7 Best Strategies for Managing Cash Flow in a Crisis

Remember early 2020? The COVID-19 pandemic hit, and suddenly, everything changed. Streets were empty, shops closed, and business owners were left scrambling to figure out how to keep their doors open.

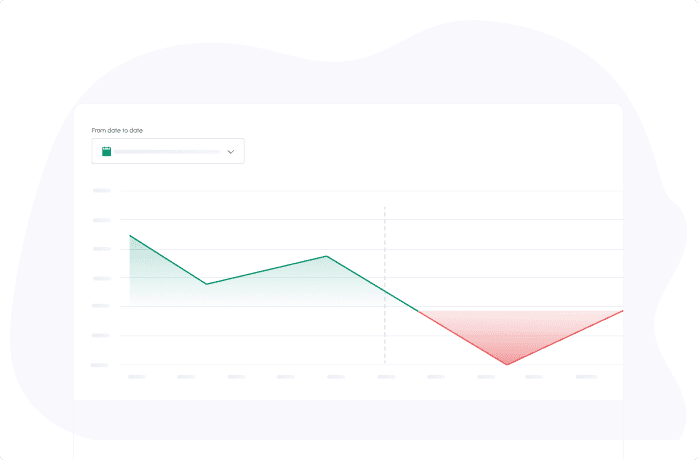

But amidst the chaos, many businesses found ways to survive and even thrive. How did they do it? By mastering cash flow management.

Whether you’re facing a global event like the pandemic, the financial turmoil of 2008, or a more localized industry crisis, managing your cash flow is key to staying afloat and emerging stronger.

In this blog, we'll explore practical, actionable strategies to keep your business resilient and prepared for any challenge. Plus, we'll demonstrate how cash flow projection software can be a game-changer in managing your finances effectively.

Why is Cash Flow Management So Important During an Economic Downturn?

When crises like recessions or inflation hit, businesses face a wave of financial challenges– reduced revenue, delayed client payments, and multiple cash flow disruptions.

Here’s why having strong cash flow management during a crisis matters:

Liquidity Maintenance

Maintaining adequate cash reserves is critical during economic challenges. You need cash on hand for daily costs like rent, utilities, and payroll. Without proper cash flow management, you might struggle to keep up, leading to:

- Delayed Supplier Payments: If you can't pay suppliers on time, it strains relationships and disrupts your supply chain. Suppliers might demand upfront payments or refuse to extend credit, increasing cash flow pressure.

- Operational Shutdowns: Severe liquidity issues can force you to halt operations temporarily, stopping production or closing stores—each day of halted operations results in revenue losses and damages customer relationships.

- Employee Morale and Retention: Timely payroll should always be a top priority. Delays can lead to dissatisfaction, decreased productivity, and higher turnover rates. Maintaining trust and morale is essential for keeping your team motivated.

- Handling Unexpected Costs: A steady cash reserve helps manage unexpected expenses, such as emergency repairs or sudden drops in revenue. This flexibility is vital for maintaining stability during turbulent times.

Debt Avoidance

Borrowing money during a financial crisis can be particularly risky for your business. When economic conditions worsen, banks and lenders often tighten their credit terms, offering less favorable loan conditions such as shorter repayment periods or higher collateral requirements.

This makes borrowing more difficult and less attractive. Additionally, interest rates typically rise during downturns, making loans more expensive and significantly impacting your bottom line.

By managing your cash flow effectively, you can reduce your dependency on external financing and avoid getting stuck with restrictive terms and high costs.

Strategic Opportunities

Good cash flow management during an economic downturn can also present unique strategic opportunities for your business. In fact, the best cash flow businesses are often those that can leverage these opportunities to stay ahead of competitors by maintaining strong liquidity and adaptability during tough times. With a strong cash position, you can take advantage of several specific opportunities:

- Acquiring Distressed Assets: During financial downturns, many businesses face severe financial difficulties, leading to lower valuations for their assets. This can be an ideal time to acquire high-value assets at a fraction of their usual cost, positioning your business for future growth when the market recovers.

- Expanding into New Markets: Market dynamics shift during economic crises, potentially creating openings in new or underserved areas. With strong cash flow, you can invest in market research, enter new geographic regions, or target new customer segments that competitors might be neglecting.

- Investing in Innovations and Technologies: Financial crises often force businesses to cut back on R&D and technological advancements. This presents an opportunity to invest in new technologies, product development, or process improvements, giving you a competitive edge and preparing your business for rapid growth once the economy stabilizes.

- Strategic Partnerships and Acquisitions: Robust cash flow enables you to form strategic partnerships or acquire other businesses that complement your operations. These alliances can provide access to new customer bases, technologies, or expertise that can enhance your competitive position.

- Talent Acquisition: Economic downturns often lead to layoffs, making top talent available on the job market. With financial stability, you can attract and hire highly skilled professionals who might otherwise be difficult to recruit, strengthening your team and positioning your business for future success.

What Industries Are the Most Vulnerable During a Crisis?

