Cash Runway

Have you ever looked at your bank balance and asked how many months of payroll, rent, and tools it can cover? That timeline is your cash runway.

Cash Runway: Meaning, Formula, and Why It Matters

Have you ever looked at your bank balance and asked how many months of payroll, rent, and tools it can cover? That timeline is your cash runway. It’s the period your current cash can support normal spending before funds run out.

With a clear number, you can plan hires, time big purchases, and choose when to raise funding. Whether you run a seed-stage startup or an established company, knowing what your cash runway meaning helps you act with clarity.

Cash Runway: Quick Definition

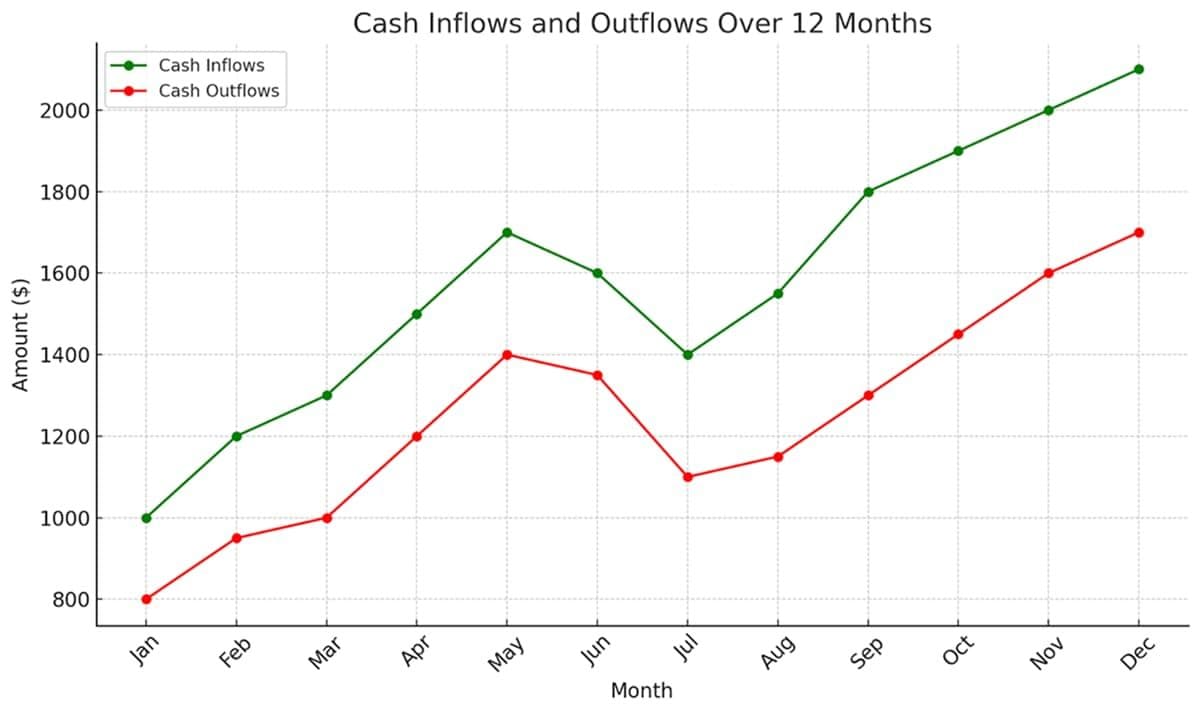

The cash runway's meaning is straightforward. It’s the number of months your current cash balance can support your average net cash outflow. In short, it's your time buffer. If outflows exceed inflows, your runway shortens. If you generate positive cash flow, your runway expands.

What Does Runway Mean in Accounting?

What is cash runway in an accounting and Financial Planning and Analysis (FP&A) context? It’s basically the period your cash reserves can fund operations, given your typical inflows and outflows. It connects daily bookkeeping to survival time, which is why founders and controllers closely monitor it.

Runway meaning in finance, is the length of time until your cash hits zero based on your typical monthly cash burn or surplus. It matters because accounting profits can differ from cash flow.

For example, depreciation impacts profit but not cash. Large invoices might boost revenue while your bank balance stays flat until clients pay. This is why cash runway uses actual transactions instead of relying solely on the income statement.

Why Cash Runway Is a Critical Metric for Businesses

For a small business, the cash runway guides hiring and marketing. It also supports financial planning for startups by setting milestones that your cash can fund. For large enterprises, it guides expansion and risk control. It strengthens working capital management by allowing you to track receivables timing, payables terms, and inventory turns with greater discipline.

