What is Debt Factoring? Definition, Pros and Cons

Debt factoring is a practice that has increased by nearly 10% each year over the past five years. If you’re running a business or handling accounting and cash flow remains an issue in your company, it may be worth learning the:

- Debt factoring meaning

- How does debt factoring work

- Trade credit advantages and disadvantages

We’re going to explain all of these points in the guide below.

What Is Debt Factoring and How Does It Work?

Before considering whether or not this type of financial vehicle is right for your business, it’s important to learn what it is.

Debt factoring, also known as invoice factoring, involves selling your business’s unpaid invoices to a third party (the factoring company) at a discount.

In return, the factoring company provides an immediate cash advance, allowing businesses to cover expenses and maintain smooth operations while waiting for customers to settle their invoices. Once the customer pays the invoice, the factoring company deducts its fees and releases the remaining balance to you.

This debt factoring definition highlights how it helps businesses improve their cash flow and manage accounts receivable more efficiently.

The Significance of Debt Factoring

Debt factoring is significant for many businesses. Trucking companies are a prime example of when factoring may be most powerful. For instance, many truckers are left waiting for invoice payments, yet they have to cover fuel and maintenance costs for their vehicles.

For construction companies, factoring serves as a cash flow tool for construction, enabling them to cover expenses such as materials, labor, and equipment while waiting for clients to pay their invoices.

Factoring allows you to:

- Speed up payments

- Offload debt collection

- Operate without piling on debt

Cash flow management is the most important metric in any business. You can have 1000% business growth and still be running at a loss that forces business closure because you don’t have adequate working capital to cover expenses.

Real-Life Example

A debt factoring example is Fast Trucking, Inc., a transportation carrier, that struggled with cash flow due to delayed client payments.

To address this, they turned to invoice factoring, selling their accounts receivable for immediate funds. This allowed them to stabilize cash flow, cover operational costs, and maintain business continuity without financial strain.

Types of Debt Factoring: Recourse vs. Non-Recourse

Debt factoring can be categorized into two main types:

Recourse Factoring

- The business remains responsible if the customer does not pay the invoice.

- Lower factoring fees due to reduced risk for the factoring company.

- Ideal for businesses confident in their customers’ creditworthiness.

Non-Recourse Factoring

- The factoring company assumes the risk of non-payment.

- Higher fees due to the increased risk.

- Suitable for businesses with clients whose payment reliability is uncertain.

Understanding these types can help you choose the right B2B financing solution based on your business’s needs and risk tolerance.

Pros of Debt Factoring

The following advantages of debt factoring are why every business should at least consider using one of these services:

Improved Cash Flow Management

Source: Lukas/Pexels

Cash flow management and debt factoring advantages are intertwined. For example, trucking businesses commonly sell their invoices for 1% to 5% of the total invoice value. Businesses may opt to sell for a few reasons:

- Payment is late and they can no longer wait for cash.

- Surprise expenses materialize and they need cash.

Rather than taking out a loan, receivables financing can help a company cover payroll and expenses without needing to add debt to its balance sheet.

For SaaS companies, effective cash flow management for SaaS is vital to sustain recurring revenue models and cover operational costs while waiting for subscription payments or delayed invoices from enterprise clients

Focus on Core Operations

Tracking down debt and being paid takes massive time and resources. Imagine running a single-person business and needing to spend 4 hours for each invoice to contact accounting teams and demand payment.

Selling the invoice at a discount allows you to:

- Focus on your business’s core activities.

- Avoid wasting resources on receiving payment.

Fast Access to Funds

Sometimes, business is all about timing. Speed and timing of funds are why many companies use debt factoring.

Capital infusions allow you to:

- Take advantage of timely opportunities.

- Avoid taking on debt to cover expenses.

- Keep running your business without interruptions.

Cons of Debt Factoring

While there are many advantages to debt factoring, you must weigh the potential drawbacks carefully.

