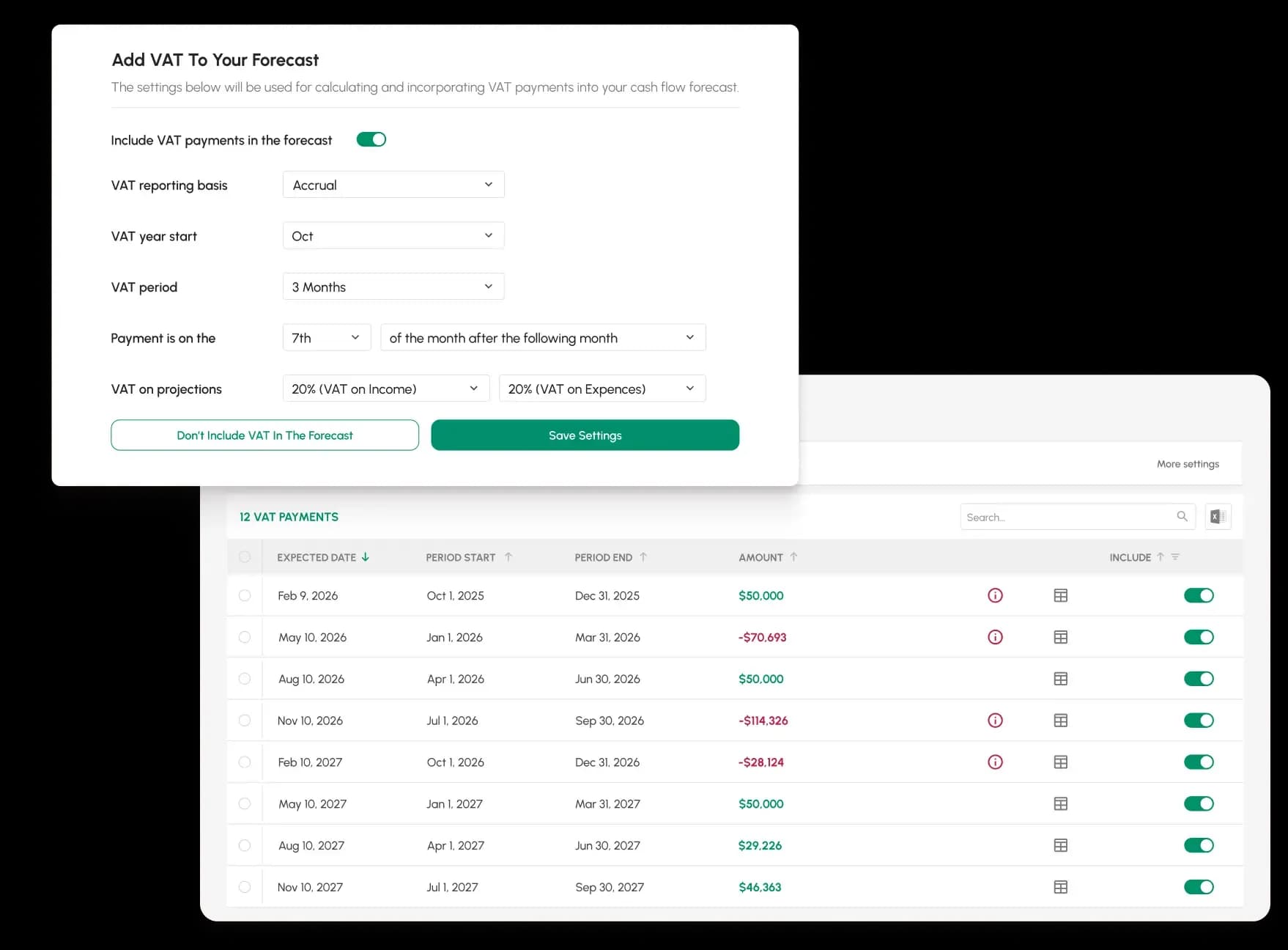

Forecast your VAT / GST payments

Cash Flow Frog uses real accounting data and logic to calculate VAT/ GST from transactions in the past and the future, highlighting both your actual and projected return and the impact on your cash flow

We do the heavy lifting for you

As every new bill, invoice and projection change your upcoming VAT / GST return it's extremely difficult to calculate it on your own.

Cash Flow Frog will analyze and update the VAT/GST returns projections on a rolling basis, helping you fine-tune your company Cash Flow Forecast with minimal effort.

How does it work?

VAT/GST returns from bills, invoices, expenses sales and projections will be calculated based on the actual rate from your accounting software and period setting and incorporated into your cash flow forecast based on your payment period terms.

Ready to take control of your cash flow?

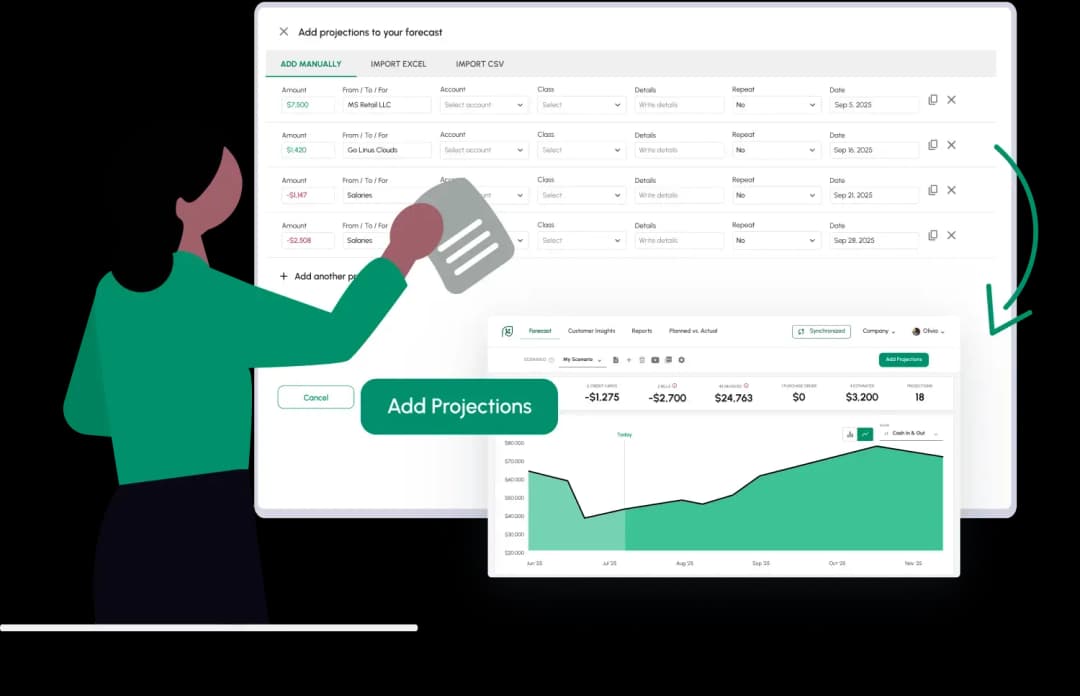

It makes cash flow forecasting dead simple, all QuickBooks updates are automatically updated in the app, new invoices or bills are integrated into the forecast.

Maria Davis

The best way to project your VAT/GST returns

Every new transaction in your accounting software will be updating your VAT/GST projections

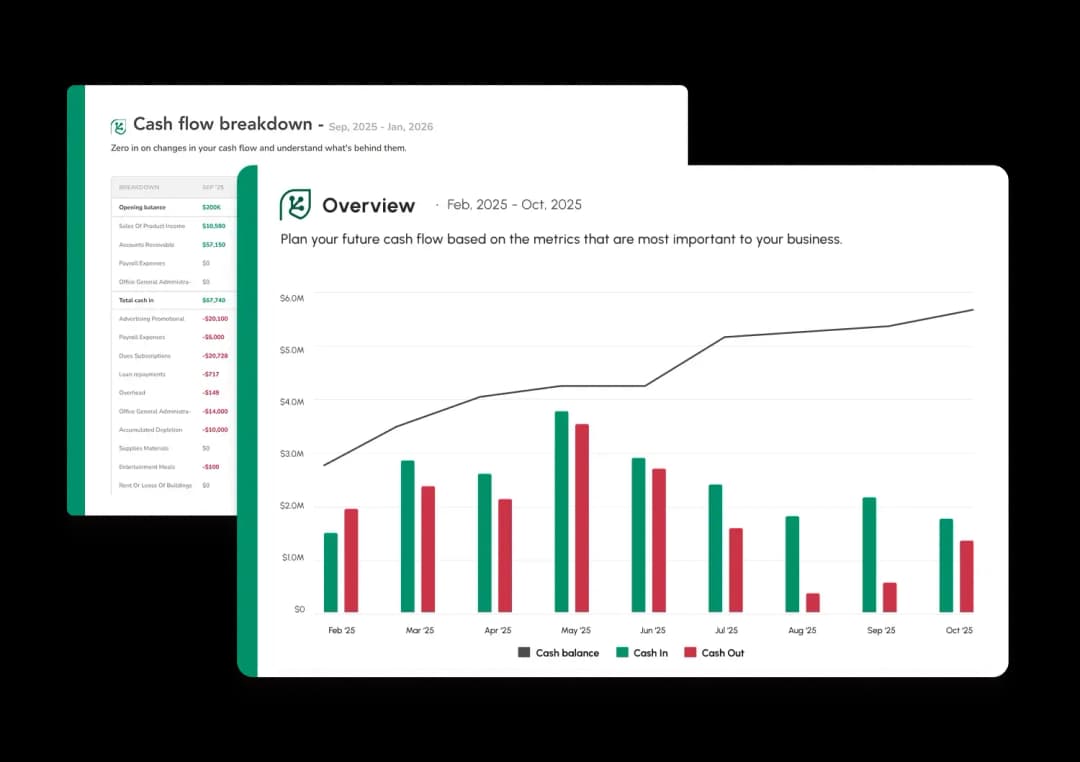

Track your cash flow metrics in real time

Get Answers

Answer very important questions

Cash Flow Frog automatically project your VAT / GST liability helping you answer the most important questionsFAQ

Get your VAT/GST Forecast in seconds

Start Free Trial Now