The best signal comes from frequent updates and cash flow forecasting. A forward view shows when collections dip or when an extensive expense lands, so that you can respond early. You can also link your runway to specific actions. If your model says eight months, you can decide whether to trim costs, raise funds, or push for faster collections.

Get Your Cash Flow Forecast

Start Free TrialCash Runway Formula: Step by Step

If you want a clear way on how to calculate cash runway, use the basic method that follows.

Standard Formula

The standard cash runway formula is: Current Cash Balance ÷ Monthly Net Burn = Cash Runway. Where:

- Current Cash Balance includes cash and cash equivalents available for operations.

- Monthly Net Burn is the average operating cash outflows minus inflows over a recent period.

If inflows exceed outflows, burn becomes negative, and the months represent a cushion rather than a countdown. To determine burn, use reconciled bank data or the cash flow statement, as the income statement might be misleading due to non-cash items.

Calculation

Suppose your bank shows $600,000 in cash, and your last three months' average net cash burn is $75,000 per month. Your runway is: $600,000 ÷ by $75,000 = 8 months

If you raise prices and improve collections so that burn declines to $50,000, the same cash covers 12 months. If you move to a positive cash flow of $10,000 per month, the runway acts as a buffer rather than a limit.

Some teams prefer a forward method. Instead of averaging the last three months, forecast the next six months by week, then compute how many weeks your cash balance can cover. Both methods are valid as long as the inputs accurately reflect the current situation.

Adjustments for Seasonal Businesses

Seasonal companies should calculate cash runway based on the calendar ahead. Retailers build inventory before holidays, raising outflows. SaaS companies may experience a surge in inflows at quarter-end due to annual prepayments. Project the monthly cash burn for each month, then divide current cash by upcoming months’ burn until the balance is close to zero.

Segment the year into demand peaks and troughs. Add a seasonal reserve line to your plan, or a minimum cash level you’ll maintain during low months. This step protects your working capital when business slows down.

Cash Runway in Practice: Real-World Examples

Financing of creative projects | mentalmind | Shutterstock

Financing of creative projects | mentalmind | Shutterstock

The following use cases demonstrate how runway finance is applied in daily operations and how it informs decision-making.

Startup Scenario

A software team with six people tracks startup cash flow weekly. They have $450,000 in cash and burn $90,000 per month while in development. The team expects to launch in four months and start bringing in $40,000/month by month six.

Currently, their runway is five months. The founders decide to delay one hire and shift a portion of ad spend to customer research. That trims the burn to $75,000 and adds a month and a half of time. The change allows us to complete the product and start early sales with real customers.

Small Business Case

A local manufacturer runs two product lines. One has steady orders, while the other moves in bursts tied to trade shows. The owner keeps a simple cash model that shows quarterly cycles. In slow quarters, expenses are $30,000 monthly; during busy ones, an additional $20,000 is spent monthly. The owner keeps $180,000 in cash.

In the slow part of the year, the runway looks like six months. In busy periods, the focus shifts to where to deploy surplus cash, such as paying down a credit line or buying a machine that removes a bottleneck.

Corporate Example

A public company uses rolling forecasts across divisions. Treasury manages liquidity, while FP&A uses runway financial views to test scenarios. The company starts the quarter with $200 million in cash and a typical monthly net outflow of $15 million after seasonal inflows. That implies about 13 months.

Leadership plans a bond issue next spring and wants at least 12 months of cushion. They run stress tests for scenarios like slow payments and supply chain disruptions. Triggers, such as a cash balance threshold or forecasted coverage below 12 months, prompt cost controls or funding actions.

Grow Your Manufacturing Business

Sign Up TodayCommon Mistakes When Calculating Cash Runway

Teams often make avoidable errors in their cash runway calculation. Watch for these traps:

- Using accrual metrics, which can be misleading. Always base calculations on cash flow statements and bank activity.

- Ignoring taxes, interest, and debt covenants, which may spike quarterly or yearly, and should be included or modeled separately.

- Counting restricted cash, like debt agreements, deposits, and reserves, which are not accessible and should be excluded.

- Allowing a single month to skew averages. Use a rolling average and note unusual one-time items.

- Not updating for planned changes, such as new hires or rent hikes, before sharing estimates.

Fix these by reconciling bank activity, confirming non-monthly obligations, and checking a cautious case before you share the number.

Runway Cash Strategy: How to Extend It

The right runway financial plan gives you time to hit milestones on your schedule. Here are practical levers for extending the cash runway.

Reducing Operating Expenses

Start with costs you can change quickly. Audit marketing spend and keep only channels with a clear return. Remove unused software, right-size seats to match active users, and revisit vendor contracts for better terms.

For payroll, pause backfills and shift to contractors for non-core work when possible. If reductions become necessary, protect customer support and the systems that keep the business running. A small monthly change accumulates into extra months of breathing room.

