A cash flow gap can create serious problems for businesses if they aren’t corrected. Fortunately, there are many steps businesses can take to close the gap and prevent them from forming in the future. The key is to be able to identify gaps and take a proactive approach to managing your cash flow.

Why is the Cash Gap So Important?

To understand why a cash gap is important, you have to understand the cash flow gap definition. What does it mean to have a cash flow gap?

A cash flow gap is the time between paying for something and getting money in return.

For example, you pay your supplier for stock today. A customer makes a purchase, but you don’t receive payment for 30 days. The time between when you purchased stock and when the customer paid is your cash gap.

Cash gap is so important because the larger it is, the greater the risk of negative cash flow. When your cash inflows and outflows aren’t aligned, you leave your business vulnerable to a cash shortfall.

The longer a cash gap goes on, the greater the risk of your business running out of cash and not being able to cover its operational expenses.

How to Find Cash Flow Gaps

You know that minimizing cash flow growth rate the gap is important, but how do you find gaps?

The best way to find cash gaps is to use a special formula.

Formula for Calculating the Cash Gap

You can use a simple equation to find cash gaps:

Days receivables + days inventory – days payables = cash flow gap

Let’s take a look at each component of this equation that you’ll use when calculating the cash gap.

Days Inventory

The days inventory component of the equation is your inventory turnover (the cost of sales divided by average inventory). This is the average amount of time it takes for your business to turn its inventory into sales.

Days inventory is also known as:

- Days in inventory

- Days inventory outstanding

- Days sales in inventory

The lower the days inventory, the better. The quicker you sell off your inventory, the quicker your business will receive cash for its sales.

Here’s how to calculate days inventory:

Average inventory / cost of goods sold X 365 = days inventory

To find your average inventory, use the following equation:

(Beginning inventory + ending inventory) / 2 = average inventory

Days Receivables

Days receivables, or days sales outstanding, is the average number of days it takes for customers or clients to pay you. It can be calculated on a monthly, quarterly or annual basis.

To find your days receivables, use the following equation:

Accounts receivable / total credit sales X number of days = days receivables

Like with “days inventory,” the goal is to have as low of a days receivables as possible. Why? Because this means that your business is being paid quickly.

For some businesses, having a high days receivables is common and acceptable. For example, in the financial industry, it’s common to have long payment periods.

However, most small businesses rely on steady, consistent cash flow to stay in business. It’s best for these businesses to have as low of a days receivables as possible.

Days Payables

Days payables, or days payable outstanding, is the average number of days it takes to pay suppliers, vendors or creditors. Typically, days payables are calculated on a quarterly or annual basis. It’s a good indicator of how well the cash outflows are being managed.

To calculate your days payable, use the following equation:

(Accounts payable X number of days) / cost of goods sold = days payables

To find the cost of goods sold, use this equation:

Beginning inventory + Purchases – ending inventory = cost of goods sold

A higher days payables means that a business has a longer period of time before it has to pay creditors, vendors, etc. As a result, they may have more flexibility in being able to invest in more inventory and growth.

How Can I Close a Cash Flow Gap?

The goal for every business is to make its indirect cash flow gap as small as possible. The smaller the gap, the more consistent the cash flow.

Once you’ve determined the size of your cash gap, you can take steps to reduce it.

Here’s how:

Act Quickly

If your cash gap is too big, it’s important to act quickly to remedy the situation. Waiting too long to address the issue will only increase the risk of your business missing payments to suppliers or creditors.

Late or missing payments will have a negative impact on your credit score and may prevent you from continuing operations.

Keep on Top of Your Finances

The sooner you can identify a cash gap, the quicker you can take action. Make sure that you’re staying on top of your finances and being mindful of your cash flow at all times.

Raise Funds

The quickest way to close a cash gap is to raise funds to cover it. Of course, this is not a long-term solution, but it’s one that can help remedy an immediate problem.

Some businesses will use credit cards to inject some cash into the business, but loans are also an option.

Reduce Expenses

Another immediate way to close a cash gap is to reduce your spending. The less money you spend, the more money that stays in your bank account and can be used to help overcome your cash gap.

Can you reduce any upcoming expenses? Can you delay payments without it having a negative impact on relationships or your credit score? Can you find a supplier who will offer a better price?

Finding ways to cut back on expenses can help close your cash gap relatively quickly.

How to Improve Your Cash Cap

Now that you know how to bridge a cash flow gap, let’s look at some ways you can improve your gap going forward.

Maintain Cash Reserves

Every business experiences cash shortfalls from time to time. Maintaining cash reserves ensures that you have the funds to weather the slow periods.

Consider it an emergency fund for your business. Aim to have at least 3-6 months’ worth of expenses in your reserve.

Keeping a close eye on your cash flow can help you determine how much money you’ll need to put aside.

Keep a Close Eye on Cash Flow

Keeping a watchful eye on your cash flow is crucial if you want to close your cash gap. You can’t take steps to close the gap and maintain a healthy cash flow if you don’t know where you’re at.

There are many great tools out there that can help you manage and track your cash flow quickly, easily and automatically.

Monitor and Review Your Strategies

Taking steps to improve your cash gap isn’t a one-time thing. It’s an ongoing process that requires careful monitoring, reviewing and adjusting.

Make sure that you’re taking the time to keep track of your cash flow, monitoring your progress and reviewing your strategies regularly. Make changes as needed to ensure that your business stays on the right track.

Managing the Cash Flow Gap

Managing the cash flow gap requires diligence and the right strategy. Let’s look at a few ways to manage your cash gap.

Reduce Your Days Inventory

Reducing the number of days you hold onto inventory will help close your cash gap. Consider adopting a “just in time” approach to your inventory, where you only have enough stock to cover an existing order.

If you cannot take this approach to your inventory, consider negotiating longer payment terms or a lower price for your inventory.

Improve Your Days Receivables

Another way to close your cash gap is to improve your days receivables. You can do this by offering rewards or incentives for paying early.

Alternatively, you can impose fines for those who are late with their payments.

You can also encourage customers/clients to pay more quickly by offering more payment options and sending invoices out as quickly as possible.

Monitor Your Growth

Growth is the goal of every business, but if it happens too quickly, it can put you at great risk of a significant cash gap.

Monitor your growth carefully to prevent this from happening. Keep a close eye on your fixed expenses. Make sure that you’re focused on collecting payments in a timely manner, especially if you are spending a lot on inventory and hiring new employees.

Cash Flow Frog - The Best Cash Flow Forecasting Software

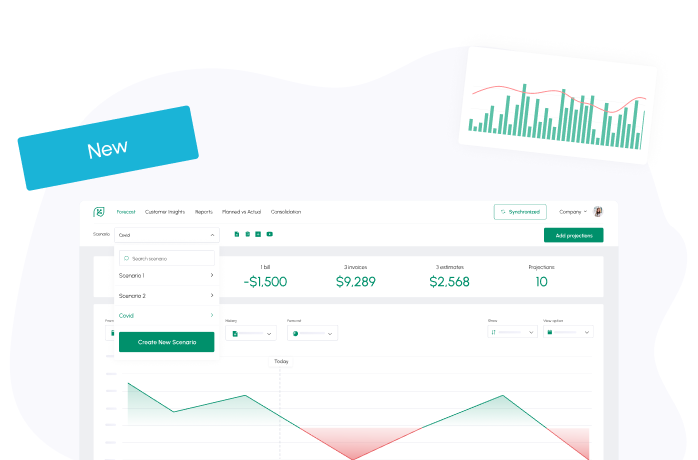

Keeping an eye on your cash flow is one of the most important steps in reducing and managing a cash flow gap. Cash Flow Frog is an online cash planning tool that makes it easy for businesses to track and manage their cash flow automatically.

Cash Flow Frog uses data from your accounting software services to create accurate cash flow statements, forecasts, projections and more. With Cash Flow Frog, you can identify cash gaps before they become a major problem.

You can get started with Cash Flow Frog for free today.

Related posts:

You may be interested:

New: