Direct vs Indirect Cash Flow - Which Method Fits Your Business Better?

The difference between the direct and indirect methods of cash flow reporting shapes how clearly a business owner can understand whether the company truly has the cash to support growth.

A cash flow statement bridges the gap between profit on paper and cash in the bank. Two reporting styles exist, so we’ve prepared this cash flow statement methods comparison to help owners choose which version explains their cash reality more clearly.

What Are the Direct and Indirect Methods of Cash Flow?

A cash flow statement helps business owners answer one key question: “Where did the money go?” It details the inflow of cash from sales and the outflow needed to support day-to-day operations.

The only difference in direct vs indirect method cash flow reporting appears in the operating section. Investing and financing activities remain identical in both formats.

Direct method

- Shows the actual cash collected from customers

- Shows the actual cash paid to employees, suppliers, and service providers

- Reads like a clear list of deposits and withdrawals in the business bank account

- Helps owners see real cash behavior without accounting adjustments

Indirect method

- Starts with net income from the profit report

- Adds back non-cash expenses such as depreciation

- Adjusts for timing differences when sales are booked but customers have not paid yet

- Feels familiar to accountants, banks, and investors

While the difference between the direct and indirect methods of cash flow affects how information is presented, both arrive at the same net result. One shows cash behavior directly in daily business life. The other translates accounting profit into cash to help explain performance to stakeholders.

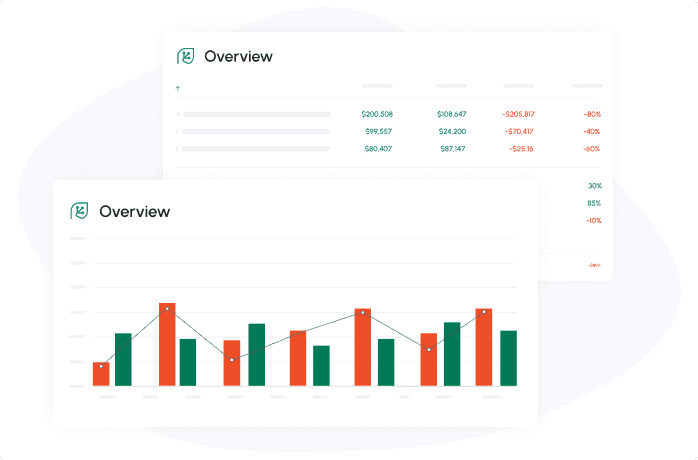

Image: Daily, weekly, and monthly view of financial data on Cash Flow Frog | source: cashflowfrog.com

How the Direct Method Works - Step by Step

The direct method follows cash exactly. It tracks receipts and payments from daily activity without requiring adjustments for accounting rules. Every line tells what happened with money.

Formula used with the direct method:

Net Operating Cash Flow = Total Cash Received from Operations minus Total Cash Paid for Operations

| Cash Category | Cash Inflow or Outflow (USD) | What This Means for the Business |

|---|---|---|

| Money collected from customers | 92,500 | Cash received after selling products or services during the month |

| Customer refunds paid | (2,500) | Money returned to customers for issues like returns or disputes |

| Payments to suppliers for merchandise | (45,000) | Cash spent to replenish inventory or materials used for sales |

| Payroll and employee benefits | (23,500) | Cash paid to employees, including wages, taxes, and benefits |

| Rent, utilities, and service expenses | (7,200) | Cash required to keep the location running day to day |

| Interest paid on short-term debt | (2,300) | Cash paid to lenders for borrowing money |

| Net operating cash flow | 12,000 | Cash left after paying operational expenses from operational revenue |

The direct method shows that the $ 12,000 left is actual cash in the bank. Profit might look bigger on financial reports, but this number tells the owner what can truly be spent next month on payroll, new stock, or any surprise costs without running short.

How the Indirect Method Works - Step by Step

Most businesses record revenue when goods or services are delivered rather than when customers pay. Expenses like depreciation do not involve cash at all. These rules create a mismatch between profit performance and real-life liquidity. The indirect method resolves that mismatch.

