One of the biggest reasons startups fail is because they run out of cash. Proper cash flow management can help startups maintain operations and plan for steady, sustainable growth. One important component of cash flow management is creating cash flow statements.

A cash flow statement for startup can help the startup better manage its finances. Let’s take a closer look at how to create a cash flow statement.

What Is a Cash Flow Statement?

A cash flow statement is a financial document that outlines all of the cash inflows and cash outflows for a company.

The purpose of a cash flow statement is to give the owner a detailed look at the financial health of the business and what happened to its cash during the statement period.

Components Of a Cash Flow Statement

A cash flow statement for startup looks at several key areas of the business to paint a clear and complete picture of the company’s finances.

The components of a cash flow statement include:

Cash Flow from Operating Activities

The cash flow from operating activities includes any sources of income and spending for the business. It looks at the cash generated from a business’s services or products.

Income or expenses from operating activities can include:

- Sales of goods or services

- Rent and utility payments

- Income tax payments

- Salary and wage payments

- Interest payments

- Payments to suppliers or service providers for production

- Any other operating expense

Cash Flow from Investing Activities

The cash flow from investing activities includes all of the cash generated and spent on investments.

These can include:

- Investment income

- Investment purchases

- Loans to vendors or received from customers

- Payments associated with mergers and acquisitions

Cash Flow from Financing Activities

The cash flow from financing activities includes cash coming into or out of the business when funds are raised or dividends are paid.

This section of a cash flow statement can include:

- Cash from banks or investors

- Dividends paid to shareholders

- Stock repurchases

- Repayment of debt principal

When Should a Startup Make a Cash Flow Statement?

Both new and established businesses should prepare cash flow statements regularly in order to stay on top of their finances. A cash flow statement for startup should be created on a monthly basis, but they may also be needed when seeking financing or investors.

How To Calculate Cash Flow?

Creating cash flow statement for startup is a straightforward process.

Here’s a simple formula for calculating your cash flow:

- Cash flow = Total cash inflows – Total cash outflows

Cash inflows are the cash that’s coming into your business. Cash outflows are the cash that’s flowing out of your business.

If your cash flow is a positive number, this indicates that your business is able to cover its expenses.

If your cash flow is a negative number, this indicates that more cash is leaving your business than coming into it (i.e., your spending is too high or you’re not generating enough sales).

It’s important to note that learning how to calculate cash flow is different from learning how to make a projected cash flow statement for startup. A projected cash flow statement looks at the future, whereas a regular statement will look at the current month.

How To Analyze Cash Flow Statement for a Startup Business

Analyzing a cash flow statement for startup is an important step for any startup. Companies that are in this stage of growth have many concerns:

- Growth may be moving too quickly, which can cause issues with cash flow.

- They may need to hire more staff to meet their growing needs.

- Sales may be sparse because the company is still in its early stages.

A cash flow statement can provide insight that startups can use to make better decisions related to hiring, growth and sales.

It’s essential to take a close look at each line item in the cash flow statement and determine how it’s impacting the business. Make sure that you’re analyzing your negative cash flow to determine whether it’s just growing pains or an issue that needs to be addressed right away.

The Importance of a Cash Flow Statement for a Startup

It is crucial to create a cash flow statement for startup because cash flow statements are one of the most fundamental financial documents for a business.

Cash flow statements are important because they:

- Help startups understand their spending activities. For example, loans are typically not included in profit and loss statements, but they are in cash flow statements. Taking out a loan and repaying it will have an impact on the startup’s cash flow, so it’s important to have a clear picture of spending habits.

- Help startups make plans. Cash flow statements provide a detailed look at how much cash a startup has on hand. This helps them make more informed plans for the future.

5 Tips to Managing Cash Flow in Startup

Creating a cash flow statement for startup company is just one piece of the puzzle. It’s essential to use the information from these statements to help improve cash flow management.

Here’s how startups can improve their cash flow management:

- Optimize spending. Make sure that your spending is focused on areas that will provide a healthy return. Cut back on expenses that aren’t absolutely vital.

- Prioritize talent spending. Startups often need to hire more talent to continue with their plans for growth and launch. Make sure that spending is done properly and optimized to focus on the most impactful roles.

- Be smart about credit card use. Yes, credit cards can help startups bridge cash gaps, but relying too much on credit could put you in a debt hole that’s difficult to climb out of.

- Negotiate payment terms and options with suppliers. Longer payment terms will help keep cash in your coffers for as long as possible.

- Lease equipment. Purchasing equipment requires a large upfront investment. Leasing, on the other hand, allows you to get the equipment you need while keeping more cash on hand.

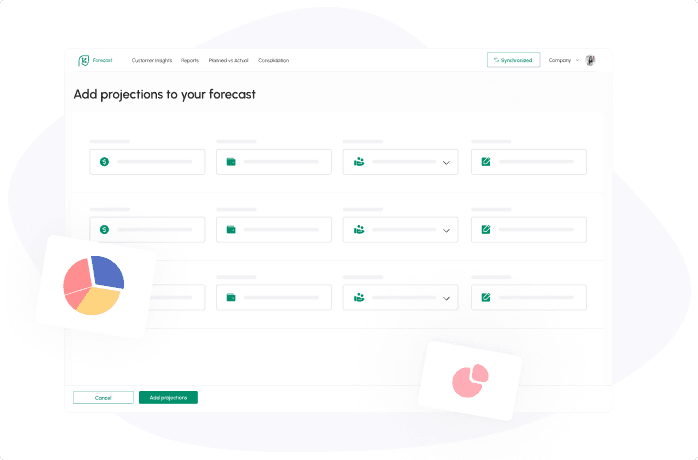

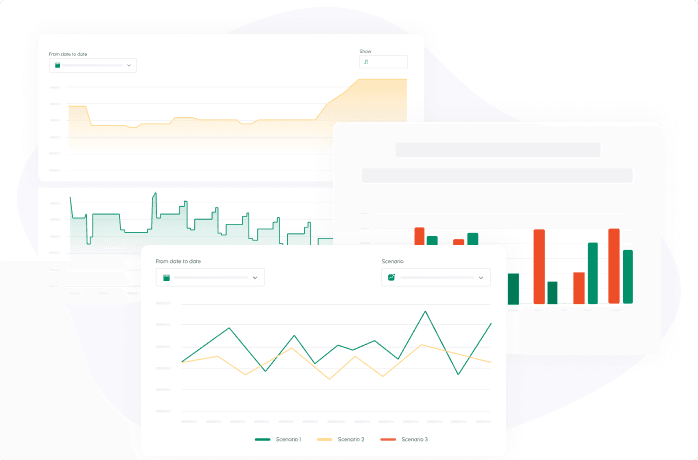

Why Does Your Startup Need Cash Flow Frog Software?

Software like Cash Flow Frog makes it easy for startups to manage their cash flow and plan for the future. Cash Flow Frog offers a complete set of tools to create cash flow statements, forecasts, projections, what-if scenarios and more.

Best of all, the tool integrates with accounting software, which automates cash flow management, improves accuracy and saves you time.

Related posts:

You may be interested:

New: