How to Evaluate Cash Flow Metrics That Actually Matter

Developing a financially healthy business requires understanding cash flow measures. Profit margins aren’t enough; monitoring fund flow is essential. Cash flow metrics show your ability to pay employees, fund growth, and handle challenges.

Why Cash Flow Metrics Deserve More Attention Than Profit

Substantial profits don’t show the full picture. Many companies still struggle with expenses or growth. Cash flow metrics show movement and flexibility that profit can’t.

Unlike accrual accounting, cash flow KPIs show precisely how much cash you have and where it goes.

Here’s why that matters:

- Liquidity keeps businesses alive: profit doesn’t pay the bills. Cash does. You need clear visibility into whether you can cover upcoming expenses, even during periods of slow revenue.

- Cash flow metrics reflect real-time financial health: profit reports show what happened in the past. You can see issues early and take swift action by using cash flow measurements, which show what's happening right now.

- They highlight timing mismatches: a company may appear profitable on paper but face a cash crunch because customer payments are delayed or expenses are incurred all at once.

- You can’t fake cash flow: profit can be adjusted by accounting methods. The actual flow of money is reflected in cash flow key performance metrics.

- They enable improved decision-making: CFOs, founders, and finance teams apply cash flow analytics to determine if they should invest, how to handle financial risk, and when to save resources.

- Investors and lenders depend on them: lenders seek robust cash flow to guarantee repayment. Investors are interested in knowing that your business can support its expansion without depleting its funds.

- They help you run lean and adaptable by supporting lean and flexible operations. Finding waste, optimizing cash cycles, and maintaining flexibility when conditions change are all made possible by tracking cash flow efficiency.

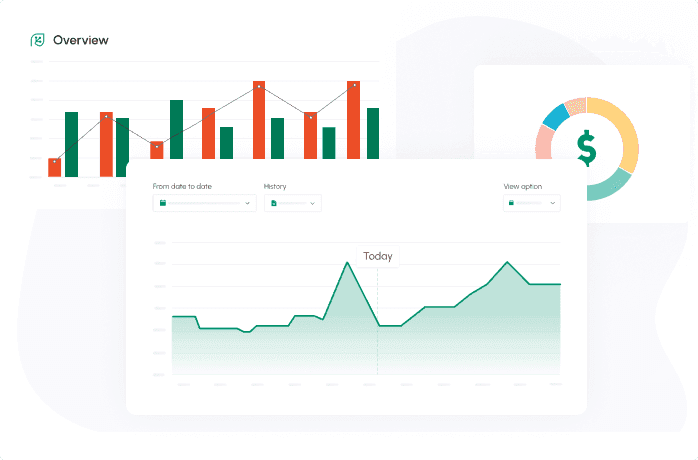

Profit shows earnings; cash flow shows movement and is essential to financial health, as the graphic below illustrates.

Track your cash flow metrics in real time

Start free with Cash Flow Frog

Focusing solely on earnings may conceal a worsening financial condition. Monitoring cash flow key performance indicators provides accurate, useful financial insight.

What Is the KPI for Cash Flow?

![]()

There’s no single cash flow key performance indicator. Instead, a set measures efficiency, timing, and adequacy to show business health.

Cash Flow KPIs vs. Financial KPIs

While financial KPIs, such as net margin or ROE, focus on earnings, cash flow KPIs highlight liquidity and timing. For example:

Cash Burn Rate shows how quickly your business consumes cash reserves.

Operating Cash Flow (OCF) calculates the cash flow from your core operations.

These two provide a fuller picture of your business’s ability to sustain daily operations.

Lagging vs. Leading Indicators

Some cash flow indicators look backward, like net cash flow from past quarters. Certain factors, such as growing DSO (Days Sales Outstanding), signal potential future issues. To avoid shocks, smart firms monitor both trailing and leading cash flow data.

These KPIs provide a comprehensive perspective on the actual flow of cash within your business.

How to Check If Your Cash Flow Is Healthy

Evaluating the health of cash flow will require an examination of patterns and timing rather than a focus only on figures. A positive net flow can still be deceptive if significant inflows and outflows unpredictably offset one another.

Patterns to Look for in Reports

Look for trends like steadily increasing OCF or a consistent cash flow margin. Over time, are inflows exceeding outflows? Are unexpected increases in costs indicative of a plan or a mistake? These questions are at the heart of effective cash flow statement analysis.

