What Is liquidity planning?

Payday shouldn’t feel like roulette. However, many small businesses can’t cover one month of expenses. That’s not bad luck — it’s a sign of a broken planning approach.

Liquidity planning can help you forecast cash, avoid payroll panic, and build breathing room before your balance hits zero.

What is liquidity planning? It’s your strategy for maintaining control over your cash position so you can meet obligations without scrambling. If you’ve ever delayed payroll or postponed payments because cash wasn’t available, you’ve experienced the consequences of poor liquidity oversight. Liquidity planning isn’t optional — it’s a core function that separates businesses that survive from those that thrive.

According to JPMorgan Chase, almost half of small businesses in America have a cash buffer of under 27 days. That margin is razor-thin. This guide explains what liquidity planning involves, why it’s essential, and how tools like Cash Flow Frog can simplify the process for any size business.

Defining Liquidity in Business Terms

Liquidity is your company’s ability to meet short-term obligations using cash or cash-equivalent assets. Unlike profitability, which reflects long-term performance, liquidity measures whether you can make payments when they’re due. It’s not about how much you’ve earned on paper — it’s about how much you can access now.

Timing is central to liquidity. Expenses such as rent, payroll, and loan repayments arrive on fixed schedules. Revenue often doesn’t. Effective liquidity financial planning ensures cash is available when it’s needed most, allowing for operational stability even in volatile times.

Liquidity planning meaning: It’s a proactive, structured process for forecasting cash availability, identifying potential shortfalls, and taking corrective action before problems arise. It’s the backbone of operational resilience and financial control.

Liquidity Planning vs. General Financial Planning

While general financial planning focuses on growth, investment, and long-term goals, liquidity management planning zeroes in on near-term execution: Will you be able to pay your bills over the next 30, 60, or 90 days?

Liquidity management is tactical. It enables the execution of strategic plans. Without short-term visibility, long-term ambitions become speculative. A solid liquidity management plan ensures that daily operations are uninterrupted, protecting your broader goals from disruption.

General financial planning tends to take a quarterly or annual view, but liquidity planning requires weekly and sometimes even daily insight. Businesses that integrate both perspectives position themselves for sustainable success.

Ready to take control of your cash flow?

Start free trial nowKey Components of Effective Liquidity Planning

A well-structured liquidity plan hinges on several essential elements working together. Forecasting cash inflows and outflows plays a pivotal role, as it provides the foundation for anticipating financial needs and ensuring sufficient resources are available to meet obligations.

Forecasting Cash Inflows and Outflows

Forecasting is the first step. You need to know what’s coming in and what’s going out. Begin your research by looking at historical data and then future expectations:

- Income sources: Sales, subscriptions, consulting fees, loans, and grants.

- Payment timing: When do clients usually pay? What’s the average delay?

- Seasonality: Are there regular periods of high or low cash flow?

Tools like Cash Flow Frog integrate directly with your bank accounts and accounting platforms to automate forecasts. These tools give you a clear picture of expected liquidity gaps before they happen.

Best practices:

- Account for late payments and irregular client behavior.

- Consider macroeconomic shifts and industry-specific trends.

- Use a rolling 6- to 12-month view to stay agile.

Liquidity planning and forecasting let you shape decisions with data, not assumptions.

Establishing Liquidity Buffers

A liquidity buffer is a financial safety net that helps you handle disruptions without derailing your operations. Think of it as your insurance policy against volatility.

To build an effective buffer:

- Target: Reserve 2–3 months of fixed operational expenses.

- Automate: Set recurring transfers to a separate reserve account.

- Optimize: Use high-interest accounts or short-term investments that preserve accessibility.

A buffer ensures continuity when cash inflows slow down or an unexpected expense hits. In practice, businesses that build buffers gain time to make decisions instead of being forced into reactionary cuts.

Scenario Planning for Different Financial Conditions

Scenario planning helps you simulate possible futures:

| Scenario | Revenue | Expenses | Net Cash Flow |

|---|---|---|---|

| Best-Case | $60,000 | $45,000 | +$15,000 |

| Expected | $50,000 | $45,000 | +$5,000 |

| Worst-Case | $35,000 | $45,000 | +$10,000 |

Response strategies:

- Best-Case: Reinvest in growth, prepay debts, or increase buffers.

- Expected: Maintain current strategy, monitor fluctuations.

- Worst-Case: Tap credit lines, delay non-essentials, renegotiate terms.

A prepared liquidity planner maps out triggers and responses, allowing faster and more confident action in real time.

How to Start Liquidity Planning for Your Business

The first essential step is assessing your current financial position, as it will help you understand what resources you have available, your existing obligations, and overall cash flow health. This will provide you with a baseline from which to plan strategically.

Assessing Your Current Financial Position

Before planning ahead, you need clarity on where you stand:

- Cash on Hand: What’s the current balance in your accessible accounts?

- Receivables: How much are you owed, and by whom?

- Liabilities: What payments are coming due?

- Cost Structure: Which expenses are fixed, and which are flexible?

A clear snapshot enables realistic goal setting and highlights areas for optimization.

Setting Realistic Liquidity Goals

Now, turn insight into intention:

- Maintain a 60-day reserve to handle emergencies without immediate action.

