How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

If you want to understand how to calculate free cash flow, you are probably dealing with a practical concern right now. On paper, profit might look fine, yet cash still feels tight. That disconnect is precisely why the calculation of free cash flow matters.

It shows how much cash your business actually has available to make decisions, handle unexpected pressure, and fund growth after covering the costs required to keep operating.

What Is Free Cash Flow (FCF)?

Free cash flow measures the cash available after a business pays for its ongoing operations and essential investments. The calculation of free cash flow focuses on reality rather than presentation. It answers a practical question: what cash is actually available to use.

When people ask how to find free cash flow, they are usually trying to remove uncertainty around decisions that feel expensive or risky. They want to know whether they can fund growth, handle slow months, or make decisions without relying on guesswork. A company that produces positive cash flow has flexibility. It can respond to pressure without immediately seeking outside capital.

Why Free Cash Flow Matters (For Owners, Investors, and Lenders)

Photo: Free cash flow supports clearer decisions across teams and stakeholders - Freepik

Free cash flow matters because it makes financial comparisons meaningful. Two companies can report similar profits while operating with very different levels of cash flexibility.

What a consistently positive FCF signals

A business that generates reliable free cash flow sends a clear signal. It operates with financial discipline and has room to absorb pressure without scrambling. The free cash flow formula reflects consistent decision-making across both daily operations and long-term investments. It suggests that growth does not depend on constant injections of external funding.

For owners, consistent FCF means fewer surprises when covering costs or planning. For investors, it supports confidence in long-term sustainability. For lenders, it signals lower risk and stronger repayment capacity.

When negative FCF is normal (and when it isn’t)

Negative results are not always a warning sign, especially early on. Early-stage companies and expanding teams often invest ahead of returns. That can create negative cash flow during periods of hiring, product development, or infrastructure upgrades.

The concern arises when negative results persist without a clear explanation or a credible path forward. If spending does not connect to future cash generation, the business loses room to adapt.

How FCF connects to valuation

Valuation relies on future cash rather than reported profit, because cash determines what a business can actually sustain. Many analysts focus on free cash flow yield to understand how much cash a business generates relative to its value and whether that cash generation is sustainable over time.

Clear presentation matters here. Using tools like financial reporting software helps businesses clearly communicate cash performance to investors and lenders, reducing confusion and improving decision-making confidence.

Wondering how different decisions affect your free cash flow.

Explore cash flow scenarios before you commitThe Most Common Free Cash Flow Formula (OCF – CapEx)

Most business owners and operators start here because this method balances clarity with usefulness. It relies on real cash movement rather than accounting presentation.

Free cash flow formula

The free cash flow formula subtracts investment spending from cash generated by the business to show what truly remains. This free cash flow formula calculation shows how much cash remains after covering the costs required to keep the company operating and competitive.

The starting point is operating cash flow, which reflects cash generated from core business activity rather than reported profit. It keeps your focus on money that actually moved, not revenue that still sits on invoices or forecasts.

Where to find OCF and CapEx in financial statements

Both inputs come from the cash flow statement, which tracks how money enters and leaves the business. Operating cash flow appears in the first section. Capital expenditures (CapEx) appear under investing activities and represent spending on long-term assets required to support operations.

Pulling these figures from the same statement keeps the result consistent and easier to compare over time.

Quick example (simple numbers)

Assume a mid-sized subscription software company generates $420,000 in operating cash during the year. It spends $120,000 on equipment and systems required to support operations. The calculation of free cash flow shows $300,000 remaining.

That remaining cash gives the team options. They can add a new hire, extend their runway, or absorb a slow quarter without abruptly cutting costs. This is where free cash flow moves from theory into day-to-day decision-making.

How to Calculate Free Cash Flow Step by Step

Photo: Step-by-step cash flow calculations rely on accurate inputs - Freepik

Breaking the process into steps makes it easier to repeat and review, mainly when multiple people rely on the numbers for decisions.

Step 1: Pull Operating Cash Flow

When learning how to calculate free cash flow, start with cash generated by regular business activity. It reflects what actually moved, not what was recorded. This figure already reflects customer collections and payments to suppliers, which makes it more reliable than earnings alone when decisions depend on timing.

Step 2: Identify CapEx (not every “purchase” is CapEx)

Not all spending qualifies as capital investment. CapEx includes long-term assets that support future operations. Routine expenses belong elsewhere. Correct classification protects accuracy and prevents inflated results that can quietly distort planning.

Step 3: Calculate FCF and sanity-check it

This step explains how to calculate the free cash flow of a company using real inputs. Apply the free cash flow formula calculation, then pause to sanity-check the result. Does the number reflect the actual cash position? For example, if collections have recently improved but expenses are rising, a high FCF might give false confidence.

If the result seems unusually high or low, review timing and classification first. Small timing shifts can materially change how the number looks.

Step 4: Compare to prior periods and revenue

Once you understand how to find free cash flow, context matters. Compare results across months or quarters and against revenue trends.

For example, two consecutive quarters might show similar revenue, but very different cash outcomes. In one quarter, delayed customer payments tighten cash availability. In the next, faster collections improve flexibility even though sales stay flat. Changes in free cash flow margin often highlight pressure before it appears in profit reports. A financial forecasting tool helps connect historical performance with forward-looking planning.

| Component | What it represents | Why it matters |

|---|---|---|

| Operating Cash Flow | Cash generated from core activity | Indicates business health |

| Capital Expenditures | Long-term investment spending | Supports sustainability |

| Free Cash Flow | Cash remaining | Enables informed decisions |

Turn free cash flow analysis into confident decisions.

