Forecasting scenarios —

See the results of your business decisions before you make them

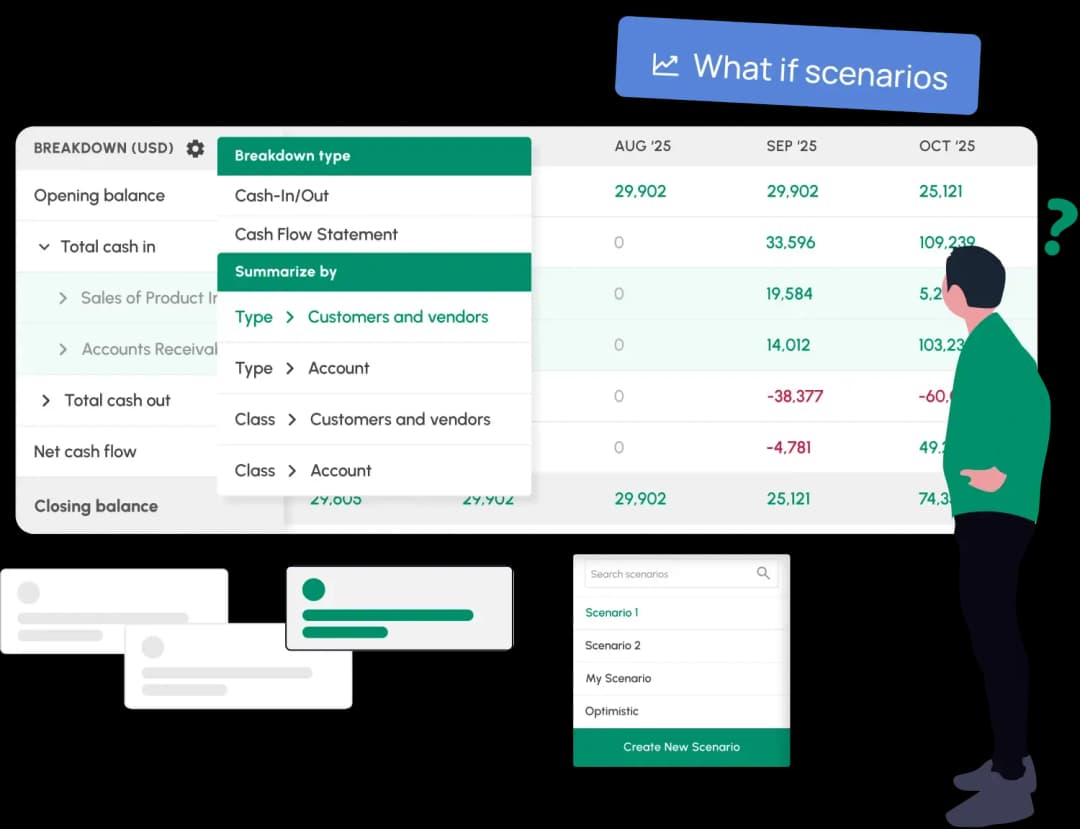

A smart way to simulate the consequences of your decisions

How would hiring a new salesperson impact your business? Sales may increase, but so will your expenses. Would it be profitable?

How would your bottom line be affected if you sign a new customer? They’ll bring in revenue but also require more employee time.

Forecast scenarios allow you to simulate simple or complex sequences of changes. You can use scenario forecasting or multiple cash flow scenario forecasting to see the impact of every option on the table.

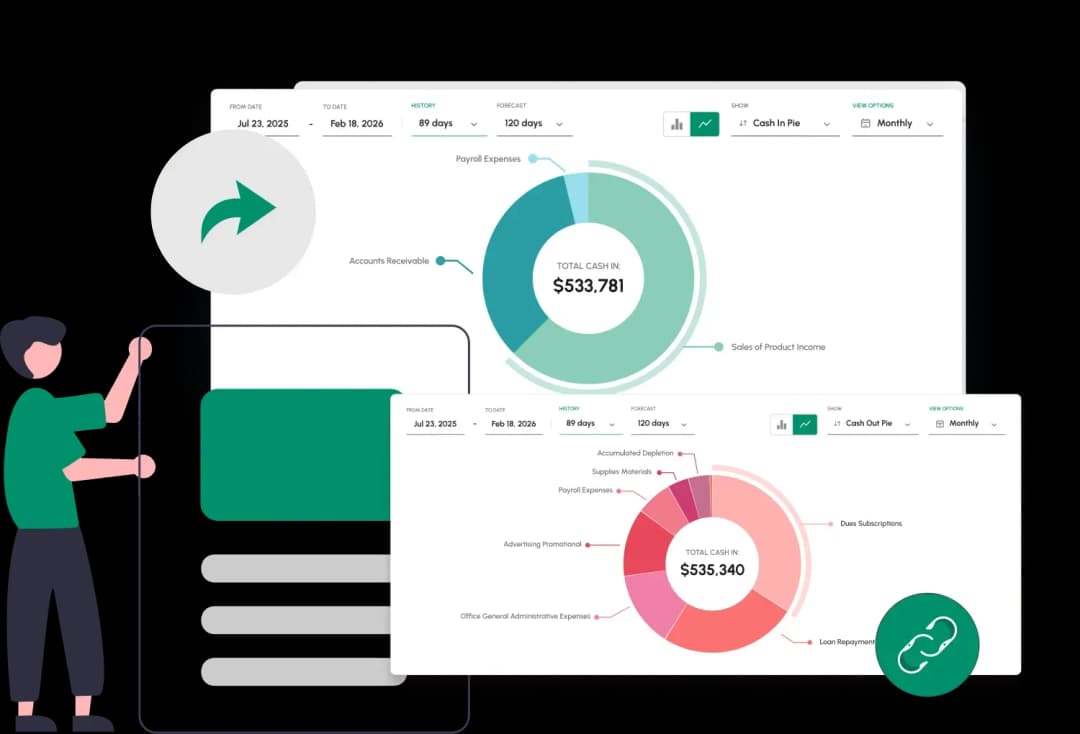

Reach conclusions and share them with your partners

- Makes forecasting cash flow scenarios simple

- Improves future planning by giving you the information you need

- Create sales forecast scenarios before major promotions of product launches

- Test headcount forecast scenarios before making hiring decisions

Test headcount forecast scenarios before making hiring decisionsour stakeholders Start Free

Ready to take control of your cash flow?

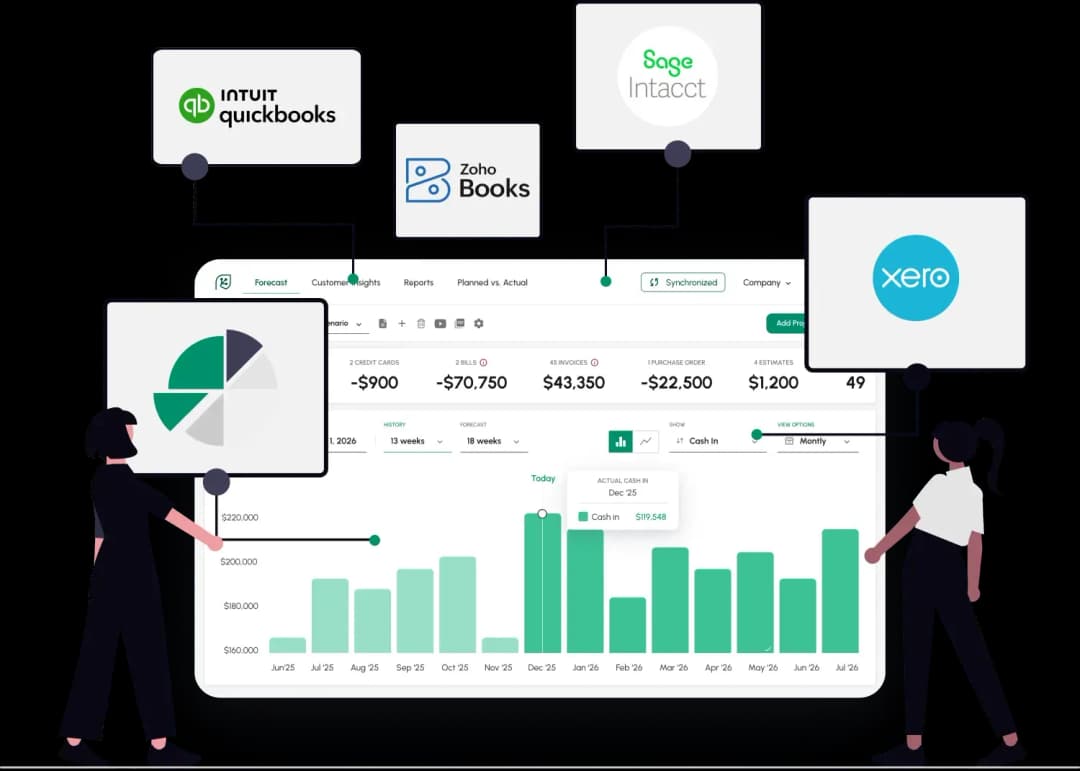

It makes cash flow forecasting dead simple, all QuickBooks updates are automatically updated in the app, new invoices or bills are integrated into the forecast.

