Incremental Cash Flow

What Is Incremental Cash Flow and Why It Drives Business Decisions

Incremental cash flows help owners distinguish between promising ideas and costly risks. Every decision about expansion or upgrades carries uncertainty, even when projections look bright.

Should the company invest in a new product line, upgrade existing equipment, or open a new branch? The excitement of growth always carries the tough question: Will this move actually bring in more cash, or will it drain what’s already there?

What Is Incremental Cash Flow?

Incremental cash flows represent the additional money a business expects to generate or lose because of a single decision. It compares two realities: what happens if the project moves forward and what happens if it does not. The difference between those two outcomes forms the incremental cash flow.

It measures the financial pulse of change. Every expansion, upgrade, or new idea carries new inflows and new outflows. Some bring fresh profit; others quietly siphon resources from somewhere else.

Regular expenses that remain unchanged, such as rent or long-term contracts, are excluded from the calculation. This narrow focus keeps analysis clean and relevant.

Discover the true incremental cash flow meaning in every forecast.

Sign up today

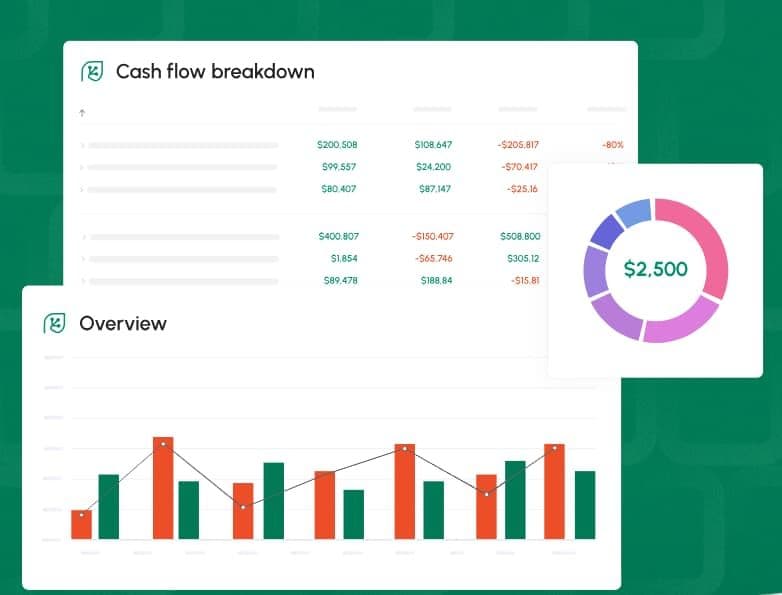

Daily, weekly, and monthly view of financial data on Cash Flow Frog | source: cashflowfrog.com

How Is Incremental Cash Flow Different from Regular Cash Flow

Regular cash flow shows the complete financial activity of the business. It captures sales, costs, taxes, and payments tied to normal operations. An incremental cash flows filter that filters down to what changes when a new initiative enters the mix.

A business may have a healthy total cash flow yet still face a bad project decision. For example, a manufacturing firm might produce strong overall profits but lose money on a new product line. Regular cash flow hides that problem because the losses get absorbed into the broader total.

For small and mid-sized business owners, this difference matters deeply. Regular cash flow helps keep the lights on. Incremental cash flow determines which new opportunities are worth pursuing.

What Goes Into the Incremental Cash Flow Formula

The incremental cash flow formula may seem complicated, but it’s really about one question: Does this project bring in more cash than it costs?

Incremental Cash Flow Formula = (Cash Inflows from Project – Cash Outflows from Project) – Initial Investment

Inflows are the money that comes from sales, savings, or new customers. Outflows are the costs incurred due to the project. The initial investment is what you pay upfront to get started. When these numbers are based on real, honest estimates, the incremental cash flow formula gives a clear answer about whether the project helps or hurts your bottom line.

Revenues vs. Expenses

Revenue shows how much new money a project is expected to generate. It may come from new products, expanded services, or better use of resources.

Expenses show what the business must spend to make those results possible. This includes staff wages, production costs, utilities, and marketing.

