Consolidate all your businesses with Cash Flow Frog

Create accurate consolidated cash flow statements in seconds with Cash Flow Frog. View cash flow data from multiple companies in one forecast to:

- Save time

- Make informed business decisions

- Help your company grow

The Importance of Consolidating Cash Flow Forecasting

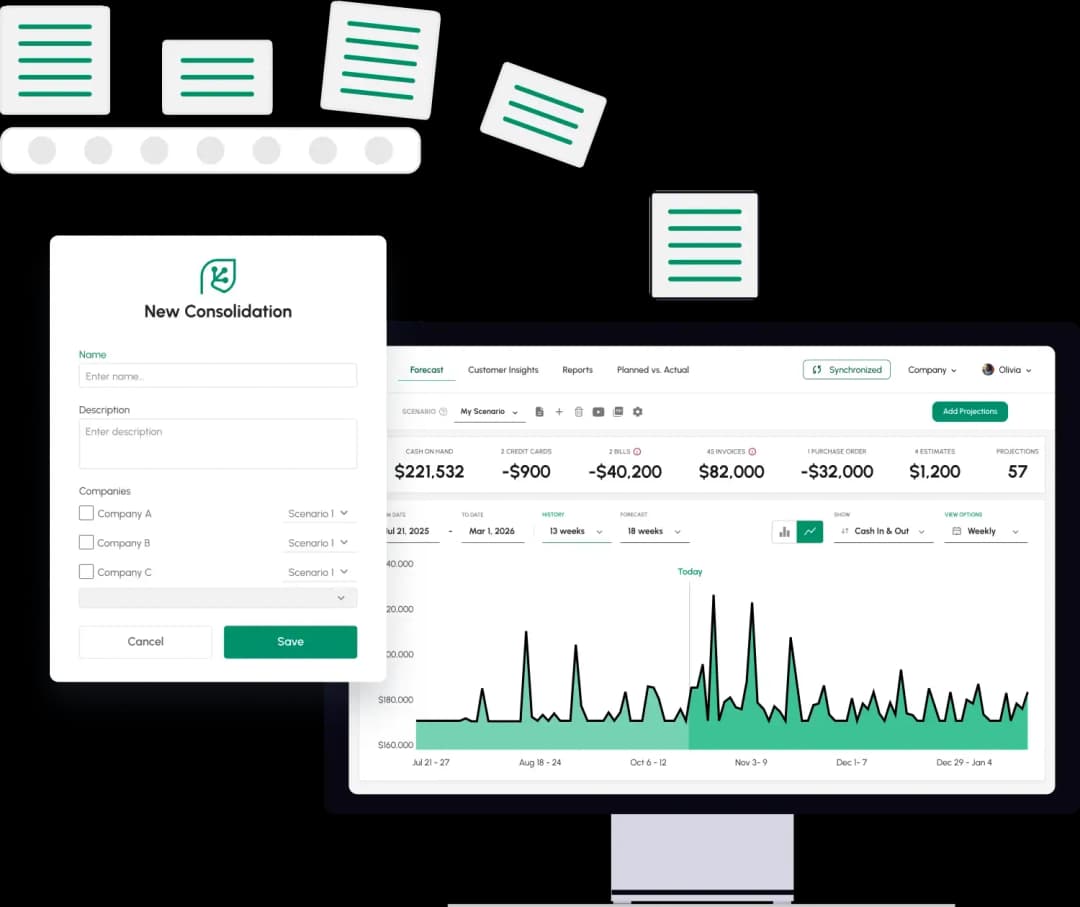

Save time and make smarter business decisions with Cash Flow Frog’s consolidated cash flow tool. Consolidated forecasts make it easier to gauge the financial health of your business.

Consolidating cash flow forecasting allows stakeholders and decision-makers to view cash inflows and outflows of all subsidiaries at a glance.

With all of your data in one location, it’s easy to make more informed decisions and make plans for the future. Consolidated statements and forecasts eliminate the need to look through multiple documents and simplifies the process by putting all of your companies’ cash flow data in one place.

Without consolidated statements and forecasts, decision-making and cash flow planning becomes complicated and messy.

Compare Cash Flow Forecasts and Make Plans Without Confusion or Errors

Cash Flow Frog simplifies and automates the consolidated accounting process to:

- Save you time

- Eliminate human errors

- Deliver the most up-to-date cash flow data

Join the many other businesses using Cash Flow Frog to create consolidated cash flow statements.

Start for free!

Ready to take control of your cash flow?

It makes cash flow forecasting dead simple, all QuickBooks updates are automatically updated in the app, new invoices or bills are integrated into the forecast.

Maria Davis

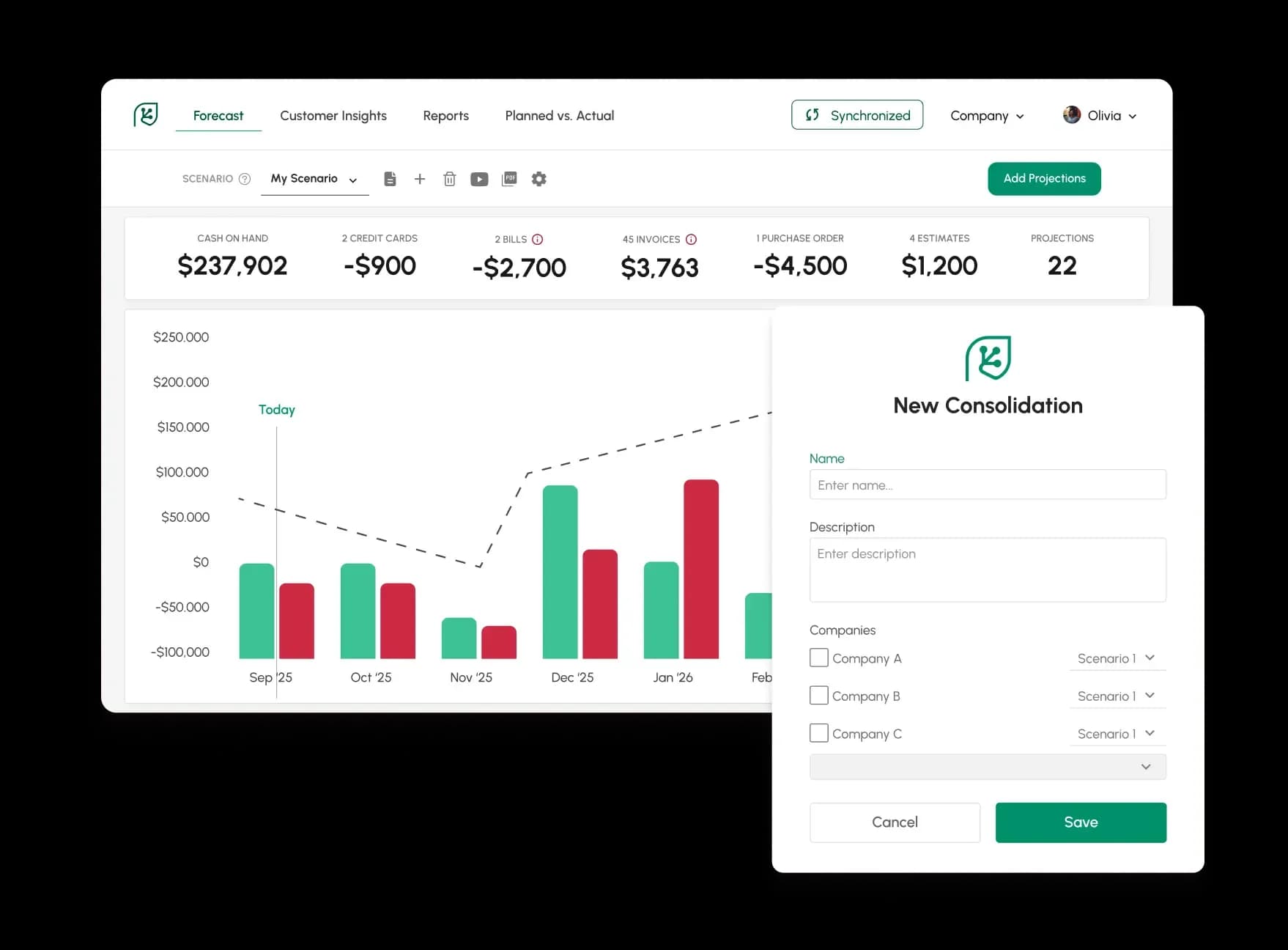

Setting Up Your Consolidated Cash Flow

With Cash Flow Frog, you can quickly and easily consolidate cash flow statements from multiple companies into one cash flow forecast.

Here’s how it works:

- Navigate to the Consolidations feature.

- Name your consolidation.

- Add your companies and information.

- Click “save,” and view your report.

In just a few simple steps, Cash Flow Frog creates accurate consolidated cash flow statements and forecasts online. Share these statements with stakeholders and decision-makers to move your business in the right direction.

The Advantages of a Consolidating Cash Flow Statement

How does financial statement consolidation help your business? A consolidated financial statement:

- Tells you the financial health of your company.

- Helps stakeholders understand the financial position of your business.

- Promotes transparency. View the financial health of the parent company and all of its subsidiaries in one convenient statement.

With a consolidated cash flow statement, you save time and complication with consolidated statements and reports that put all of this data in one location.

