when considering the high inflation impact on business, which can shift cost structures and customer behavior faster than many companies are prepared for.

- What if inflation stays flat?

- What if it increases by 5%?

- What if it spikes again?

Use these models to test decisions before they happen. You don’t need to predict the future. You just need to be ready for it. Having multiple plans gives you a more flexible foundation for how to deal with inflation in a business landscape that refuses to stay still. In unpredictable markets, it’s not the biggest or fastest businesses that win, but the ones that remain ready to move.

Built for SMEs, founders, and finance leaders. Discover our solutions for small businesses.

Ready to take control of your cash flow?

Start free trial

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now