If the money earned exceeds the money spent, the project generates a positive cash flow.

A strong revenue forecast means little if expenses rise just as fast. That’s why managers often test multiple versions of the same scenario. One shows optimistic expectations, another moderate, and a third outlines the cautious case.

Planned vs Actual cash flow data on Cash Flow Frog | source: cashflowfrog.com

Taxes, Depreciation, and Working Capital

Tax effects can turn a profitable idea into a disappointment if ignored. Extra income increases taxable profit, while deductible costs reduce it. Depreciation, though non-cash, influences taxes because it lowers reported profit. It reduces taxable income, which in turn influences how much cash the business retains after taxes. That makes it part of the incremental cash flow conversation, even if no real money leaves the business.

Working capital also changes with new projects. Extra sales can mean larger inventories or longer payment terms. Both situations tie up cash that could have been used elsewhere. If growth happens faster than cash returns, even a successful project can strain liquidity.

Including tax and working capital impacts transforms a simple forecast into a full picture. The more complete that view, the fewer surprises appear later.

Real-World Examples of Incremental Cash Flow

Every business faces crossroads where numbers look promising but reality feels uncertain. Incremental cash flows turn those “what ifs” into measurable facts. Incremental cash flow examples:

- In manufacturing, a company weighs replacing an old machine. The new model costs $250,000 but cuts $60,000 a year in labor and repair expenses. Incremental cash flow tracks when the savings cover the cost and when the investment begins to produce actual gain.

- In technology, a software firm designs a cheaper version of its main product. New customers arrive, but some existing users switch to the lower-priced plan. Revenue rises while profit falls. Incremental cash flows uncover the risk before launch, allowing time to adjust pricing and protect margins.

Built for business owners, accountants, and finance teams who want more than an incremental cash flow definition.

Try todayWhy Incremental Cash Flow Crucial in Capital Budgeting

In capital budgeting, companies must decide where to allocate their long-term funds. Incremental cash flow acts as the filter that separates strong ideas from weak ones. It shows which projects generate real, lasting revenue after every expense.

Managers use it to calculate Net Present Value and Internal Rate of Return, both of which rely on accurate cash projections. A project that creates steady positive incremental cash flow over time signals strength. One that struggles to stay above zero warns of risk.

Without incremental analysis, companies may commit large sums to projects that only appear profitable on paper.

Business cash flow forecast dashboard showing incremental cash flow projections and real-time inflows and outflows. | source: cashflowfrog.com

Pros and Cons of Using Incremental Cash Flow

Every financial measure carries both advantages and limitations. Understanding both sides keeps judgment sharp.

Advantages

Incremental cash flow delivers transparency. It tells managers what a project truly adds, not what they hope it adds.

It also allows comparison across different proposals. When two projects promise growth, incremental cash flow reveals which one actually delivers higher returns after all costs. The method acts as a financial equalizer, giving small businesses the same analytical advantage larger corporations enjoy.

Limitations and Common Pitfalls

Forecasts depend on assumptions, and assumptions change. Markets shift, suppliers raise prices, and customers behave differently than expected. Incremental cash flow cannot predict every twist, so flexibility matters.

Another frequent issue involves hidden opportunity costs. Time, staff, and equipment dedicated to one project cannot serve another. If that trade-off is ignored, potential profit elsewhere disappears quietly.

Cannibalization adds complexity when new products undercut existing ones. And many owners mistakenly include sunk costs (money already spent) before deciding. Those amounts should never appear in the incremental cash flow because they no longer influence future decisions.

How to Calculate Incremental Cash Flow Step by Step

The aim is to measure the additional revenue generated by a project after accounting for all costs.

| How to calculate incremental cash flow | What to do | Example |

|---|---|---|

| 1. Estimate cash inflows | Identify new sales, savings, or added efficiency | +$200,000 |

| 2. Record cash outflows | Include materials, labor, marketing, and utilities | −$120,000 |

| 3. Apply taxes | Calculate tax on project profit before depreciation | −$20,000 |

| 4. Add back depreciation | Return non-cash expense to reflect tax benefit | +$3,750 |

| 5. Adjust for working capital | Account for extra inventory or delayed payments | −$10,000 |

| 6. Subtract initial investment | Deduct equipment or setup costs | −$50,000 |

Result: Incremental Cash Flow = $3,750

When calculating incremental cash flows, positive cash flow signals financial gain. A negative figure suggests the project needs new pricing, lower costs, or tighter execution.