- Reduce Days Sales Outstanding (DSO) by 10–20% through better billing and follow-ups.

- Achieve a liquidity ratio (current assets ÷ current liabilities) of 1.5 or higher.

These benchmarks make your liquidity management planning measurable. Goals should be revisited quarterly to reflect changes in revenue cycles or market conditions.

See how our cost forecasting works

Learn moreTools and Techniques for Liquidity Planning

Among the various tools and techniques for liquidity planning, one of the most impactful is using cash flow forecasting software, which enables businesses to project future cash movements with greater accuracy and make informed decisions to maintain financial stability.

Using Cash Flow Forecasting Software

Human error can affect manual spreadsheets. Modern software for liquidity planning automates, streamlines, and enhances accuracy.

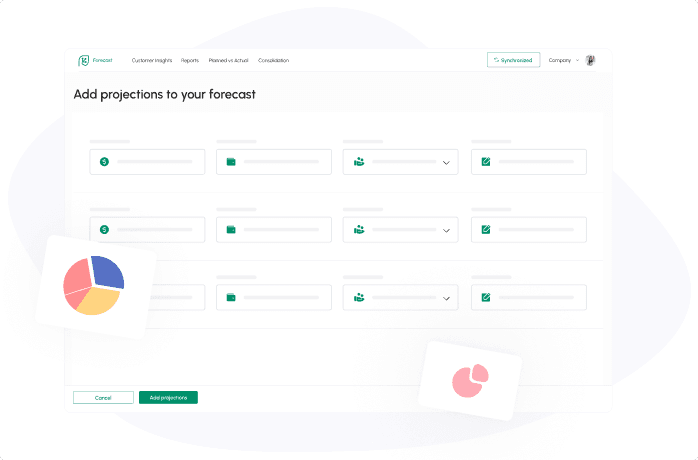

Cash Flow Frog offers:

- Real-time syncing with financial accounts

- Rolling forecasts and dashboards

- Scenario planning modules

- Alerts for low-cash thresholds

You can update your Cash Flow Frog plan as your finances change. This supports your immediate needs, but also gives you direction for the long term.

| Tool | Scenario Modelling | Real-Time Sync | Pricing |

|---|---|---|---|

| Cash Flow Frog | ✅ | ✅ | Mid-range |

| Float | ✅ | ❌ | Premium |

| Pulse | ❌ | ✅ | Entry-level |

Importance of Real-Time Financial Data

Outdated data causes blind spots. Real-time financial data empowers you to:

- Spot risks early before they become crises

- Make hiring and investment decisions with confidence

- Streamline alerts and monitoring with minimal manual effort

The right information at the right time is the foundation of effective cash management.

Liquidity Planning in Different Business Scenarios

Liquidity challenges vary across industries:

- Retailers: Face upfront inventory costs and delayed revenue due to seasonal demand.

- Service Providers: Often experience staggered payments tied to project phases.

- Startups: Rely heavily on capital injections and frequently operate at a loss.

Each model requires tailored liquidity planning strategies that reflect the business’s cash flow dynamics, risks, and revenue cadence.

Common Liquidity Planning Mistakes and How to Avoid Them

Avoid these common pitfalls:

- Relying on outdated forecasts: Weekly updates provide a clearer view.

- Ignoring client payment behavior: Account for late payers in your modeling.

- Profitability doesn’t necessarily mean liquidity: Revenue doesn’t equal accessible cash.

Solutions:

- Use automated tools for forecasting and alerts

- Conduct monthly stress tests using your liquidity plan template

- Maintain a dashboard of real-time liquidity metrics

Your goal is resilience, not just compliance.

How Liquidity Planning Supports Strategic Business Decisions

Robust liquidity management planning does more than cover the basics:

- Hiring: Know you can sustain a new salary long term.

- Investments: Jump on opportunities without cash constraints.

- Creditworthiness: Demonstrate control to lenders and investors.

Liquidity is not just a safeguard; it’s a catalyst for growth and agility.

Liquidity Planning for Small vs. Large Enterprises

Small businesses operate with limited buffers, so liquidity gaps can be existential. They benefit most from intuitive tools, rigid discipline, and scenario planning.

Large enterprises have more resources but greater complexity. Liquidity visibility often depends on cross-departmental coordination and consolidated reporting.

Regardless of size, the right liquidity planner can provide clarity and control.

Precise Planning with Cash Flow Frog Minimizes Risks

Spreadsheets aren’t built for today’s speed. Cash Flow Frog offers:

- Dynamic forecasting based on up-to-the-minute data

- Multi-scenario simulations for preparedness

- Proactive alerts and KPI tracking

Your liquidity plan should evolve as your business grows. Cash Flow Frog makes that evolution seamless.

Liquidity Planning Is Business Survival Planning

Uncertainty is constant. Payments get delayed. Costs rise. The real question is whether you’re caught off guard or already positioned to respond.

With a strong liquidity planner and modern software for liquidity planning like Cash Flow Frog, you’ll stay ahead of problems, act with confidence, and keep your business resilient.

Built for founders, accountants & finance teams

See how it works

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now