Cash flow management for real estate is just as important as any other type of business. If you run a real estate company, it’s important to understand what cash flow is, why it’s important, common issues with cash flow and how to manage it better.

What Is Cash Flow in Real Estate?

In real estate, the definition of cash flow is the amount of cash coming into and out of your bank account. It provides insight into the financial health of your business.

Every business, real estate included, has income and expenses. Income is the cash that flows into your business, and expenses are the cash that flows out of the business.

When cash outflows are greater than cash inflows, the business will have negative cash flow. Negative cash flow is a sign that the company is struggling to cover its base costs.

Understanding and managing cash flow is an essential part of running a real estate company.

Cash Flow Importance Real Estate Business

Do you really need to create a cash flow statement for real estate company? Why is it essential to track and manage cash flow for real estate? Because without healthy cash flow, a real estate business won’t be able to continue operations.

Yes, profit is important, but managing cash flow is arguably one of the most important aspects of running a business. Real estate companies, like other cash generating businesses, must ensure that their cash flow is managed effectively to maintain financial stability and growth. For example, if a real estate company doesn’t have the cash to pay its bill or cover payroll expenses, then it won’t be in business for long.

Proper cash flow management allows real estate companies to:

- Make better business decisions and plans

- Track their revenue

- Prevent cash shortfalls

Income can sometimes be unpredictable for real estate companies simply because of the nature of the industry. Understanding and managing your cash flow will allow you to build up reserves to weather slow periods.

Additionally, when you’re managing and tracking your cash flow, you can determine whether the business is bringing in less income than expected. If the company is underperforming, then it may be time to adjust your marketing plan or business strategy.

Cash Flow Problems in Real Estate Companies

Real estate companies are not immune to cash flow problems. In fact, they have their own unique issues that can kill their cash flow without remedial action.

Common cash flow problems in real estate include:

Vacant Properties

When properties are vacant, they do not generate income. However, they still have the same expenses.

The goal of every real estate company is to keep vacancy rates low to ensure a steady stream of income each month. Providing a desirable property and excellent support to your tenants can help you achieve that goal.

Higher Property Taxes

Fluctuations in property taxes will affect a real estate company's cash flow. Higher property taxes mean less cash is coming into and staying in business.

Raising rent can help offset these higher costs, but higher rent may lead to:

- Lost tenants

- Late rent payments

If real estate businesses do not prepare for tax increases every year, they may find themselves facing an unexpected shortfall of cash.

Late Payments from Clients

Unfortunately, late payments are a reality that real estate companies need to be prepared for. When clients or tenants delay payments, it has a negative impact on cash flow.

Having clear payment terms is crucial and can help prevent this cash flow problem.

Additional Unexpected Expenses

Unexpected expenses can also impact cash flow, and these types of expenses are relatively common in real estate companies.

Along with vacancies and delayed payments from customers, real estate companies also need to worry about unexpected repairs and maintenance.

Tenants can be unpredictable. Life can be unpredictable, and this can lead to unexpected repairs.

- A leak may happen in the middle of the night

- A furnace may need to be repaired or replaced

Often, major repairs or maintenance tasks will be discovered after the tenant moves out, but it’s still important to be prepared for them while the unit is occupied.

Otherwise, an unplanned repair can have a significant impact on your cash flow – and not in a good way.

Poor Management of Cash Flow Fluctuations

Real estate companies are unique in that cash flow is constantly fluctuating. E-commerce businesses may make several sales a day, while a real estate company may only collect large payments a few times per month.

Proper cash flow management is the key to keeping the business afloat.

Poor management will only mean trouble for the company’s cash flow.

Best Real Estate Markets for Cash Flow

Pinpointing the best real estate markets for cash flow can be tricky because markets are always changing.

But when comparing markets, there are a few things to look for that may indicate a great potential for positive cash flow. These include:

- A favorable price-to-rent ratio

- Low property tax rate

- Affordable property prices

- High local population

- Low risks of flooding or hazardous weather

Markets that can meet this criterion will have the best cash flow for real estate companies.

Cash Flow Management Tips for Real Estate Companies

Along with performing a cash flow analysis for real estate investment, there are several other things a real estate company can do to better manage its cash flow.

Automate and Optimize the Process

One of the simplest and most effective things real estate businesses can do to improve their cash flow management is to automate and optimize the process.

There are many services and tools that can automate the process of creating cash flow forecasts, projections, statements and more.

Manual cash flow management can be time-consuming, and this can prevent businesses from keeping on top of creating statements and forecasts.

When the process is automated and optimized, it’s much easier to maintain your cash flow statements and forecasts because they don’t require a major time commitment.

Forecast Your Cash Flow

Forecasting is another important step in proper cash flow management. Creating cash flow forecasts will allow you to predict how much cash you will have in the future and whether you may have a cash shortfall that you need to prepare for.

Having a rolling cash flow forecast is a great way to stay on top of your cash flow. It’s updated regularly and changes as conditions in the market and your business change.

Reduce Costs

One way to improve your cash flow management immediately is to reduce your expenses. Lowering costs will immediately free up more cash that can be put into reserves or invested to grow the business.

Proper Bookkeeping

Real estate companies are like any other business. Proper bookkeeping is essential to ensure the business is running smoothly.

If you’re not recording every single transaction properly, then you’ll have a difficult time creating accurate and reliable cash flow statements and forecasts.

Find Deals for Investors

When it comes to cash flow planning and management, real estate companies can benefit from finding deals for investors. Finding deals will help bring in more cash and minimize shortfalls.

Prepare Financial Reports Regularly

It’s difficult to manage your cash flow if you’re not preparing financial reports regularly. Financial reports will give insight into the financial health of your business and allow you to make changes as needed to improve cash flow.

How to Improve Cash Flow in Real Estate Business

There are several ways real estate businesses can improve their cash flow, including:

- Increasing rent: Raising rent can help improve cash flow. However, it’s important to ensure that the increase is reasonable. Otherwise, you risk losing tenants.

- Find other ways to generate income: Installing laundry facilities, offering storage options and other amenities can add to your income. If these amenities come at a reasonable cost, tenants or clients will be happy to pay for them.

- Reduce turnovers: Finding ways to lower vacancy rates can help improve cash flow. Vacancies have a significant and negative effect on your cash flow. Ensuring your properties are occupied will generate a steady, healthy stream of cash flow.

These are some effective and simple ways real estate companies can start improving their cash flow today.

How Can You Calculate Cash Flow?

Calculating cash flow is a straightforward process for real estate companies.

- Start by creating a list of all of your income. Be sure to include all of your income sources, including those from dividends, interest and other non-traditional income sources.

- Now, create a list of your expenses.

- Start with your beginning balance for the period.

- Add your income (cash inflows).

- Now, subtract your expenses (cash outflows).

This figure is your cash flow.

Cash Flow Frog - Best Cash Flow Forecasting Software for Business

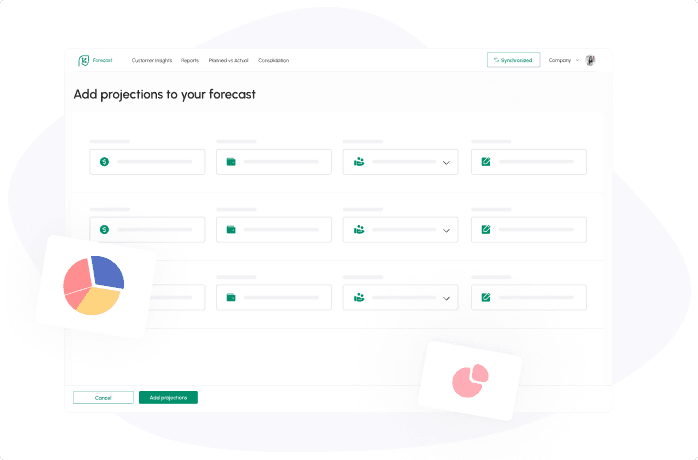

Creating cash flow forecasts is important for every real estate business, but it can be a tedious and time-consuming process if you do it manually.

With Cash Flow Frog, you can create cash flow forecasts automatically online quickly and easily. The platform pulls data from your accounting software to ensure that only the most accurate and up to date information is used.

Along with forecasts, you can create projections, reports, what-if scenarios and more. Cash Flow Frog is a complete cash flow management solution for real estate businesses of all sizes.

Related posts:

You may be interested:

New: