Flash Reports and Why to Build Them

For anyone running a business, a month can feel like an eternity when waiting on performance updates. By the time traditional reports land on your desk, you may have missed critical signs of what’s working—or what’s not.

Here’s where flash reports make a difference. These quick, targeted updates reveal what’s happening right now, giving you the edge to act on opportunities and respond to challenges in real-time.

Let’s explore what awhat is a flash report is, the key types to know, and exactly how you can make flash reports work for you.

What is a Flash Report?

Think of the flash report meaning as the daily pulse check of your business. Rather than wading through detailed data, a flash report presents a simplified view of essential numbers, which empowers faster, smarter decisions. It distills what matters most, like a scoreboard that shows the score without the play-by-play.

To grasp the full flash report meaning, it helps to think of it as a streamlined reporting tool, meant to capture only the most relevant data in the shortest possible time.

For example, picture a small bakery. Every day, the owner wants to see three basics: total sales, best-selling items, and daily expenses. Instead of combing through lengthy spreadsheets, a flash report provides these three details on a single page, making it easy to spot trends and respond accordingly.

Why Flash Reports Work:

Flash reports are specific, timely, and actionable. Say that the bakery owner’s flash report reveals the new lemon cupcakes sold twice as much as everything else yesterday. They now know to bake more of those for today. Or if sales unexpectedly dropped, they might quickly decide to promote certain items or offer discounts to boost sales. With flash reports, businesses don’t just track what happened—they gain insights on how to improve each day.

Types of Flash Reports

Flash reports come in several forms, tailored to specific business needs. Here are a couple of key types that deliver the right data at the right time.

1. General Ledger Flash Report

This flash report is a straightforward daily snapshot of the numbers that matter most financially. It might cover three essentials: revenue, expenses, and cash flow. This way, the General Ledger Flash Report provides a concise summary of how the business performed financially that day.

Example Scenario:

A small bookstore could use a General Ledger Flash Report to track revenue from daily sales, as well as the day’s expenses, such as payroll or inventory costs. If revenue doesn’t cover expenses, they’ll catch it fast and decide whether to adjust staffing, inventory orders, or marketing efforts to balance out costs.

2. Report on the Flash Manufacturing Purchasing Managers' Index (PMI)

For manufacturers, this flash report tracks production efficiency and inventory levels. It shows metrics like order volume, production levels, and inventory status, providing a quick overview of factory operations and the readiness to meet demand.

Example Scenario:

Consider a small factory producing custom furniture. A flash report at the end of each day could show how many pieces were completed, the current stock of materials, and any production slowdowns. If they’re running low on wood supplies, they’ll catch it early and order more, preventing potential delays and keeping production running smoothly.

Untrustworthy Flash Reports? Examine These Typical Errors

Flash reports can only be effective if they are accurate and timely. Unfortunately, some common pitfalls can lead to unreliable data, which defeats the purpose of using flash reports in the first place.

1. Inaccurate or Missing Data

Consider a coffee shop that’s pulling data for a daily flash report but misses a chunk of expenses. The profits look fantastic—but they’re missing half the story because costs weren’t fully accounted for. Without accurate data, the flash report provides a misleading snapshot, potentially leading to misinformed decisions. Ensuring every piece of essential information is included is key to producing reliable flash reports.

2. Delays in Reporting

Flash reporting depends on timely data. If yesterday’s numbers don’t come in until tomorrow, then today’s decisions can’t benefit from the insight. Imagine a clothing store missing out on a promotion opportunity because they received their daily flash report on sales two days late. The quicker the flash report arrives, the faster the business can respond to trends as they unfold.

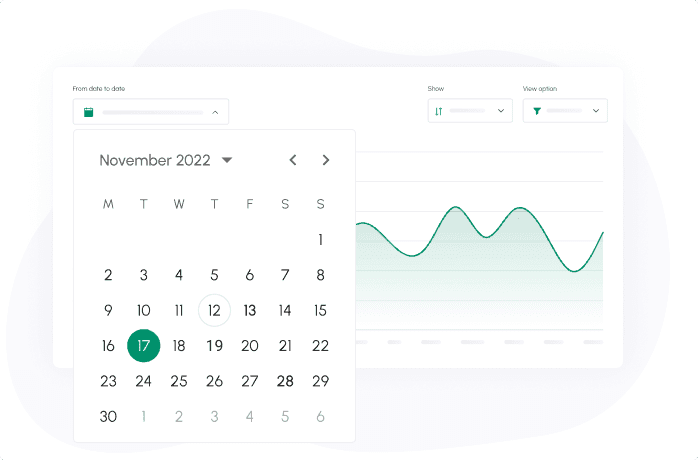

3. Overly Complicated Visuals

Complex visuals may look impressive but can detract from the clarity of a flash report. A clean line graph or bar chart typically works better than cluttered visuals. For instance, a coffee shop’s flash report showing only two clear charts—one for revenue and one for expenses—would provide a quick, meaningful summary without unnecessary distractions.

Tips for Creating Reliable Flash Reports

Creating effective flash reports doesn’t have to be complex or time-consuming. These practical tips will help keep reporting fast, clean, and insightful.

1. You’re Not Doing It Right if It Takes More Than One Hour

Flash reports should be quick to produce and review, not a drain on your time. If creating your report takes more than an hour, simplify the process. Consider using a flash report template, automated tools like Cash Flow Frog, or even dashboards that pull data directly from your point-of-sale (POS) system or accounting software.

Example Scenario:

A florist sets up a flash report template that automatically pulls data from the POS system, displaying daily sales and top items sold. Now, it takes only minutes to check daily performance, allowing the owner to focus on serving customers and arranging flowers rather than managing spreadsheets.

2. Although Visually Appealing, Keep the Narrative Front and Center

Visually appealing flash reports are great, but clarity matters more. Flash reports should communicate information immediately and answer key questions within seconds. Keeping visuals simple and the narrative straightforward helps ensure the report’s focus remains clear.

Example Scenario:

A restaurant’s flash report displays basic sales data, the cost of high-end ingredients, and best-selling dishes, along with a clean bar chart that highlights revenue-generating items. This layout puts the focus on the essential: actionable insights, not just the aesthetics.

3. Don’t Be Scared To Personalize Reports While Maintaining Consistency!

Each business has unique data needs, so a flash report should track what matters most. But once a format is settled, keep it consistent. Consistent flash reports make it easy to detect trends and changes over time, improving decision-making.

Example Scenario:

A gym uses a daily flash report to monitor new memberships, cancellations, and class attendance. They keep the format the same each day, allowing the owner to see if attendance drops or cancellations rise. The report’s structure remains steady, but the numbers are customized to track the gym’s unique focus.

Qualities of a Strong Flash Report

Every effective flash report shares key qualities, regardless of business type. The best flash reports have these characteristics:

- Timeliness: Fresh data ensures that actions align with the most recent business trends.

- Accuracy: Minimizing errors is essential for the flash report to reflect a true picture.

- Relevance: Including only metrics that directly impact decision-making keeps the report focused.

- Simplicity: Clean visuals and minimal noise make flash reports easy to read and understand.

Consider a small retail store that checks its daily flash report for yesterday’s sales, expenses, top-selling products, and overall inventory. A straightforward layout with just these essentials keeps the focus clear, showing only what matters for deciding whether sales strategies or inventory orders need adjusting.

Key Metrics to Include in Your Flash Reports

Knowing which metrics to include in flash reports ensures that each report remains focused, relevant, and actionable. The table below lists suggested metrics by business function, which can be adapted based on your unique operational needs.

| Business Function | Recommended Metrics | Purpose |

|---|---|---|

| Sales and Revenue | Daily sales, top-selling products/services, revenue by product category | Quickly assess performance trends, identify popular products, and adjust inventory or promotions accordingly. |

| Finance | Total revenue, expenses, net profit, cash flow | Monitor financial health daily to prevent unexpected cash shortfalls and maintain a balanced budget. |

| Operations/Production | Daily output, order fulfillment rate, production downtime | Evaluate efficiency, manage inventory levels, and reduce production bottlenecks. |

| Inventory Management | Stock levels, turnover rate, reorder points | Prevent stockouts and avoid over-ordering, keeping inventory costs in line with demand. |

Conclusion

Flash reports provide the tools to keep your business adaptable and proactive. By understanding what is a flash report and implementing it effectively, you can gain real-time insights on daily performance, empowering smarter decisions without the overwhelm of traditional reporting cycles. With the right data, simple visuals, and a consistent approach, flash reports become more than just daily updates—they serve as early warning signals and opportunity indicators.

For businesses looking to streamline cash flow management alongside flash reports, Cash Flow Frog offers an intuitive solution.

This powerful tool is designed for growth-focused companies, making it easy to forecast future cash flow, track cash flow by class, and even model how multiple scenarios might impact your cash reserves—all without altering your accounting software’s data.

By using Cash Flow Frog you can take full control of your financial growth planning and make strategic, informed adjustments to support your business’s success.

Using Cash Flow Frog to make flash reports puts you firmly in the driver’s seat, with the power to adjust quickly, refine your strategies, and maximize every day’s potential. Whether tracking sales, inventory, or cash flow, flash reports bring the clarity and agility every business deserves, making it easier to seize opportunities as they happen.

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now