Costs and Fees

Debt factoring does come at a cost, and that cost can be high in some cases. Typically, factoring companies will advance you a percentage of the invoice (85% to 90%) and charge a fee (usually 3%) for every 30 days it takes for the customer to pay the invoice.

Customer Relationships

Another potential disadvantage of factoring is that it may damage your reputation and relationships with customers. The factoring company will be in charge of collecting invoice payments and will use its own methods for doing so. This could leave a bad impression on customers if their practices are too aggressive.

Qualification and Eligibility

Factoring companies have eligibility requirements, such as:

- Creditworthy customers.

- Minimum monthly sales thresholds.

- Payment terms of at least 30 days.

Meeting these requirements is easier than qualifying for a loan but can still pose challenges for some businesses. One of the common reasons why small businesses fail is their inability to secure sufficient working capital, especially for cash flow management during crisis, making it critical to meet these criteria or explore alternative financing options.

Pros and Cons Table

Here are some debt factoring advantages and disadvantages:

| Pros | Cons |

|---|---|

| Improved cash flow | Costs and fees can be high |

| Focus on core operations | May strain customer relations |

| Fast access to funds | Eligibility requirements |

Debunking Common Myths About Debt Factoring

Despite its benefits, debt factoring is often misunderstood, leading to myths that can deter businesses from using it as an effective financial solution.

Myth 1: Debt Factoring Hurts Credit Scores

Factoring does not impact your business’s credit score. It’s a sale of an asset (invoices) rather than taking on debt.

Myth 2: Factoring Is Only for Struggling Businesses

While factoring is useful for businesses in financial trouble, it’s also used by thriving businesses to manage growth and seize opportunities.

Myth 3: Factoring Means Losing Control

You retain control over your business. Factoring simply shifts the responsibility of invoice collection to a third party.

Is Debt Factoring Right for Your Business?

When determining whether factoring is right for your business, keep the following points in mind.

Assessing Your Business Needs

- Do you need to bridge a temporary, urgent cash gap, or is there a long-term issue with your cash flow?

- How much cash do you need? Invoice factoring will be limited to the value of your invoices.

- How quickly do clients pay their invoices? It may not be worth losing a percentage of the invoice if clients pay relatively quickly.

Making an Informed Decision

Debt factoring is a simple and quick way to infuse your business with cash, but it’s also expensive. For this reason, it’s important to weigh the debt factoring pros and cons very carefully before making your final decision.

Many businesses find that debt factoring disadvantages make it suitable only for temporary cash flow problems and should be viewed as a short-term solution.

Conclusion

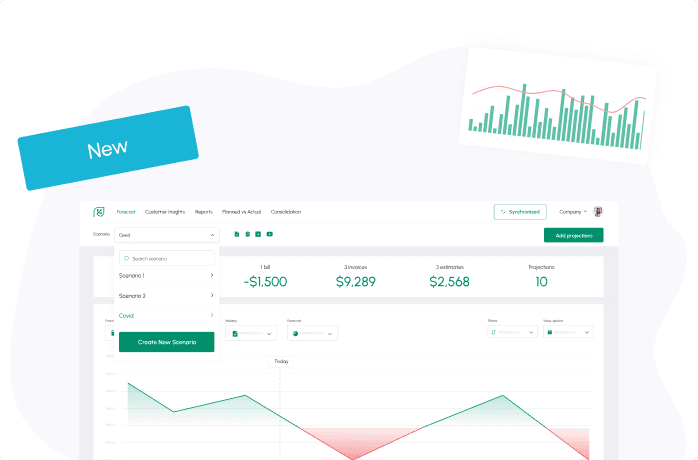

Source: Cash Flow Frog

Source: Cash Flow Frog

Debt factoring is one of many financial services available for businesses that need to bridge cash gaps, offered by companies such as Cash Flow Frog. Understanding what debt factoring is, its advantages and its disadvantages can help your business decide whether invoice factoring is the right choice.

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now