Cash flow drives the day-to-day health of your business. While profit measures long-term success, cash flow keeps operations running—covering payroll, rent, growth initiatives, and more.

One cash shortage or unplanned expense can mean everything grinds to a halt. But what if you had a way to see those risks before they hit? That’s the power of cash flow forecasting.

So, why is it important to have a cash flow forecast?

A cash flow forecast offers a precise view of money entering and leaving your business over a set timeframe. Without it, planning for your business operations becomes challenging. A forecast helps you spot potential cash shortfalls and allows for better strategic planning, ensuring financial stability.

Let's explore the cash flow forecast benefits and drawbacks to help you understand how this powerful tool can enable you to pursue new opportunities confidently when utilized properly.

9 Advantages of Cash Flow Forecasting

The benefits of cash flow forecasts are immense, helping improve competitiveness and proactive management. Here are nine key advantages:

1. Predict Future Cash Positions

Why is a cash flow forecast important? It illuminates upcoming inflows and outflows, giving clarity to operational costs and investments. This clarity ensures operational costs are met, investments are prioritized, and challenges are prepared for. Seasonal businesses know this all too well. Planning for those dips means staying stable year-round.

2. Ensure Stable Growth

Unplanned growth can strain resources, but the benefits of using a cash flow forecast ensure stability by aligning reserves with expansion needs. For example, it reveals whether hiring staff or purchasing equipment is financially viable, preventing overextension.

3. Facilitate Debt Reduction

Effective debt management is one of the key advantages of cash flow forecasting. It highlights when surplus funds can be used to pay down debt. This approach strengthens financial health and improves creditworthiness, creating a healthier financial foundation.

4. Avoid Crippling Shortages

Cash shortages can halt operations, but understanding what are the benefits of a cash flow forecast helps businesses stay ahead of potential gaps. A forecast provides time to:

- Negotiate better vendor terms.

- Shorten payment cycles with early payment incentives.

- Secure alternative financing options.

Tools like Cash Flow Frog’s cash flow forecasting software offer actionable insights, helping businesses bridge shortfalls effectively.

5. Maximize Cash Surpluses

Forecasting helps identify surplus funds, allowing businesses to reinvest or save effectively. This demonstrates the importance of cash flow forecast, as it ensures that surplus cash is used wisely for new products, market expansion, or future opportunities.

6. Enable Scenario Planning

Scenario planning is one of the most dynamic benefits of forecasting, helping businesses prepare for “what if” situations:

- What if sales drop by 20%?

- What if expenses rise unexpectedly?

- What if we expand into a new market?

One of the cash flow forecast benefits is that you can simulate scenarios in seconds. You'll see the ripple effects instantly, so you can plan ahead.

7. Align Spending with Goals

Cash flow forecasting helps businesses align spending with long-term goals by categorizing income and expenses. This practice highlights the benefits of cash flow forecast for a business. By keeping accurate budgets and monitoring progress, businesses can meet revenue targets effectively.

8. Attract Financing Opportunities

Having positive cash flow projections boosts confidence among lenders and investors. The benefits of having a cash flow forecast include clear forecasts that demonstrate financial stability and profitability, making it easier to secure loans or funding.

Why it matters:

- Banks and investors evaluate forecasts to assess a business's credibility.

- Financial stability demonstrated through forecasts increases the likelihood of favorable terms.

Presenting a detailed forecast during investor meetings, for example, highlights preparedness and builds trust.

9. Streamline Payment Management

Late payments disrupt operations, but one of the key benefits of preparing a cash flow forecast is its ability to identify overdue invoices and assess their impact. This allows businesses to implement solutions like:

- Automated payment reminders.

- Flexible payment methods.

- Late-payment penalties to discourage delays.

To manage finances effectively, explore strategies on how to improve cash flow in a manufacturing business to tackle payment delays proactively. This will ensure smooth cash flow and uninterrupted operations.

Risks Associated with Cash Flow Forecasting

Despite the numerous advantages of cash flow forecast, it has its challenges. Recognizing these can help you improve the process.

Inaccurate Inputs

Poor data quality leads to flawed forecasts. Outdated or incorrect information can result in cash shortages or missed opportunities. Regularly update and review data and cross-check sales forecasts, accounts receivable, and payable information. Using integrated accounting tools can automate data collection and minimize errors. Prioritizing data integrity is essential for creating reliable forecasts.

Overconfidence in Tools

Relying solely on forecasting software without understanding its limitations can overlook critical insights. While these tools are useful, human expertise is necessary to interpret the data and adjust forecasts for specific business scenarios. For instance, reviewing a sales forecast example can provide valuable context that software alone might miss.

External Factors

Economic changes, regulatory updates, or global events can disrupt forecasts. Stay updated on industry trends to anticipate impacts. Build contingency plans and maintain a cash reserve to handle surprises. Use scenario planning to simulate outcomes and prepare for various situations, enhancing your resilience to external shocks.

Short-Term Focus

Focusing only on immediate cash needs? That’s a recipe for stagnation. Long-term goals must share the spotlight to ensure sustainable growth. A balanced approach keeps both short-term agility and long-term vision in check. Regularly review forecasts to maintain this harmony.

Making Cash Flow Forecasting Work for Your Business

The importance of cash flow forecasting extends far beyond the need for basic financial planning. Forecasting empowers businesses to navigate challenges, optimize growth, and make informed, data-driven decisions. With accurate projections, you can anticipate risks, attract investments, and achieve long-term success.

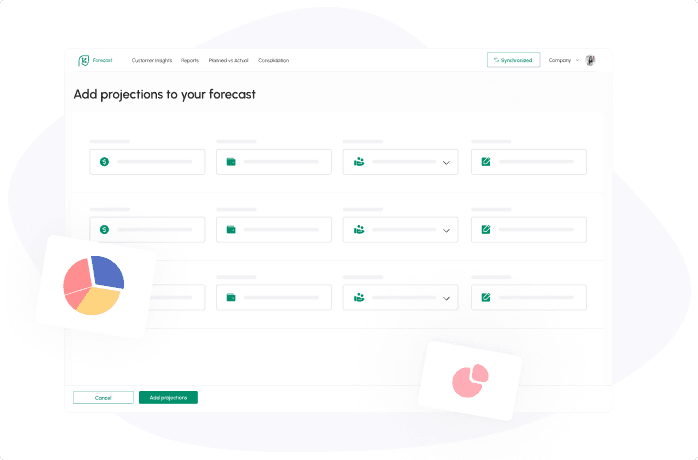

Getting started is simpler than you might think. To begin:

- Sign up for a Cash Flow Frog account.

- Connect your accounting software—no data entry is needed.

- Let the tool generate clear, accurate forecasts, providing valuable insights into your business’s financial future.

Start forecasting today! With Cash Flow Frog, you can experience cash flow forecast advantages firsthand by generating insights in minutes—no spreadsheets required. Connect your accounting software, and let the tool handle the rest. It’s that simple to secure your financial future.

Related posts:

You may be interested:

New: