Best Cash Flow Forecasting Software For Your Ecommerce Businesses

Research shows that many ecommerce businesses fail because of cash flow issues – not poor products or services.

Maintaining positive cash flow is crucial for any ecommerce business. Cash Flow Frog can help.

What Is Cash Flow And Why Is It Important For The Ecommerce Businesses?

Cash flow is the amount of net cash moving in and out of a company. Cash flow can be either positive or negative.

- Positive cash flow indicates that the business has more money moving in than out.

- Negative cash flow indicates that the business is spending more than it’s bringing in.

There are three types of cash flow:

- Investing: Cash generated from investment activities, such as the sale of assets, purchase of equipment or securities investments.

- Operating: Cash generated by the company's day-to-day operations.

- Financing: The amount of cash moving between the business and its creditors, stakeholders or owners.

Ways To Keep Ecommerce Cash Flow Positive

Cash flow management tools for ecommerce help you have a better understanding of your ecommerce cash flow and reveal ways to keep cash flow positive. A few ways Cash Flow Frog helps you maintain positive cash flow are:

- Understand expenses and where to reduce expenditures

- Learn which clients pay on time and which don’t

- Create projections to better understand what cash flow may look like in the future

Through projections, client analysis and reducing expenditures, businesses can create positive cash flow.

Cash flow allows your business to invest without the risk of debt.

Ready to take control of your cash flow?

It makes cash flow forecasting dead simple, all QuickBooks updates are automatically updated in the app, new invoices or bills are integrated into the forecast.

Maria Davis

Ecommerce Cash Flow Problems And Solutions With Cash Flow Frog Software

Businesses face cash flow problems because of:

Inventory. Ecommerce businesses often forget that they have to store their inventory somewhere, and that storage can be costly. Ecommerce businesses that use drop-shipping services don’t have to worry about this issue.

Payment delays. If you’re selling your products on a third-party platform, there may be costly delays between sales and the time you receive your payment. Payments can be delayed for a variety of reasons. Meanwhile, you need to cover the costs of marketing, inventory and other fees.

Cash Flow Frog empowers you with customer and payment details to enhance cash flow.

Example Cash Flow Statement For Ecommerce

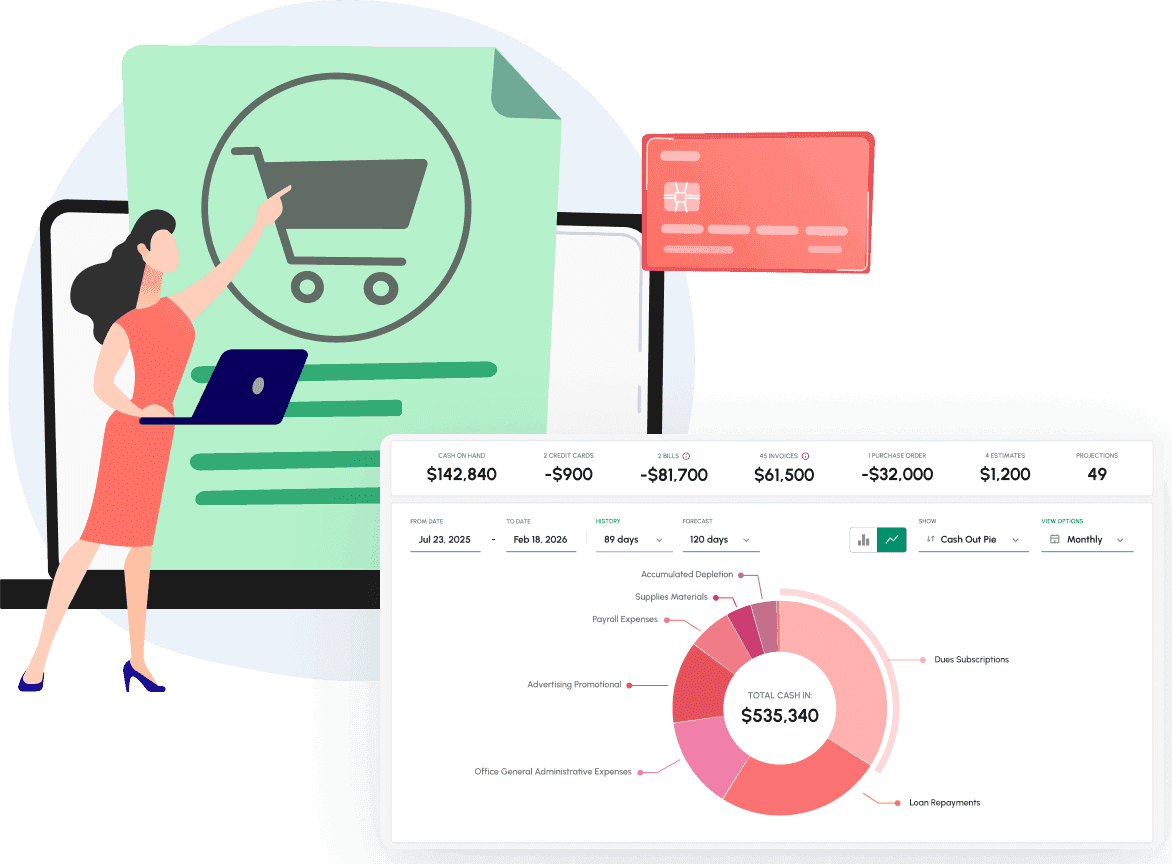

Cash Flow Frog provides fast, accurate cash flow statements in seconds. In minutes, our platform allows you to connect to the leading software, such as QuickBooks and Xero, to gather financial data and present you with:

- Branded reports

- Cash flow graphs

- Cash flow charts

Through our graphical interface, it’s easy for businesses to know their exact cash flow at any time in the quarter. You can also run projections and forecasts to understand what future cash flow may look like, too.

With software geared towards eCommerce businesses, you’ll be able to quickly understand the health of your store.

Track your cash flow metrics in real time

What people are saying about us

Tieshena Davis

CEO, Publish Your Gift®

A true life saver!

I've been trying to find an efficient and simplified way to forecast our cash flow and expenses, this is the complete solution.

Robert Hughes

Owner, Hughes Engineering, PLLC

Extremely useful

Extremely useful, helping me maintain my cash flow through an aggressive growth period, evaluate the financial planning for the future, and sleep better at night.

Cara Curphey

Founder Albion Bookkeeping & Consulting

Peace of mind

Finally found one that works for us! We tried several and finally found one that actually gave us what we needed - great UX, intuitive software, accurate forecasting.

FAQ

Get more out of Ecommerce

Start free