Cash Spikes, Dips, and Seasonal Curves

Each company has its tempo. For instance, during slower months, seasonal businesses frequently anticipate declines in cash flow. Variations that become excessive or unpredictable, however, can be a sign of subpar billing or inventory management procedures. At this point, real-time cash flow monitoring becomes essential.

You can anticipate issues, create more precise plans, and maintain stability throughout your business’s lifecycle by tracking trends.

Key Metrics You Should Be Tracking

You can react quickly, plan confidently, and grow sustainably by keeping an eye on the appropriate cash flow indicator.

These are the best cash flow metrics to monitor:

Operating Cash Flow (OCF)

Measures cash generated from core operations. A high OCF indicates that the company can finance its operations without outside assistance. It’s also essential for calculating other metrics, such as free cash flow.

Free Cash Flow (FCF)

This shows how much cash remains after investing in assets. The free cash flow calculation:

Operating Cash Flow – Capital Expenditures is known as FCF.

FCF is frequently utilized to evaluate firms, decide on dividend distributions, or gauge the possibilities for reinvestment

Cash Conversion Cycle (CCC)

The cash conversion cycle evaluates how long it takes to turn receivables and inventory investments into cash. Strong cash flow efficiency is indicated by a short CCC.

Days Sales Outstanding (DSO)

A high DSO indicates that clients are slow to pay, which can harm liquidity. A lower DSO results in faster cash inflows, improved forecasting, and increased working capital to operate or grow efficiently.

Cash Burn Rate

The cash burn rate, which indicates how long your reserves will endure, is particularly important for startups. Decisions on hiring, funding, and scaling may or may not be influenced by this measure.

Cash Flow Margin

This percentage shows how much of your revenue is turning into usable cash. It is an essential measure of cash flow efficiency ratio, operational health, long-term financial sustainability, and performance trends.

Net Cash Flow

This all-encompassing number adds up all cash inflows and outflows. It is simple, but it gives a powerful read on your business’s overall direction. You can see how much your company produces, spends, and saves using these cash flow measures. Examined collectively, they reveal comprehensive financial management.

Turn insights into action with cost forecasting

Explore forecasting featuresCash Flow Metrics Examples

Understanding cash flow performance means looking beyond profit and revenue. Two businesses may seem alike on paper, yet differ greatly when you examine their cash flow metrics.

Example 1: SaaS Business with Strong Profit but Weak Cash Flow

This company shows strong top-line growth and solid quarterly profits. However, cash flow measures reveal a different picture.

- Days Sales Outstanding (DSO) increases because clients often pay 45–60 days after the invoice.

- Operational Cash Flow (OCF) consequently stays low in spite of strong sales.

- A company can struggle to pay its employees during lean times or postpone payments to suppliers.

- High growth, but cash is constantly lagging behind

Key takeaway: Profit doesn’t always mean liquidity. Poor cash collection can lead to operational strain even when revenue looks strong.

Example 2: Manufacturing Business with Modest Revenue but Strong Cash Flow

This company doesn’t stand out for high profits or fast growth, but it has a tightly run operation when it comes to cash.

- Customers pay within 15–20 days, keeping DSO low.

- Inventory turnover is effective, leading to a reduction in the Cash Conversion Cycle (CCC)

- Expenses are well managed, and capital expenditures are controlled.

- Net Cash Flow remains positive quarter after quarter.

- Consistent tracking of receivables reduces the likelihood of overdue payments.

- Since cash flow forecasting is part of everyday activities, it enables the business to foresee problems instead of just solving them.

Main point: Effective financial management and streamlined processes can enhance stability and growth opportunities, even with limited earnings.

These instances show that the best cash flow metrics reveal the real movement of money within a company, showing that profit alone can be misleading.

What Is the Appropriate Way to Measure Cash Flow?

No universal method exists for how to measure cash flow performance. The right approach depends on your sector, business model, growth stage, and financial goals. Still, certain core metrics offer valuable insight when viewed together.

To understand how to measure cash flow, companies should track a mix of the following:

- Cash flow from everyday activities is shown in operating cash flow (OCF). A strong OCF shows that the company can make it on its own without outside funding.

- By subtracting capital expenditures from operational cash flow, free cash flow (FCF) is calculated. It represents your accessible funds for savings, growth, or dividends.

- Tracking the time companies take to convert investments in inventory and receivables into cash is known as the Cash Conversion Cycle (CCC). A shorter CCC suggests better cash flow efficiency.

- Cash Burn Rate is essential for startups; this metric indicates how quickly cash reserves are being depleted. A high burn rate with low replenishment means a shorter runway and higher risk.

