Cash Flow Forecasting Template

A free cash flow forecast template gives you a clear answer to a question every business eventually faces: will you have enough money to pay your bills next week, next month, or three months from now? A well-structured template for cash flow forecast helps you outline these timelines clearly and reduces the guesswork around financial planning.

Forecasting does not just help large companies with CFOs and finance teams. It helps founders, operators, and managers spot risks before the bank balance tells them something is wrong.

A good template does not predict the future with perfection. It shows how close or far your current operations are from a cash shortage, so you have time to respond, not react.

What Is a Cash Flow Forecasting Template?

A simple cash flow forecast template lays out all the money you expect to bring in and spend over a specific period. It starts with your current bank balance, then tracks expected cash inflows such as customer payments or loans, and maps out what’s going out (like rent, payroll, inventory purchases, and tax payments).

This structure gives you a week-by-week or month-by-month view of when cash will land and when it will leave. The goal is not to track profit. It is to monitor available cash.

Templates are built to reflect the actual timing of cash events. If a customer pays 30 days after being invoiced, the cash forecast reflects that timing. If payroll lands twice a month, the forecast accounts for those exact days. This is what makes a forecasting template more useful than a profit-and-loss report or even a standard budget. It forces a conversation about when cash moves, not only how much.

How a template fits into cash flow forecasting

Forecasting becomes inconsistent without a structure. A business might use one spreadsheet in January, rebuild something different in March, and start over again in May. That creates friction. People rely on assumptions that were never written down. Numbers are entered once and forgotten. The forecast stops being useful.

A reusable, free cash flow forecast template provides consistency. You do not rebuild the logic every month. You update inputs. The structure stays the same. That gives you a clear frame to compare performance, spot issues, and make adjustments.

Template vs ad hoc spreadsheets

Ad hoc spreadsheets often look like a quick solution. Someone opens a blank tab, types in a few rows, and builds a fast estimate of where cash might land. These sheets can answer a single question, such as whether a specific purchase is possible. They rarely work long-term.

Without consistent formulas, fixed categories, or structured assumptions, ad hoc spreadsheets become outdated in days. A structured cash flow forecast template avoids these issues. Categories remain consistent. Timing assumptions are visible. Formulas stay intact. You spend less time fixing errors and more time analyzing what the numbers actually mean.

Ready to simplify your planning with a small business cash flow forecast template that doesn’t require spreadsheets?

Sign up todayWhy a Cash Flow Forecasting Template Matters for Your Business

Cash flow forecasting matters because nearly all financial stress in a business begins when cash flows change. Not when profit drops. Not when revenue dips. Stress increases when money that should have arrived on Monday does not show up until Thursday. The template helps you see those shifts before they create real consequences.

Even with good sales, cash can run low. Clients may pay in 60 days. Projects often need upfront spending. A few late payments can throw everything off. Without a forecast, timing issues remain hidden until several large bills arrive at once.

A simple cash flow forecast template helps you plan around that reality. You can shift expenses, accelerate receivables, delay a purchase, or talk to your bank. You are not waiting for your balance to drop. You are already prepared.