Certain industries are more vulnerable to economic downturns due to their reliance on discretionary spending. Here’s a detailed look at some of the most affected industries and the specific negative impacts they would face if they do not implement effective cash flow tactics for a recession:

| Industry | Impact During a Crisis |

|---|---|

| Retail | Many retail stores see a dramatic decrease in foot traffic and sales, leading to widespread store closures. |

| Hospitality and Travel | Airlines and hotels face massive cancellations and decreased bookings, leading to substantial revenue losses. |

| Construction | Project delays or cancellations due to tighter credit conditions–causing significant financial strain on contractors and developers. |

| Manufacturing | Reduced orders and lower production levels as consumer and business spending decreases, leading to significant cash flow issues and layoffs. |

| Entertainment | Movie theaters and live entertainment venues face closures and revenue losses due to restrictions and reduced consumer spending. |

| Food and Beverage (Non-Essentials) | Restaurants and cafes experience a sharp decline in customers and revenue, forcing operational shutdowns. |

Pro-tip: Explore specialized tools with features tailored to specific industries. For example, cash flow forecasting software for manufacturing can streamline financial planning and operations management for manufacturers.

7 Strategies for Cash Flow Management During a Recession

Let’s use the example below to better understand the best cash flow practices in an economic crisis.

Sample business: Green Earth Goods, a small retail store specializing in eco-friendly products, is facing significant challenges due to the recession. Here are the steps they took to keep their business afloat:

Strategy 1: Improve Cash Flow Forecasting

For Green Earth Goods, achieving accurate cash flow forecasting required using financial planning software for retailers. This software enabled the tracking of daily sales and expenses in real time.

| Projection | Amount ($) |

|---|---|

| Projected Inflows | 20,000 |

| (Minus) Projected Outflows | 18,000 |

| Net Cash Flow | 2,000 |

They forecasted a positive net cash flow of $2,000. This indicates that the company expects to generate more cash than it spends each month, providing a surplus that can be used for savings, investments, or other financial needs.

Strategy 2: Reduce Overhead Costs

The next step Green Earth Goods took was to review and reduce overhead costs.

They negotiated a 10% reduction in their lease, saving $500 a month, and switched to energy-efficient lighting, which saved another $150 monthly. Outsourcing IT and marketing functions further cut costs by $1,000 per month.

| Cost Reduction Measure | Savings ($ per month) |

|---|---|

| Lease Reduction (10%) | 500 |

| Energy Efficiency | 150 |

| Outsourcing IT/Marketing | 1,000 |

| Net Cash Flow | 1,650 |

Their actions collectively saved them $1,650 monthly, providing much-needed financial relief.

Strategy 3: Accelerate Receivables

Speeding up the collection of receivables was another key strategy. Green Earth Goods introduced a 2% discount for early payments, which reduced their average collection period from 30 to 20 days.

Using invoicing software automated the billing process, ensuring prompt invoicing and follow-ups. Additionally, employing a collection agency helped recover 80% of overdue payments.

By accelerating receivables, the company was able to shorten its cash conversion cycle.

Strategy 4: Extend Payables Without Damaging Relationships

Managing payables effectively can provide breathing room. Green Earth Goods negotiated longer payment terms with their suppliers, extending from 30 to 60 days. This move gave them an additional 30 days to manage cash outflows without straining relationships with suppliers.

Strategy 5: Diversify Revenue Streams

Relying on a single revenue stream is risky during a recession. Green Earth Goods diversified its offerings by expanding into e-commerce and introducing new product lines.

| Revenue Stream | Monthly Increase ($) |

|---|---|

| E-commerce Expansion | 500 |

| Corporate Eco-Friendly Kits | 150 |

| Budget-Friendly Products | 1,000 |

| Total Increase | 1,650 |

These initiatives collectively boosted their total revenue by $10,000 per month. This significant increase in revenue not only improved their financial stability but also allowed them to reinvest in the business. It also helped offset recession challenges and positioned them for sustained growth in the eco-friendly retail market.

Strategy 6: Secure Financing Early

Securing financing early can provide stability for businesses in any situation. Green Earth Goods used three financing sources to improve cash flow during a recession:

- Bank Line of Credit: They maintained a good relationship with their bank to secure a line of credit, ensuring quick access to funds when necessary.

- Government Grant: They received non-repayable funds to support specific business initiatives.

- Invoice Factoring: By selling invoices to a third party at a discount, Green Earth Goods quickly turned unpaid invoices into cash, meeting short-term financial needs and enhancing their financial flexibility.

Strategy 7: Implement a Strong Cash Reserve Policy

Having a cash reserve acts as a safety net for businesses. Green Earth Goods aimed to save enough to cover six months of operating expenses, aiming for $60,000 in total. During prosperous times, they saved $1,000 each month in their cash reserve.

By the time the recession hit, they had built up a $50,000 reserve. This allowed them to handle unexpected costs and revenue drops without having to borrow money.

Conclusion

These cash flow strategies during an economic downturn are not just about survival; it's about positioning your business to emerge stronger and more competitive.

By diligently managing the ebb and flow of finances, you can strategically allocate resources, capitalize on growth opportunities, and drive innovation. Ready to get started and implement these tips? Sign up for a free trial of cash flow projection software using Cash Flow Frog.

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now