Formula used with the indirect method:

Net Operating Cash Flow = Net Income plus Non- Cash Expenses minus Gains plus or minus Changes in Working Capital

| Adjustment Step | Amount (USD) | What the Adjustment Means |

|---|---|---|

| Net income reported on P&L | 64,000 | Accounting profit |

| Add depreciation expense | 9,000 | No cash spent |

| Add amortization of software | 6,500 | No cash spent |

| Subtract gain on equipment sale | (3,400) | Cash from the sale is shown in investing |

| Increase in accounts receivable | (18,000) | Customers owe more cash |

| Increase in accounts payable | 11,700 | Bills recorded but not yet paid |

| Decrease in prepaid expenses | 2,800 | Prior cash outflow helped the current period |

| Net operating cash flow | 72,600 | Final cash impact |

The indirect method reveals that 72,600 dollars of operating cash actually reached the business, even though the profit report showed 64,000 dollars. The difference comes from timing and non-cash items. Customers still owe money, but unpaid bills and past prepayments helped boost cash this period.

Direct vs Indirect: Major Differences You Should Know

Owners typically want answers to practical questions that affect everyday decisions, so direct and indirect cash flow must be reviewed to decide which view supports better choices.

| Business Question | Direct Method | Indirect Method |

|---|---|---|

| How did cash move this period? | Shows each category of receipts and payments | Explains movement through adjustments |

| Can customer cash be seen clearly? | Yes, shown directly | No, mixed into receivable movement |

| Time required to prepare? | More tracking needed | Faster with existing accounting data |

| Good for lender communication? | Less familiar to lenders | Preferred by financial reviewers |

| Good for planning next month? | Very strong | Requires interpretation |

Both methods reveal the same bottom-line cash result, which proves that the cash flow statement’s direct and indirect method only changes how information is presented, not the outcome.

Explore how Cash Flow Frog financial reporting software automates direct and indirect cash flow statements.

Read morePros and Cons of Each Method

Choosing between the direct and indirect cash flow method becomes easier when the benefits and trade-offs reflect real business situations rather than theory.

Advantages of the direct method

A direct method of cash flow statement shows exactly where cash came from and where it went. Owners immediately see whether customers paid on time and whether spending increased faster than sales.

This visibility helps prevent cash surprises and supports smarter decisions about inventory, staffing, and vendor payments.

Disadvantages of the direct method

Tracking every type of cash inflow and outflow takes effort. Without reliable systems and consistent bookkeeping, the data can fall behind. Because external reviewers often prefer the indirect format, having a statement of cash flows in direct vs indirect versions may come in handy for banks or investors.

Advantages of the indirect method

Cash flow statement indirect method connects profit to cash, which strengthens reporting for lenders, accountants, and investors. It highlights whether growth creates real liquidity or locks money in receivables or stock.

Disadvantages of the indirect method

Owners who focus on the bank balance may struggle to connect the adjustments to their daily reality. Profit can look strong while cash remains tight if timing shifts go unnoticed. To understand a statement of cash flows direct vs indirect, fully, seek guidance from a finance professional.

Image: Forecast scenario feature on CashFlow Frog | Source: cashflowfrog.com

Which Method Should Be Used to Forecast Cash Flows?

Cash flow forecasting using the cash flow method allows owners to anticipate how future events will affect cash. The direct method supports short-term forecasting because it follows payment behavior. If customers typically take 30 days to pay invoices, this method clearly shows the delay, so owners can prepare.

Long-term forecasts often start with projected profit and then adjust based on expected working capital needs. That reflects the indirect logic. Investors care about long-term value, so strategic forecasts incorporate indirect thinking.

Many organizations use both because viewing direct vs indirect method cash flow side-by-side helps balance simplicity and compliance. Directly helps run the business day by day. Indirectly supports growth planning and capital strategy.

When the Direct Method Makes Sense

Companies with daily or weekly cash demands benefit from a method that mirrors the bank account. Restaurants, retailers, e-commerce shops, repair services, and construction trades often depend heavily on timely customer payments to fund operations.

When demand fluctuates, cash clarity keeps decisions grounded, a key reason service businesses favor the direct vs indirect method cash flow choice toward direct reporting. Owners quickly notice if the business is building reserves or falling behind.