Tools to Track and Project Incremental Cash Flow

Spreadsheets remain the traditional tool, but they leave room for manual error. Many modern platforms now automate the incremental cash flow calculation formula, updating results as sales or costs change in real time.

Cashflow software like Cashflow Frog, for instance, allows teams to create dynamic projections that adjust automatically as numbers change.

These cash flow evaluation tools simplify scenario planning. Users can test different scenarios by changing one number, like sales growth or cost increases, and the cash flow updates right away.

Forecast scenario feature on Cash Flow Frog | source: cashflowfrog.com

Incremental Cash Flow in Project Evaluation

Project evaluation uses incremental cash flow to check how close real results come to early forecasts. This planned vs actual review shows whether a project builds cash or drains it.

Lower-than-expected inflows often signal issues with sales, pricing, or cost control. When results improve, it shows what drives stronger performance.

Ongoing evaluation keeps projects realistic and ensures every decision connects to measurable financial outcomes.

Incremental vs. Marginal vs. Total Cash Flow

These cash flow types help a business see money from different angles.

- Incremental cash flow measures the amount a project adds to or subtracts from total cash. It is calculated using the incremental cash flow calculation formula, which compares cash inflows and outflows for the business with and without the project.

- Marginal cash flow examines the changes that occur when a company produces just a little more.

- Total cash flow represents all cash generated and spent across the business during a given period.

For instance, a furniture manufacturer planning to buy automated equipment checks the incremental cash flow to see how it affects total profit. They also review marginal cash flow to determine if a 10 percent production increase improves efficiency or erodes margins.

Common Mistakes When Interpreting Incremental Cash Flow

One major mistake involves mixing past and future costs. Money already spent cannot change, so adding it to a new project hides the real impact. Timing also matters. A project may show strong revenue, yet late payments and early expenses strain cash.

Missing taxes, depreciation, or opportunity costs causes more distortion. Each affects the amount of money that actually stays in the business. Effective analysis means checking what truly changes because of the project and ignoring what does not.

Incremental Cash Flow in M&A and Expansion Decisions

Mergers create new revenue paths but also duplicate expenses. Incremental cash flow separates the two. It identifies real savings from shared systems and flags integration costs that cut early profits. Leaders see the net impact before signing the deal.

Expansion decisions follow the same thinking. The analysis shows if a new store or product line increases total cash or only shifts sales around.

Forecasting Incremental Cash Flow Over Time

The incremental cash flow should evolve in tandem with the business. A single-year incremental cash flow projection often hides the full picture. Most projects require upfront spending before generating returns. Modeling the forecast across several years shows how cash flow behaves through investment, ramp-up, and maturity.

Through incremental cash flow forecasting, business owners can test what happens if sales fall short or costs rise unexpectedly. Rolling forecasts updated quarterly keep projections connected to current performance. This ongoing review transforms incremental cash flow from a static number into a living financial guide.

Is Incremental Cash Flow the Missing Link in Your Financial Strategy

For many business owners, incremental cash flow becomes the bridge between vision and financial truth. It connects ideas to outcomes in measurable terms. Every expansion, campaign, or investment can be tested before money leaves the account.

Teams see how each department’s decisions affect the company’s overall cash position. Success becomes quantifiable, not theoretical. By grounding ambition in data, incremental cash flow empowers leaders to grow boldly while protecting what they have worked hard to build.

To understand what is incremental cash flow, you need to know where your money truly moves.

Start building smarter business project cash flow forecasts and make confident decisions backed by data with CashFlow Frog.

Start nowRelated Terms

FAQ

Looking for more help?

Visit our help center to find answers to your questions about CashFlowFrog.

Trusted by thousands of business owners

Start Free Trial Now