Start tracking your cash flow todayAlternative FCF Calculation (From Net Income)

Some teams prefer to approach cash analysis from the income statement, especially when cash flow data feels less familiar or when they want to reconcile profit with cash outcomes.

Net income-based formula

This method starts with net income and adjusts it to reflect actual cash movement. The calculation of free cash flow here requires adding back non-cash expenses like depreciation and amortization, and adjusting for balance sheet changes.

While valid, this approach requires more judgment and closer review.

Why is this formula trickier

Accrual accounting introduces timing differences. Revenue can appear before cash arrives. Expenses can post before money leaves. These gaps complicate interpretation and increase the risk of misunderstanding true liquidity.

Example with working capital

Changes in working capital often explain why net income and cash diverge. A rise in receivables can reduce available cash even when profits increase. Tracking net working capital change helps reconcile that difference.

In this context, the free cash flow formula highlights whether growth absorbs cash or releases it.

Free Cash Flow vs FCFF vs FCFE (Don’t Mix Them Up)

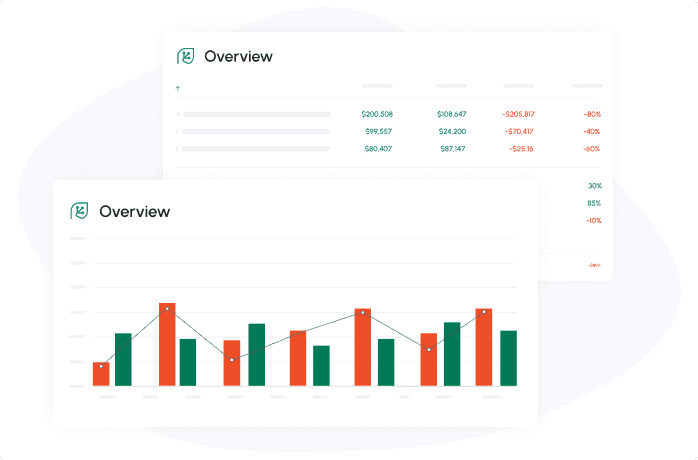

Photo: Cash Flow Frog dashboard showing clearly separated cash flow metrics - Cash Flow Frog

At this stage, the main risk is usually not misunderstanding free cash flow itself. It is using the wrong version. Understanding how to calculate free cash flow also means knowing when it is the right metric for the question you are trying to answer.

Free cash flow is best suited for operational decisions because it shows what the business can actually use after covering its own costs. FCFF serves a different role. It is commonly used in valuation because it removes the impact of financing choices. FCFE narrows the focus further by isolating what remains for equity holders.

The differences become clearer when you look at how each metric is applied.

| Metric | Best used for | What does it tell you | Common mistake |

|---|---|---|---|

| Free Cash Flow | Operational decisions | Cash, the business can actually deploy | Treating it as a valuation metric |

| FCFF | Valuation and lender analysis | Cash available to all capital providers | Comparing it to equity-only measures |

| FCFE | Equity-focused decisions | Cash available to shareholders | Ignoring debt obligations |

Problems arise when these measures are treated as interchangeable. Each one answers a different question, and using the wrong one can distort comparisons, valuations, or expectations about financial flexibility.

How Do You Calculate FCFF Using EBIT?

This method is used when the focus shifts from day-to-day cash management to valuation or capital analysis. It explains how to calculate free cash flow to the firm by starting with operating earnings before financing costs and converting those earnings into cash.

EBIT shows how the business performs at an operating level, before interest and financing decisions. From there, you adjust for taxes to estimate what the company would retain under normal conditions. You then account for the cash required to sustain operations and support growth, along with balance sheet movements that can temporarily absorb or release some money.

Example:

Suppose a company reports EBIT of $500,000 for the year. With a 25% tax rate, operating profit after tax is $375,000. During the same period, the business spends $90,000 on long-term investments and ties up $40,000 in funding for daily operations. After those adjustments, FCFF for the period is $245,000.

That figure is not cash available to owners. It reflects the cash the business generates before financing, which is why analysts and lenders rely on it to compare companies with different capital structures or to estimate enterprise value.

Working Capital Changes That Can “Fake” Your FC

Delayed vendor payments, inventory buildup, or aggressive collections may temporarily inflate free cash flow.

Reviewing trends over time helps separate sustainable performance from timing effects and prevents decisions based on temporary conditions.

Common Mistakes When Calculating Free Cash Flow

Photo: Small errors in cash flow assumptions can create big problems - Freepik

The most common mistakes in free cash flow analysis happen when assumptions shift unnoticed. The calculation of free cash flow remains accurate only when inputs and classifications remain consistent from period to period.

Common issues include:

- Classifying regular expenses as CapEx

- Omitting recurring maintenance costs

- Comparing financials across different periods or formats

- Changing your definition of CapEx from one report to the next

- Mixing audited and unaudited data in the same analysis

How to Improve Free Cash Flow

Improvement starts with discipline, not shortcuts. The free cash flow formula makes pressure points visible so teams can respond deliberately.

Practical actions include:

- Tightening collection cycles

- Aligning investment with demand

- Planning with a realistic cash flow forecast

Using cash flow forecasting software provides better visibility and more stable decision-making.

Free cash flow discipline is critical for scaling efficiently.

Built for SaaS teams that need clear cash flow visibilityConclusion: Free Cash Flow Is a Better “Reality Check” Than Profit

Knowing how to calculate free cash flow changes how decisions get made. Profit reflects performance on paper. The free cash flow formula reveals what remains after essential costs. When planning growth, managing risk, or funding operations, that clarity often matters more than headline earnings.

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

Direct vs Indirect Cash Flow - Which Method Fits Your Business Better?

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now