Increasing Revenue Flow

Runway finance decisions improve when sales and collections are predictable. Shorten payment terms by offering early pay discounts, or add milestone invoicing to long projects. For subscriptions, raise annual billing share and introduce gentle late fee policies.

Review pricing, packaging, and discounts. Remove the discounts that do not drive volume. When increasing prices, align with a clear value like faster support or new features. Simplify checkout, add self-serve upgrades, and clarify upgrade paths to reduce friction and collect faster.

External Funding Options

If internal funds fall short, explore capital sources. Equity provides cash and partners for hiring and customers, while bank credit lines suit steady revenue businesses. Asset-based loans quickly convert receivables and inventory into cash.

For later-stage firms, bonds or term loans spread enormous costs over time. The key is to model the impact on interest, covenants, and future flexibility before you commit.

Cash Runway vs Burn Rate: What’s the Difference?

Burn Rate Concept | HL12 | Shutterstock

Burn Rate Concept | HL12 | Shutterstock

People mix up cash runway with burn rate because they relate to the same data. The burn rate formula calculates a monthly figure from inflows and outflows:

Burn Rate = Cash Balance (Previous Month) - Cash Balance (Current Month)

The cash runway formula relies on the burn rate as a key input. If the burn rate is negative, that means you add cash each month. Your runway then describes a buffer rather than a countdown. Conversely, a positive burn rate describes how long you have until the bank balance hits zero if conditions hold.

Tools and Templates to Track Cash Runway

Spreadsheets can get you started. A simple cash-in and cash-out tab linked to a summary tab works fine for small teams. As complexity grows, purpose-built tools save time and reduce mistakes.

Cash flow software pulls transactions, categorizes them, and syncs actuals to forecasts. This provides a single view of your plan, actual results, and variance. A regular cash runway analysis that sits next to your budget helps leaders act early rather than react late.

Whether using spreadsheets or software, your templates should include:

- Opening cash

- Inflows/outflows by type

- Rolling monthly view

Add a policy note that defines which items you include in burn. Include alerts when projected cash crosses thresholds you set with your board or lenders.

Make Financial Planning a Breeze

Try Our Forecasting ToolCash Runway Benchmarks: What’s Healthy?

What is a good cash runway? The answer depends on the industry and the stability of cash flows.

- Early startups target 9 to 18 months to give product and go-to-market work time to produce results.

- Service firms with recurring contracts often keep 4-6 months' worth of inventory if collections are steady.

- Venture-backed companies raising on milestones may target at least 12 months to avoid rushing the next round.

- Companies with customer prepayments or deposits may carry a lower month count for a period because cash arrives before delivery.

If your revenue is volatile, aim higher. If you have reliable access to financing, a shorter runway can be acceptable for a brief period, but with well-defined guardrails. Review the plan with investors or lenders to ensure expectations remain aligned and your healthy cash position remains visible to all parties.

How Often Should You Recalculate Cash Runway?

Update the cash runway formula monthly at a minimum. During higher-risk periods, run the calculation twice a month. Weekly checks are proper during launches, downturns, or hiring sprees. Tie updates to bank reconciliations for accurate burn data.

As your business changes, update the method. If you expand to new markets, separate burn by region to see which area drives cash needs. When adding a hardware product, consider factors such as deposits, lead times, and freight costs. Regular review, combined with careful inputs, yields a reliable cash runway calculation.

What If Your Cash Runway Is Too Short?

Declining financial reports| Vanz Studio | Shutterstock

Declining financial reports| Vanz Studio | Shutterstock

When balances point to a negative cash runway within a few months, act quickly.

- Cut or pause discretionary spending

- Move slow-moving inventory with targeted discounts

- Accelerate collections with early-pay incentives or stricter terms

- Sell excess equipment

- Raise prices where customers see clear value

If you’re in a hurry to increase cash runway, consider short-term financing that buys time for more substantial changes. You can also cut trials that do not convert and sell idle assets. Assign owners to each step and track weekly progress until your buffer returns.

Final Thoughts on Managing Cash Runway

Cash runway turns complex plans into a clear time frame. It shows how many months your current cash can support normal spending. The concept is straightforward, and the payoff is practical.

A steady focus on cash runway gives you timely signals, fewer surprises, and better choices across the business. Share the figure with stakeholders and maintain consistency in the method so that everyone interprets it uniformly.

Pan Your Cash Flow Like a Pro

Try Cash Flow FrogRelated Terms

FAQ

Looking for more help?

Visit our help center to find answers to your questions about CashFlowFrog.

Trusted by thousands of business owners

Start Free Trial Now