MIS Reports: Types, Meaning & Example

Management Information System reports are among the key tools helping modern businesses achieve this goal. But what are MIS reports? These reports summarize and interpret data used by organizations to appraise performance, observe trends, and make decisions. Understanding the meaning of MIS in finance is crucial, as it highlights how these reports can impact financial decision-making and strategic planning. This tutorial will examine the importance of MIS reports, their types, some practical applications, and how they are created.

What are MIS reports?

Management Information System reports are formal reports that combine information from various sources. They give a comprehensive overview of an organization’s performance. It is custom-made for managers to follow indicators or key factors such as revenues accrued, sales trends, or financial health. The reports present the data in an understandable way, making them effective in decision-making and formulation of strategies.

How Do MIS Reports Work?

The reports from MIS are produced by compiling, processing, and analyzing raw data from different departments. This usually goes through:

- Data Collection: Information is acquired from sales logs, inventory databases, and accounting software.

- Data Organization: Data is sorted out and organized by the organization's goals.

- Data Analysis: The data are analyzed using software tools to identify trends, outliers, and other actionable insights.

- Report Generation: Charts, graphs, and tables will be added to the report generation process to make the report more presentable.

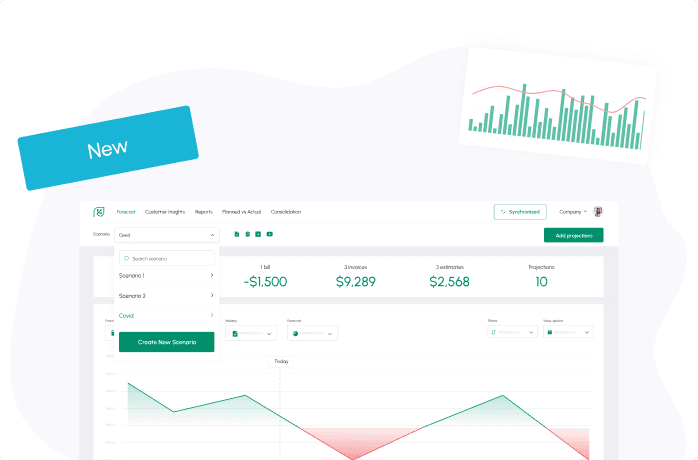

Businesses often use various instruments, such as cash flow forecasting tools, to ease the process and ensure the completeness of records.

Types of Reports in MIS

There are various types of MIS reports, each serving specific purposes. Let's look into eight common types of MIS reports.

1. Summary MIS Reports

Summary reports offer a broad overview of the operations of an organization. The data in summary reports comes from multiple sources and provides insight into:

- Gross Income

- Sales Performance

- Inventory Status

By using branded financial reports, businesses can create professional and visually appealing summary reports.

2. Trend MIS Reports

Trend reports focus on past data to identify trends and forecast future performance. They help businesses understand:

- Changes in market trends

- Changes in consumer behavior

- Performance metrics measured over specified timeframes.

For instance, a retail business might use trend reports to analyze seasonal sales trends.

3. Profit MIS Reports

Profit MIS reports are required to perform analyses related to financial performance. The reports involve factors like:

- Actual versus projected profits

- Key revenue drivers

- Underperforming segments

Understanding these metrics enables businesses to optimize their strategies for long-term profitability.

4. Inventory MIS Reports

Inventory MIS reports support businesses in stock-level tracking and effective inventory management. The reports show data on:

- Best-selling products

- Overstocked or understocked merchandise

- Inventory turnover rates

For instance, retailers rely on such reports to ensure sufficient supplies of relevant products during timeframes of high sales.

5. Cashflow MIS Reports

Cash flow management is critical for maintaining operational stability. Cashflow MIS reports offer insights into:

- In-flows and out-flows.

- Liquidity status

- Financial health forecasts.

A reliable cash flow forecasting tool can simplify the creation of these reports and help businesses plan ahead.

6. MIS Reports in Accounting

Accounting MIS reports summarize financial statements to provide insight into a company’s financial status. But what is an MIS report in accounting? The typical content of such reports includes:

- Income statements

- Balance sheets

- Tax compliance summaries

Such reports are essential for maintaining transparency in financial operations and complying with regulatory requirements.

7. Sales MIS Reports

Sales MIS reports are focused on business sales metrics. The key information would relate to:

- Revenue by Product or by Region

- Sales trend over time

- Customer Acquisition Costs

These reports enable businesses to fine-tune their sales strategy and concentrate on top-selling products.

