Cash flow is one of the most important measures of success and sustainability.

Here are 10 great reasons why you should start planning your cash flow and budgeting from that plan.

Better Vendor Relations

When you have your cash flow under control, you’re able to pay your bills on time. For individuals this is important; for businesses it’s crucial. A good relationship with suppliers can get you better prices, extended credit in a pinch, and a vendor who is on your side if you ever need to make a special request.

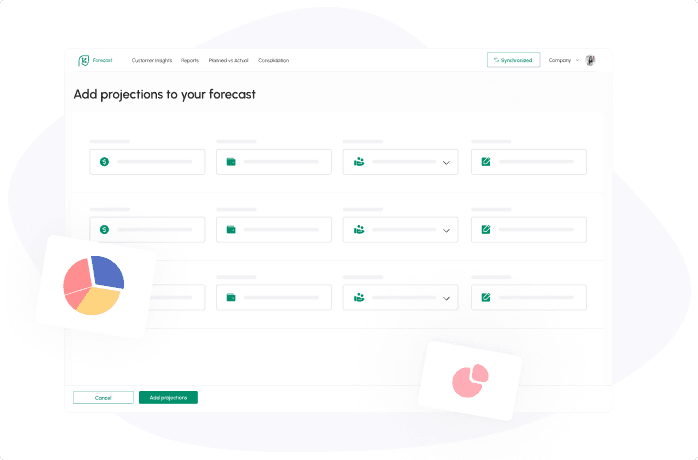

Know Where the Money Comes From

Planning cash flow lets you see where the money will be coming in and how much to expect. If you make sales on credit, you need a forecast or estimate of when they will be paid in order to properly plan your business.

Know Where the Money Goes

A cash flow plan that includes when bills are due and when expenses are expected lets you see when you need cash on hand. It also paints a clear picture of where your money goes, so you can evaluate if your spending on things that aren’t necessary.

Track Your Goals and See When You Miss the Mark

We know that positive cash flow is a good thing, but how positive should it be? Without a budgeted plan, there’s no way to compare your actual results to what they should be. So make a plan and hit those goals.

Stop Guessing

When decision time comes, a cash flow plan allows you to do “what if” scenarios to determine how your choices will impact your bank account. Stop guessing and start planning.

See the Highs and Lows

Most businesses go through ups and downs, both seasonally and weekly/monthly. A good cash flow plan allows you to see where the high and low points are so you can be ready.

Be Able to Cover the Low Points

Your plan will show you exactly what’s needed to cover the low points and slow periods in your business. If sales will be down but rent is still due, how much do you need to have reserved or how much might you need to borrow to cover the shortage?

Make Use of Extra Cash

Sometimes your business will have extra cash on hand. This is a great problem to have! But it doesn’t do any good just sitting there. When you know you’ll have extra cash and know exactly how much you need, you can invest the excess or take advantage of an early payment discount with a vendor to save money.

Better Employee Relations

If your business is still young, you’ve had those weeks when making payroll wasn’t easy. It’s stressful for a business owner but it’s also stressful for the employees. They know that there’s a chance their job won’t last. Always having a cash plan ensures coverage for paychecks and happier employees.

Cut the Stress

This could be a summary of the nine reasons above, but it deserves its own spotlight. When you know what to expect with your cash flow, it takes the stress and anxiety away. Business is a challenge, but you don’t have to go in blind.

Related posts:

You may be interested:

New: