Monthly Cash Flow Forecast

Cash flow is a crucial part of every business. If you do not have positive cash flow, you need to either secure financing (debt) or sell equity in the business. You need a lot of capital or financing to withstand negative cash for long periods of time.

What is monthly cash flow?

That's what we’re going to explore in this article.

What Is A 13-week Cash Flow?

A 13-week cash flow forecast is one of the most widely used “periods” when creating projections. The 13-week model is exactly one quarter, so it will provide insights into the coming quarter’s:

- Cash inflows

- Cash outflows

Many businesses like to plan their operations for the coming quarter so that they can promote as much growth as possible. For example, you may find that the forecast shows negative cash flow in the quarter, so you can take action, such as:

- Reducing expenses, like laying off workers or trimming down unnecessary costs

- Taking out loans or credit to cover upcoming expenses

When trying to secure funding or lure investors to your business, you can also use a 13-week cash flow to secure funding. However, you can also opt to create a monthly forecast to learn more about your short-term cash position.

But what is monthly cash flow?

This is the cash flow that you have after a single monthly period. You'll find that there are numerous benefits to running a cash flow forecast that is shorter in length. If you forecast cash flow that is 12+ months in the future, it will become less accurate.

When to Use a Monthly Cash Flow Forecast

Do you need a monthly cash flow statement? Absolutely. The statement will provide invaluable insight into your business’s operations and goes beyond a daily or weekly forecast. You'll want to create monthly projections regularly.

Most companies begin running forecasts of this length when:

- Management wants to understand future cash reserves

- You want to understand how sales will perform for certain business segments

- Creating budgets to understand what an organization can and cannot afford

- Daily or weekly statements do not provide enough information to make smarter decisions

Understanding that the month ahead may have sluggish sales and that a business may not be able to make debt payments allows businesses to take action. A month is enough time to secure financing and allow operations to continue uninterrupted.

However, if you run a weekly forecast, you may see a 25% boost in sales and not realize that by the end of the month, your revenue is down 25%. The more insight that you have into your cash position, the better. Monthly cash flow statements provide insight into operations that drive decision-making.

When Is a Monthly Cash Flow Forecast Not Suitable?

What is monthly cash flow? A 28 – 31-day forecast, depending on the number of days in the coming month. This should signal the main time when this type of forecast isn’t ideal: for the long term.

Short-term forecasts are just as important as long-term ones.

However, you’ll find that if you want to plan to expand operations or release new products, it’s best to have a forecast that spans more than a month. You may have a record-breaking month in December and then experience a 70% drop in sales in January.

Making long-term decisions based on a monthly forecast is never suitable.

Do I Need Monthly Cash Flow for My Business?

While you can operate without running cash flow reports or projections, you’re doing your business a disservice by not using monthly cash flow statements. The world’s most successful businesses use monthly reports to fully understand their:

- Financial position

- Liquidity

- Potential funding needs

If you’re running a successful business, having a monthly cash flow will only strengthen your operations and allow you to plan for the future. In fact, there are many advantages to running one of these reports.

Advantages of a Monthly Cash Flow Forecast

Creating a monthly cash flow forecast has a lot of advantages, including:

- Insight into potential negative monthly cash flow situations

- Knowing when additional financing is necessary

- Making smarter business decisions

- Greater accuracy than longer projections

- Data to provide investors and business leaders

You need to analyze these projections properly to leverage them to your advantage. If you uncover potential negative cash flow situations, you’ll have time to correct them, thanks to the forecast you make.

How to Make a Monthly Cash Flow Forecast

Now that you can answer the question “what is monthly cash flow?” you should learn how to make your forecast. Instead of showing you a monthly cash flow statement example, it’s better to sign up for Cash Flow Frog and create your own report.

If you want to create a report on your own, you’ll need:

- A list of all cash expected to come into the business

- A list of all expected expenses

Gather as much information from past periods as you can to have concrete figures for both cash inflows and outflows. You'll then want to account for traditional gains and losses during the month to adjust these figures properly.

With this in mind, you need to sum your inflows and outflows and then subtract your outflows from your inflows to learn your projected cash flow.

Why A Monthly Cash Flow Isn’t Enough

You should create a monthly cash flow report, but is it enough? No. You can use a monthly report for short-term liquidity planning. However, you will find that making the right business decisions will require:

- 13-week forecasts

- Longer forecasts

- Hybrid forecasts

Many business owners will use a hybrid approach to increase the accuracy of their forecasts. It's insightful to see what your cash position will be in 4 weeks, 8 weeks, 13 weeks and longer.

What Are the Advantages of Automated Cash Flow Forecasting?

A monthly cash flow plan can help you review the short-term cash position of your business and allow you to make smarter business decisions. If you’re wondering what the advantages of automated cash flow forecasting are, they include:

- Easy, hand-off way to understand business growth and declines

- Save a lot of time and resources using an automated monthly cash flow calculator

- Better understanding of current liquidity

Software and tools that allow you to create automated cash flow forecasts are empowering and will remove the need to have accounting teams manually create projections.

On top of this, your business will have the information it needs at its fingertips to make smarter decisions. If you see that you’ll have excess cash at the end of the month, you can opt to invest the money to grow operations or offer bonuses to your workforce to improve retention rates.

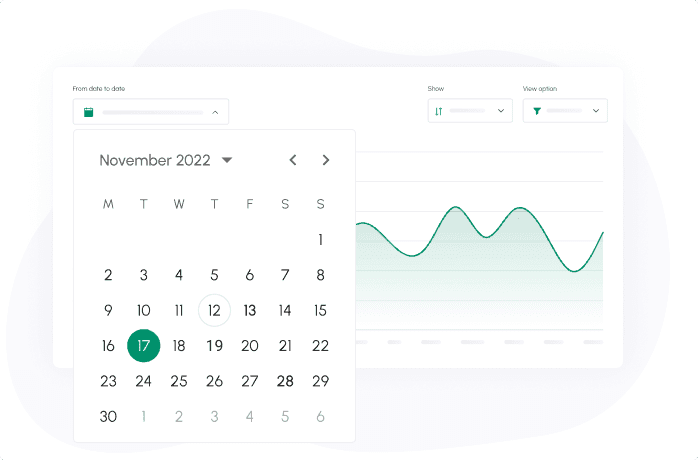

Cash Flow Frog Software to Create a Monthly Cash Flow Forecast

If you’re looking for the industry’s leading cash flow forecast tool, you’re welcome to give Cash Flow Frog a try. You can run your monthly cash flow forecast using data that you already have by integrating with QuickBooks, Xero or FreshBooks – among many other platforms.

We make it fast and easy to begin running forecasts and even create scenario plans.

If you want to take the complexity out of your forecasts and improve overall accuracy, we offer a free trial that you can begin using today to gain control of your cash flow.

How to Calculate Free Cash Flow (FCF): Formulas + Real Examples

Read more

The 3 Types of Cash Flow: What They Mean and Why They Matter

Read more

Cash Flow Forecasting Template

Read more

Your Guide To Financial Metrics And KPIs

Read more

10 Cash Management Trends for 2026

Read more

10 Best Cash Flow Business Ideas: Build Income That Counts

Read more

FAQ

Trusted by thousands of business owners

Start Free Trial Now