Maria Davis

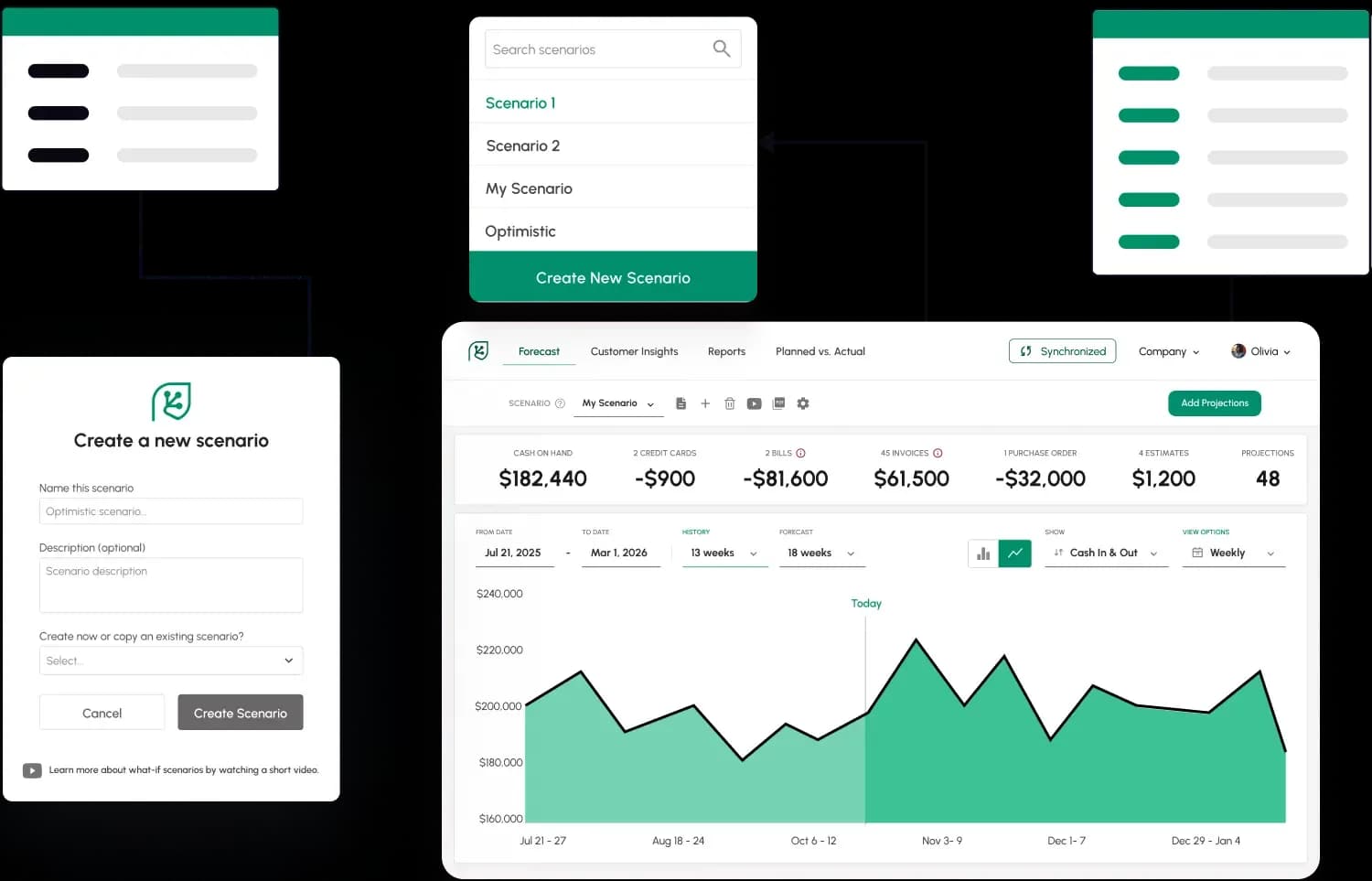

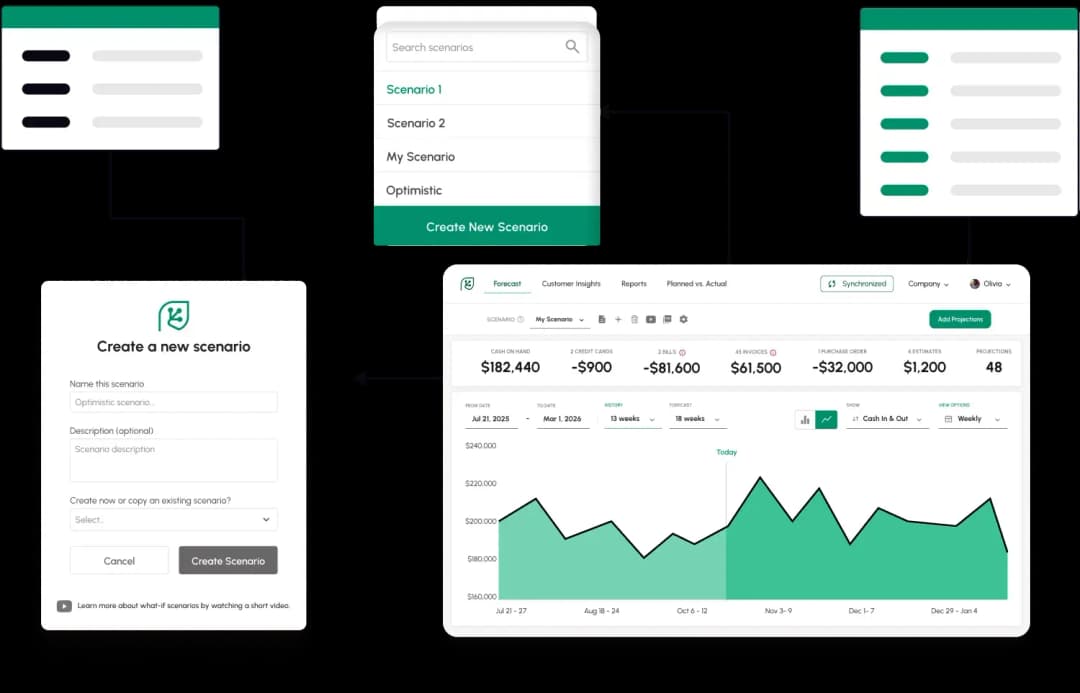

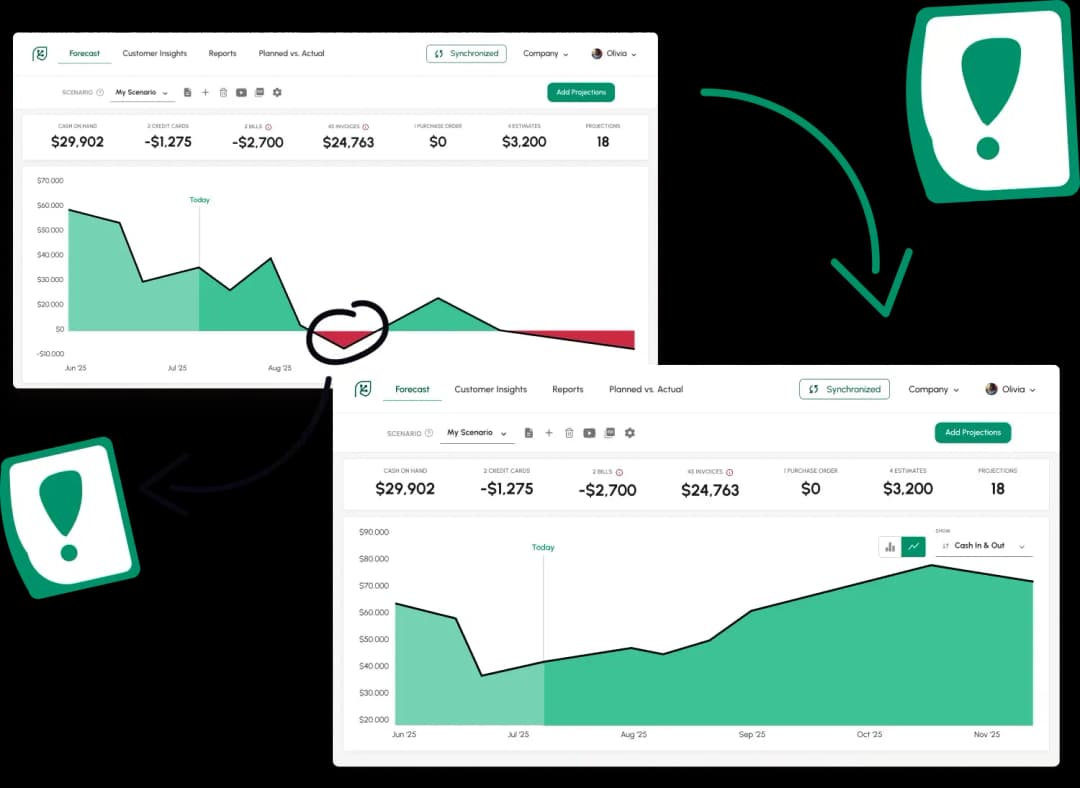

Easily create and manage your forecast scenarios

- Create brand new forecasts, or simply duplicate existing ones.

- Model multiple cash flow scenarios forecasting future changes without changing your actual accounting data.

- Give each forecast a name and description so you know exactly which possible scenario it represents.

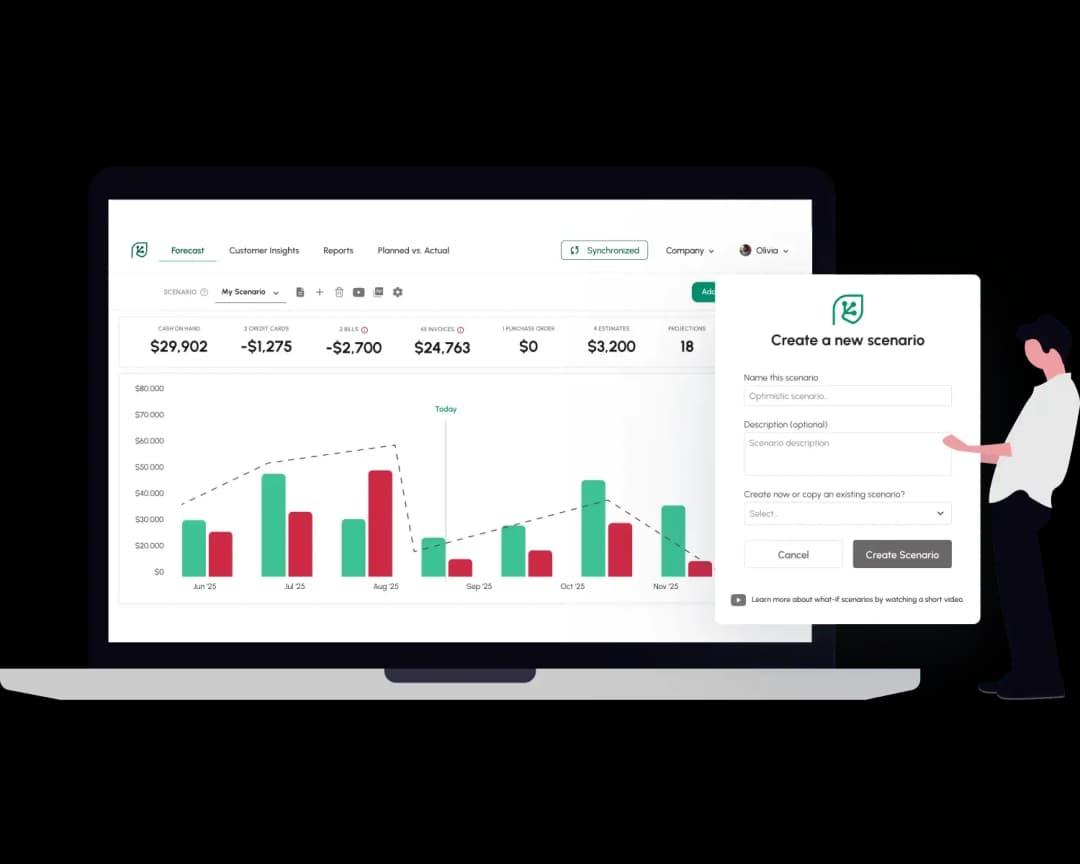

Freely test changes without affecting your accounting software data

Test changes in any financial aspect of your business: Payroll, salaries, include or exclude customers’ invoices, vendors’ bills, and much more.

Changes will only affect the forecast scenario you are testing. Other forecasts will not be affected and the data in your accounting software (QuickBooks Desktop, QuickBooks Online, Xero etc.) will not be affected at all.

What’s the difference between scenario planning and forecasting?

Cash Flow Frog is a natural add-on to your accounting software

Track your cash flow metrics in real time

Get Answers

Scenarios can answer very important questions

Use Scenarios to test events that occur only once, such as a one time purchase, or changes that will have a recurring effect on your business, such as hiring a new employee, or increasing your rent.

Scenarios can easily be used to test multiple changes in cases where one change triggers others. For example:

FAQ

Create a scenario

Start Free Trial Now