8. Exception MIS Reports

Exception reports serve to identify anomalies or irregularities within business operations. They underscore:

- Anomalous sales or expense trends

- Errors in data entry.

- Operational constraints.

Addressing them beforehand allows the company to reduce risks and increase efficiency.

Real-life Examples of MIS Reports

The MIS report is crucial for smooth operations within businesses, performance analysis, and appropriate decisions. MIS reports are designed for different purposes. Here are a few examples of the uses of MIS reports in real-world applications:

- Retail Industry: Retailers use MIS reports to gain insight into sales trends, track best-sellers, and take the necessary inventory action to maintain the stocking levels of fast-moving items and control the levels of slow-selling items.

- Manufacturing Sector: Manufacturing companies use MIS reports to track production efficiency, manage supply chains, and identify bottlenecks. A production MIS, for instance, can show delays in the procurement of raw materials, thus mandating immediate corrective actions.

- Customer Service: Monitor response times and customer satisfaction metrics to improve service quality.

- Healthcare: Hospitals and clinics use MIS reports to analyze patient admissions, track resource use, and monitor outcomes. These reports help optimize staff allocation and enhance patient care.

- Finance and Banking: The MIS reports track cash flows, monitor loans, and analyze profits. They show liquidity, risks, compliance, and stability.

By leveraging industry-specific MIS reports, organizations gain a competitive edge, improve efficiency, and drive growth through informed decision-making.

How Are MIS Reports Generated?

MIS reports can be created manually or using specialized software. Here’s a detailed step-by-step guide:

The first step is gathering data. This includes information from each department head, such as sales, inventory, and finance, monitoring every metric. For this, raw data will come from a POS system, accounting software, or CRM platforms.

After gathering data, the information should be sorted out and systematically arranged. This entails categorizing information in terms of what the report is to achieve. For instance, the MIS report for inventory management will focus on the stock levels, product or product line turnover, and the trend of sales, while the profit report will focus on revenue, expenses, and margins.

Next is data analysis, which also involves highlighting patterns, trends, and anomalies. Organizations often analyze volumes of big data through analytical tools and software programs, which they can automate to ensure precision and save time. Charts, graphs, and tables are needed to present data upon analysis.

These graphical representations provide information in a form that stakeholders can interpret and action.

Lastly, confirm the correct information and format it professionally into branded financial reports to make it more visually appealing.

This process automation will go a long way toward enabling enterprise continuity, minimizing errors, and providing insight with visually appealing MIS reports in finance and MIS reports in accounting using a cash flow forecasting tool.

Expected MIS Reports for Different Levels of Management

Different levels of management require reports tailored to their specific responsibilities. A short comparison may be seen below:

| Management Level | Focus | Examples |

|---|---|---|

| Operational | Day-to-day metrics | Inventory levels, sales figures |

| Tactical | Departmental goals and performance | Trend reports, cash flow |

| Strategic | Long-term planning and forecasting | Profit analysis, market trends |

Why are MIS reports important?

MIS Reports enable the organization to transform raw data into helpful information, allowing leaders to make truly informed decisions. These reports identify key performance indicators relevant to companies' tracking of their financial health, operational efficiency, and market position.

MIS reports identify what needs to be improved and set the way for process improvement and organizational goals.

The key benefit of MIS reports is that they enhance the capability of making superior decisions. The reports provided through MIS supply the required information to correctly ascertain the risks and opportunities, be it the organization's expansion, new product introductions, or falling sales. Financial MIS reports, for instance, can point out cash flow and profitability trends, permitting the business to make judicious use of its resources.

MIS reports also enhance organizational communication. Comprehensive information summarized and presented on a standard template helps stakeholders, employees, managers, or investors understand the company's performance. This builds confidence and fosters cooperation.

Thirdly, MIS reports explain the trends and patterns in historical data that will further help in long-run strategic planning. In this way, businesses can anticipate the challenges and opportunities that will hit them and remain competitive.

Regularly generating MIS reports ensures businesses remain agile and competitive.

Conclusion

MIS reports are essential for organizations seeking to make informed decisions and achieve strategic goals. Businesses can create professional, accurate, and insightful reports by leveraging tools like Cash Flow Frog’s branded financial reports. Whether you’re analyzing inventory, tracking profits, or forecasting cash flows, MIS reports provide the clarity and precision you need to succeed.

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now