To refine your analysis and guide smarter decisions, companies should also:

- Compare current cash flow to past performance to spot whether trends are improving or declining, and identify the underlying causes.

- Benchmark against industry averages: Understand how your cash flow metrics stack up against similar businesses.

- Generate forward-looking forecasts: Utilize historical and current data to simulate future cash flows across various scenarios.

- Account for seasonal variations or growth changes: Tailor your assessment to consider expected fluctuations in the timing or amount of cash flow.

Integrating these approaches provides a better understanding of the actual health, efficiency, and sustainability of your cash position.

Which Reports Help You See the Real Picture

To genuinely grasp your cash flow efficiency, you require something beyond merely a glimpse of your bank balance.

Adequate cash flow goes beyond the present balance; it involves understanding cash movement and identifying areas for optimization. The appropriate reports enable that to happen.

- Cash Flow Statement: Classifies cash movements to assist in evaluating expenditures and income sources.

- Aging Report: Assists in identifying and addressing overdue receivables, lowering DSO, and enhancing cash flow timing.

- Forecast: Allows you to plan ahead of time, stress-test multiple strategies, and be prepared for potential cash demands.

- Variance Report: Compare your cash flow estimates to actual results. It detects forecasting faults, closes gaps, and steadily improves accuracy.

These reports provide a clear picture of your financial condition, allowing you to make more informed budgeting, spending, and collection decisions.

Tools and Dashboards That Help You Track Metrics

Cash flow management does not need to be done manually. The latest advances in technology make it easier and faster to keep an accurate and transparent view of your cash flow KPIs.

The following are some of the better options:

- Cash Flow Frog: Offers simple scenario planning, graphic dashboards, and automated forecasting.

- ERP and accounting software: Cash flow reporting functions are included in tools such as NetSuite, QuickBooks, and Xero.

- Spreadsheets: Still used, but prone to errors and time-consuming to maintain.

The right dashboard should let you see patterns, flag anomalies, and run “what-if” scenarios efficiently. "

Ready to take control of your cash flow?

Sign up nowWhat to Do If Metrics Show a Problem

A financial crisis isn’t always due to cash flow, but liquidity issues need rapid attention because even small ones can quickly escalate.

Diagnose the root cause:

- Are slow-paying clients delaying revenue?

- Are expenses rising faster than expected?

- Is your DSO creeping upward?

- Are capital expenditures draining your reserves?

Take targeted action:

- Renegotiate customer/vendor terms.

- Defer large purchases and cut non-essentials.

- Invoice faster and collect more efficiently.

- Establish a line of credit or short-term finance.

The key is not to wait. Cash flow metrics act as early warnings, enabling action before minor issues grow.

Mistakes Companies Make When Analyzing Cash Flow

Many companies track cash flow but miss the big picture, leading to costly blind spots from outdated tools or poor strategy.

Below are some of the typical mistakes:

- Relying only on profit and loss reports: P&L statements show earnings, not liquidity. Without cash flow metrics, you may miss timing gaps that hurt operations.

- Disregarding seasonal patterns: Cash flow usually shows a seasonal pattern. When reserves are most needed, they may be strained if off-peak dips are not planned for.

- Focusing only on lagging indicators: Looking only at past performance delays your response. Leading indicators, such as rising DSO or projected shortfalls, help you act sooner.

- Not segmenting cash flow: Aggregated reports hide what’s happening within specific departments, clients, or product lines. Granular analysis reveals true problem areas.

- Depending on outdated or static reports, without real-time tools, you’re operating without visibility. Cash positions can change rapidly, and static information fails to reflect that.

- Monitoring numerous metrics without context: More data isn’t always beneficial. Dashboards overflowing with information can be confusing. Concentrate on the cash flow KPIs that are in line with your strategy and objectives.

Steering clear of these errors allows you to shift from a reactive to a proactive stance, empowering you to make wiser, quicker choices that safeguard your financial well-being.

In Conclusion

Acquiring skills in cash flow measurement is not just a financial pursuit. It is a discipline of strategy. By focusing on the right cash flow metrics, businesses may become more agile, lower risk, and make better decisions.

These measures, which reflect what's happening behind the scenes, range from free cash flow to cash burn rate. The best companies don’t just track metrics.

They respond to them. They leverage insights not only to understand growth but also to drive it forward. Tools like Cash Flow Frog make this process easier and more actionable. This is the real strength of cash flow metrics analysis.

Still unsure about cash flow metrics? Let us help. Message us today. Our team is here to support smarter, faster financial decisions.

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now