When the Indirect Method Is Preferable

Industries with long sales cycles, subscription revenue, or formal financial audits find the indirect approach more natural. Profit timing rules become essential in manufacturing and technology businesses.

Private equity investors expect capital performance to be evaluated consistently. External audiences appreciate seeing how net income translates into cash because it signals sustainability.

When companies prepare for financing, acquisition, or expansion into multiple entities, the indirect method supports clean reporting transitions.

See how a financial forecasting tool supports smarter planning for business owners.

Read moreImpact on Stakeholder Reporting and Transparency

The difference between the direct and indirect methods of cash flow matters for what each stakeholder wants to understand.

Internal operators look for liquidity strength. External partners review profitability and capital efficiency. Employees want steady paychecks. Customers want reliable fulfillment. Banks and investors need evidence that the business can handle obligations and deliver long-term return.

In the direct vs indirect method cash flow debate, direct reporting helps internal trust by showing cash as it truly moves. Indirect reporting improves external confidence. Keeping both perspectives visible prevents surprises and promotes accountability on all sides.

Image: Share reports features on Cash Flow Frog | source: cashflowfrog.com

Implementation Considerations: Systems, Data and Processes

Accurate data makes direct and indirect cash flow reliable. Cash flow forecasting tools like Cash Flow Frog help convert data into actionable insight.

Banking activity must stay reconciled. Receipts from online platforms and point-of-sale systems should sync properly. Standardized categories help prevent confusion and ensure the statement of cash flows in direct vs indirect versions remains accurate and easy to interpret across reporting periods. Automation reduces human error and improves timeliness.

A reporting method becomes valuable only when information stays current, regardless of direct vs indirect method cash flow selection. A monthly update helps with strategy. A weekly update helps survival during uncertainty.

Common Mistakes and How to Avoid Them

Cash gets tight fast when leaders rely on profit alone as a guide. These recurring mistakes tend to create the biggest surprises:

- Celebrating revenue that has not yet turned into cash, such as large invoices with slow customer payment

- Recording equipment purchases or loan principal payments as operating costs, which distorts performance

- Reviewing cash flow too infrequently, which allows problems like rising receivables or shrinking vendor terms to pile up quietly

Asking, “Why did cash change this period?” helps owners correct course before a crisis forms. Compare trends using direct vs indirect method cash flow reporting.

Case Examples: Real-Life Scenarios

Cash pressure does not always appear in profit results. The real strain usually comes from when money enters or leaves the bank. The difference between the direct and indirect methods of cash flow explains why strong sales do not guarantee healthy cash.

These examples show why reviewing data using cash flow statement direct and indirect method helps a business avoid cash shortages.

| Business | Reported Revenue Pattern | Actual Cash Arrival | Cash Concern | Cash Flow Method | Why It Helps |

|---|---|---|---|---|---|

| Plumbing company | About 30,000 dollars per week | Only a portion received right away, the rest collected later | Cash is tight between jobs and invoice payments | Direct | Shows cash that is genuinely available today for payroll and purchases |

| Software consulting firm | 20,000 dollars per month | Payments come in only once every 3 months | Cash dips during months without payments | Indirect | Connects profit to cash timing so expenses can be planned safely |

For the plumbing company, knowing how much has been collected allows smarter purchasing and scheduling. Late cash no longer creates surprises before payroll.

For the consulting firm, matching expenses to quarterly payments prevents borrowing during low-cash months. Revenue still looks steady, but leaders now understand when cash may fall short.

Both companies are growing and profitable. The difference comes from timing. Understanding the difference between the direct and indirect method of cash flow keeps leaders prepared.

Clarity, Choice, and Confidence in Cash Flow Methods

A business that relies heavily on timing and weekly financial balance thrives with direct reporting. A business focused on investor relationships or complex accounting thrives with indirect reporting.

Many companies combine both views once they understand how the cash flow statement’s direct and indirect method supports different decisions for internal operations and external reporting. That alignment improves confidence when approving investments or scaling faster.

Ready to apply cash management best practices? Use Cash Flow Frog’s cash flow forecasting software today!

Start Free Trial

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now