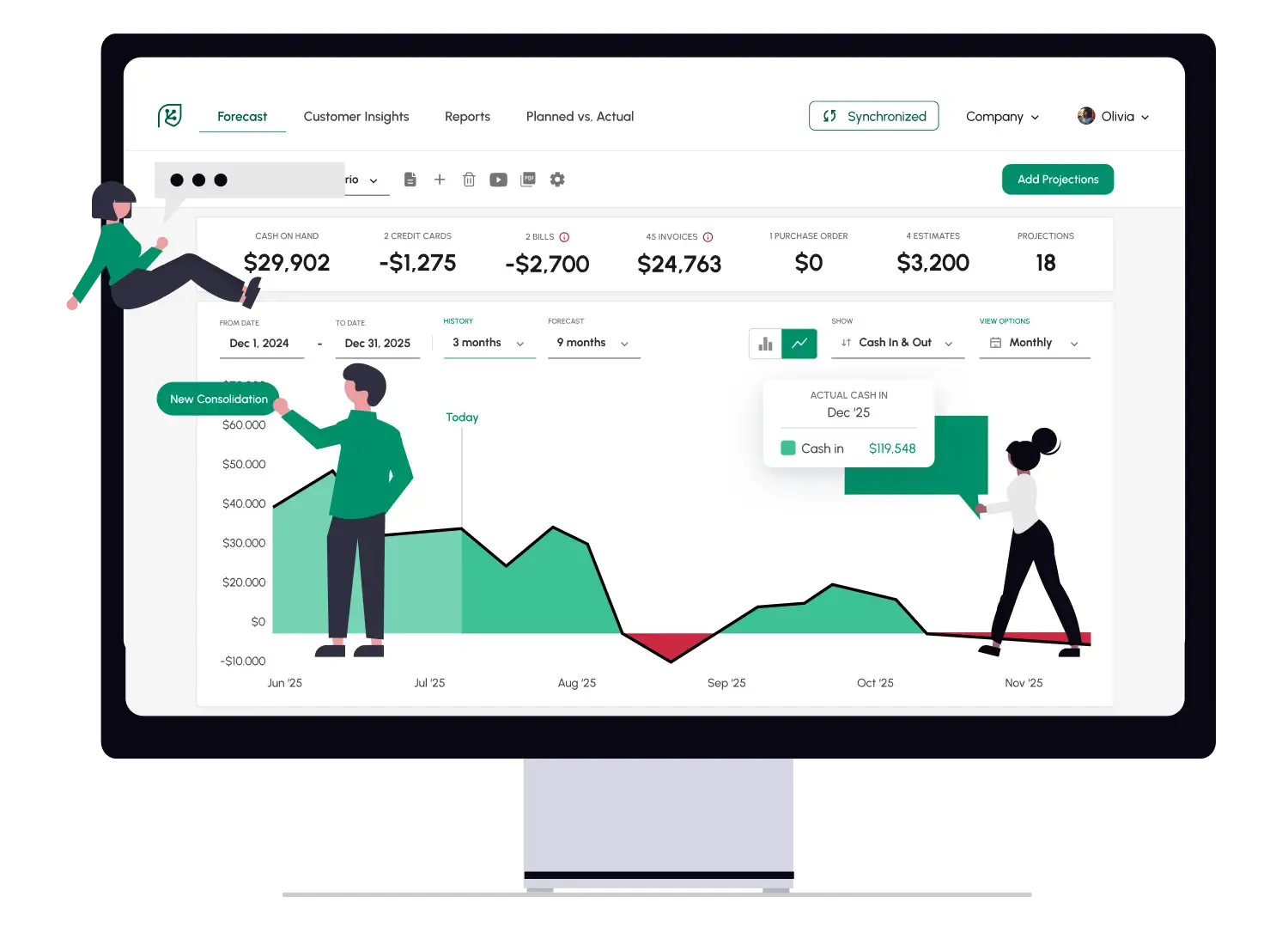

What Do You Get with Cash Flow Frog Software?

Cash Flow Frog can do more than just help with accounting for consolidations. With our online platform, you can quickly and easily:

- Create cash flow projections to plan weeks, months or years ahead.

- View customer insights to improve invoice collections.

- Create what-if scenarios to see how decisions may affect your cash flow.

- View your planned vs. actual results to improve your forecasts over time.

Cash Flow Frog works automatically to take the pain out of cash flow management. Take control of your company's finances and future with Cash Flow Frog.

Start free today!

Track your cash flow metrics in real time

Get Answers

Consolidated cash flow can answer very important questions

Use consolidated cash flow to get better understanding of your group cash flow!FAQ

Get your Consolidate entities in seconds

Start Free Trial Now