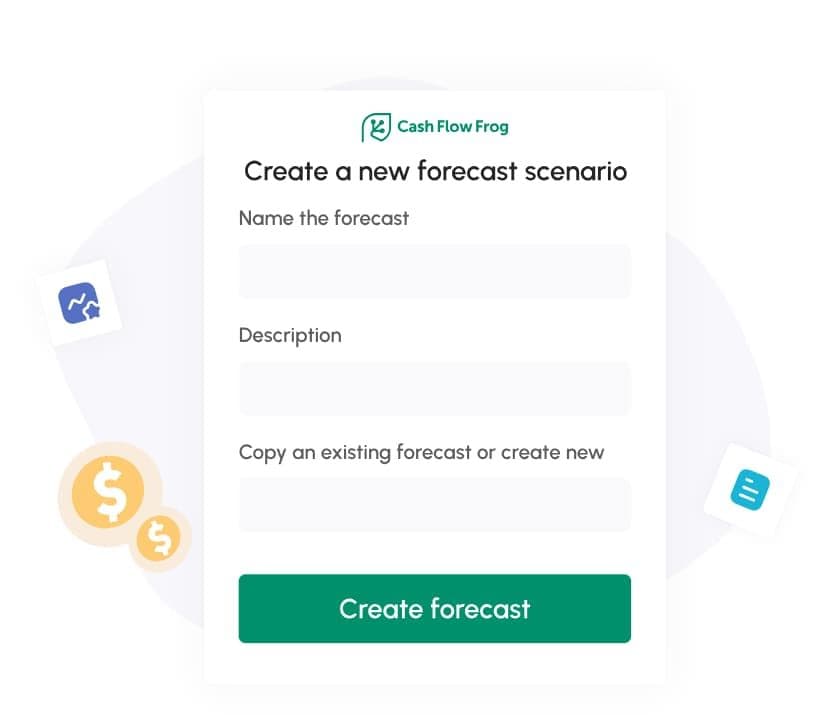

Image: Forecast dashboard on CashFlow Frog | source: cashflowfrog.com

Key Building Blocks of a Cash Flow Forecasting Template

A working forecast uses a few core components. Each one gives context to what your future cash position will look like.

Cash Inflows

Covers all incoming money expected during the forecast period. Includes customer payments, subscription revenue, loans, refunds, or grants.

Cash Outflows

Lists every planned expense. Think of fixed bills like rent and payroll, variable spending like materials, and scheduled costs such as taxes or debt payments.

Assumptions

These are timing rules behind the numbers. They clarify when cash moves in or out, based on your customer terms, vendor agreements, and payment schedules.

Running Cash Totals

Shows the projected balance after each period. It tells you whether you can meet commitments or need to make adjustments ahead of time.

A simple weekly example is shown below.

| Week | Opening Cash | Inflows | Outflows | Ending Cash |

|---|---|---|---|---|

| 1 | 50,000 | 10,000 | 18,000 | 42,000 |

| 2 | 42,000 | 5,000 | 20,000 | 27,000 |

| 3 | 27,000 | 30,000 | 15,000 | 42,000 |

| 4 | 42,000 | 15,000 | 12,000 | 45,000 |

This shows how a short dip in week two is offset by a large customer payment in week three. That insight helps you avoid making rushed cuts during a temporary low point.

Types of Cash Flow Forecasting Templates by Time Horizon

The time horizon of your forecast depends on what you are trying to solve. Short-term forecasts help you see timing risks. Long-term forecasts help you understand whether your cash model supports your future plans.

Short-term cash flow forecasting template (daily, weekly, or 13-week)

Short-term templates show whether cash is available to cover obligations over the next few weeks. A 13-week forecast is common because it spans one full quarter. You can track when payments arrive, when payroll hits, and whether any weeks will drop below your safety threshold.

If your customers pay inconsistently or your expenses land in clusters, a short-term view will help you stay ahead of problems.

Daily or weekly templates are useful for businesses that manage tight timing. For example, a firm that receives large payments once a month but pays suppliers weekly needs to know if the timing lines up.

Monthly cash flow forecasting template

A monthly template for cash flow forecast gives you a higher-level view of how money flows in and out over longer stretches. It helps you see if your regular revenue (like subscriptions, retainers, or recurring contracts) can consistently cover your monthly expenses.

This format is especially useful when your business has predictable billing cycles and fixed costs. It also supports budget reviews, gives investors clean data, and helps leaders decide whether current growth plans are financially sustainable.

Annual and multi-year projection templates

Longer forecasts help answer strategic questions. Can we afford to hire five more people? Will opening a second location require financing? If we add debt, how will that affect our cash in 12 months?

An annual and multi-year cash flow forecast template usually requires more assumptions. Revenue growth, churn, expansion costs, and rate changes all factor into the model. These templates help you test whether your business's structure supports your plans or creates future pressure.

See how automated cash flow forecasting works inside our platform

Read moreCash Flow Forecasting Template Formats: Excel, Google Sheets, or Software

The format you choose for a business cash flow forecast template depends on what you need, how fast you move, and who uses the forecast.

- Excel gives you control. You can build exactly what you need, protect formulas, and create custom views. It requires careful management and some spreadsheet fluency.

- Google Sheets supports collaboration. Multiple people can work on the forecast simultaneously. Comments, version history, and real-time edits make this format ideal for shared environments.

- Cash Flow forecasting software connects to your accounting platform and bank. They sync data automatically and reduce manual entry. This works well for companies with complex transactions, but the setup takes time, and there are subscription costs.

Image: Cash flow breakdown overview on CashFlow Frog | Source: cashflowfrog.com

Step by Step: How to Use a Cash Flow Forecasting Template

Building a business cash flow forecast template becomes easier when you use a defined process.

Step 1 - Collect historical cash data

Look at your last six months of actual transactions. Pull your bank statements. Review when customers actually paid invoices. Map how often suppliers were paid and how long you waited. Identify recurring costs like payroll, subscriptions, and taxes. This step turns assumptions into something grounded in real behavior.

Step 2 - Map inflow and outflow categories

Group your cash movements into simple, clear categories. You do not need 50 different line items. Focus on the categories that drive real change in your balance. Some examples:

- Inflows: client payments, subscription revenue, loan draws

- Outflows: rent, salaries, contractors, software, taxes, insurance

Categories help you track trends. If a category spikes or drops, you can trace the reason faster.

Step 3 - Enter assumptions and timings

Assumptions give the forecast its behavior. If your clients pay on 45-day terms, reflect that delay. If you pay vendors at the end of the month, record it. These details shape how the forecast responds to movement. Keep them visible so you can update easily if something changes.

Step 4 - Review the projected cash position

Each period ends with a projected balance. This is the number that matters most. It tells you whether the business can continue as planned or whether action is needed.

Look for dips below your comfort threshold. If your minimum desired balance is $20,000, and week six drops to $12,000, decide now how to address it.

Step 5 - Iterate, adjust, and save scenarios

Your first forecast will be wrong. That is normal. The goal is not perfection. The goal is improvement. Update the forecast regularly. Compare forecasted cash to actual cash. Adjust the assumptions.

Also, build a few scenarios. What happens if sales drop 15 percent? What if a key customer delays payment? What if a supplier changes terms? These scenarios help you stay ahead of risk.

Cash Flow Forecasting Template Examples for Different Business Profiles

Each business model experiences cash differently. Your forecast must reflect your model.

- A consulting firm needs to forecast milestone payments, retainers, and delayed collections.

- A retail business must plan for large seasonal inventory purchases and slower months.

- A manufacturer needs to model production costs, supply chain timing, and payment cycles.

- A SaaS company depends on renewal rates, churn, and customer acquisition costs.

- A construction company must forecast against contract milestones, large upfront labor, and unpredictable client payments.

Short Term vs Long Term Cash Flow Forecasting Templates

Short-term forecasts help with survival. They tell you if you can meet obligations next month. Long-term forecasts help with planning. They tell you if your business can fund the future you want.

Short-term reveals timing issues. Long-term reveals structural issues. One gives tactical insight. The other supports strategic decision-making.

You need both. One protects the present. One shapes the future.

Common Mistakes When Using a Cash Flow Forecasting Template

Several patterns cause even the most basic cash flow forecast template to fail:

- Overestimating when revenue will arrive

- Forgetting irregular or annual expenses

- Updating the forecast too infrequently

- Basing assumptions on hope instead of history

- Confusing invoice date with payment date

Fixing these issues comes from better habits and tools. A financial forecasting tool tied to real data and updated regularly reduces errors.

How to Keep Your Cash Flow Forecasting Template Accurate Over Time

Accuracy depends on attention. Forecasts drift quickly when not updated. Make it part of your routine. Schedule time each week to check actual performance against the forecast.

When numbers differ, ask why. Did a client pay late? Did a cost increase? Adjust the model. Forecasting is not a one-time activity. It is a continuous process.

Image: Share reports features on Cash Flow Frog | source: cashflowfrog.com

Practical Tips for Getting More Value Out of Any Template

Accuracy improves with use. The more often you update, the more reliable even the most basic cash flow forecast template becomes.

- Focus on timing, not totals

- Track your five largest inflows and outflows more closely than the rest

- Flag weeks where cash drops below your desired threshold

- Keep a simple notes column to explain changes

- Compare forecasted numbers with actual outcomes each month

Turning a Cash Flow Forecasting Template Into a Decision Tool

A free cash flow forecast template becomes even more powerful when paired with financial reporting software that updates forecasts in real time. Its purpose is not to document history but to show whether your next move creates stability or strain.

Planning an expansion? A 12-month cash flow forecast template can help test how decisions affect your liquidity over the next few quarters.

The value lies in action. A forecast gives you the confidence to move forward or the warning to hold back. Either way, it keeps decision-making grounded in real numbers.

Put your small business cash flow forecast template to work with CashFlow Frog and see your numbers update in real time as your business grows

Read more

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

Direct vs Indirect Cash Flow - Which Method Fits Your Business Better?

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now