One important aspect of managing a business’s finances is learning how to calculate capital expenditures. Capital expenditures are typically significant investments that businesses make into their business through the purchase of assets that promote or support growth. These expenses are treated differently from simple operational expenses.

Let’s take a closer look at what capital expenditures (capex) are, how to budget them, the types of capex, how to calculate capex and more.

What Are Capital Expenditures (Capex)?

If you’re a business owner, it’s important to understand:

- What is capex in finance

- What is a capex budget

The term “capex” sounds more complicated than it really is.

Capital expenditures, or capex, are funds a company uses to acquire, maintain or upgrade physical assets, like:

- Technology

- Property

- Equipment

- Buildings

For example, they may make capital expenditures on roof repairs, the construction of a new factory or the purchase of a new piece of equipment. Often, businesses will use capex to take on new projects or investments.

Capex is a special type of expense that is capitalized and listed on the company’s balance sheet rather than as an expense on an income statement. Capitalizing an asset means that a business will spread the expense over the asset’s useful life.

It's important to note that if the item’s useful life is less than one year, then it will be expensed on the income statement and cannot be capitalized (i.e., it would not be considered capex).

Capex also appears on a company’s cash flow statement under cash flow from investing activities. It may be listed as:

- PP&E (purchases of property, plant, and equipment)

- Capital spending

- Acquisition expenses

Some industries are more capital-intensive than others, such as:

- Oil exploration and production

- Manufacturing

- Telecommunications

- Utility industries

Companies that are in capital-intensive industries will engage in capex budgeting.

Capex budgeting: An e-commerce example capex budgeting

Capex budgeting is crucial to ensuring that a business operates and grows in a healthy way. Proper capex investment planning will typically involve:

Separating Capital Expenditure Budget

Companies typically budget their capital expenses separately. Separating capital expenditures from operational expenditures is beneficial for tax calculation purposes, as capital expenditures are spread out over the course of many years as amortization or depreciation.

Capital expenditures aren’t tax deductible directly, but they can be used to reduce a company’s taxes through their generated depreciation.

For example, if a business spends $100,000 on a piece of equipment that has a useful life of a decade, it could include $10,000 in depreciation expenses every year for up to ten years. That depreciation would reduce their pre-tax income by $10,000 per year.

Gathering Input from Department Heads

When creating a capex budget, companies typically gather input from department heads. These individuals know their department’s needs inside and out, which means they know what issues need replacement or updating.

Taking this approach to budgeting allows the company to gauge whether the proposed capital expenditures:

- Will benefit long-term growth

- Are feasible

- Will provide a return on the investment

While department heads may provide feedback, upper management and owners will ultimately have the final say when it comes to capital expenditure.

Setting a Limit for the Budget

One of the most important aspects of capital expenditure planning is setting a budget limit. Before setting a limit, the company must make a thorough assessment of its capex needs, whether it’s acquisitions, maintenance or growth. The results of this assessment will determine the limit for the budget.

Once a spending limit is in place, plans can be made around the budget.

Measuring Capex Returns

Once capital expenditures have been made, the company will then need to measure the returns on those investments.

Measuring capex returns allows the business to determine whether their valuations were correct and whether the investment is contributing to growth.

Types of CapEx

A variety of assets can be listed on a capex report. These are assets that provide long-term value to the business and have a useful life of more than one year.

Some of the many types of capex include:

- Equipment: Any machinery or equipment used to manufacture goods or create products that are ready for sale.

- Buildings: Structures used for goods manufacturing, office space, inventory storage or other similar purposes.

- Land: Used for further development or held as a long-term investment.

- Vehicles: Used to pick up clients, transport goods or provide staff with transportation.

- Computers: Used to support administrative and operational tasks, such as reporting or logistics.

- Patents: May hold long-term value, particularly if the idea is used in future product development.

- Furniture: Used to furnish the company’s commercial space.

- Upgrades to equipment or software: As software and equipment become obsolete, upgrades are necessary.

Capital expenditures are expenses spent on assets that will contribute to the company’s long-term growth or help them remain relevant in its industry. The assets listed above are just a few of the many types of capex that a business may have.

Capex Formula

Another important aspect of capex planning is learning how to calculate capex. The formula to calculate capex is as follows:

- Capex = Change in Property, Plant and Equipment + Current Depreciation

To calculate the change in Property, Plant and Equipment, simply subtract the current period’s Property, Plant and Equipment from the prior period’s Property, Plant and Equipment.

Example of the Capex Calculation in Excel

If you want to learn how to calculate capital expenditures, you can open up Excel and give it a try. The capital expenditure budget example will provide you with a basic understanding of how to begin creating your capex in Excel:

| Income Statement | 2021 | 2022 |

| Reveneue | 100,000 | 150,000 |

| Cost of Goods Sold (COGS) | 50,000 | 60,000 |

| Gross Profit | 50,000 | 90,000 |

| Expenses | - | - |

| Salaries and Benefits | 27,132 | 28,124 |

| Rent and Overhead | 10,000 | 10,000 |

| Depreciation & Amortization | 14,503 | 14,777 |

| Interest | 1,500 | 1,500 |

| Total Expenses | 53,135 | 54,401 |

| Earnings Before Tax | (3,135) | 35,599 |

| Balance Sheet | - | - |

| Assets | - | - |

| Cash | 277,789 | 310,000 |

| Accounts Receivable | 7,652 | 8,158 |

| Inventory | 11,111 | 14,521 |

| Property & Equipment | 35,258 | 36,545 |

| Total Assets | 331,810 | 369,224 |

| CapEx Formula | - | 16,064 |

Downloading a template for your capex calculations will allow you to:

- Reduce the risk of errors

- Improve accuracy

- Quickly run your calculations

Once you have all of this information available, you can work through the example below on how to use capex in your business.

Example of How to Use CapEx

Capex examples can provide you with the clarity that you need to better understand these expenditures. We're going to start with the following data points, kept to even numbers for simplicity, to show you how to use capex properly:

- Company A has $1 million in cash flow for the fiscal year

- Company A has $100,000 in capital expenditures for the fiscal year

You can use this data to create a cash flow to capital expenditure ratio. For example, for this calculation, you would use the following formula: (CF from Operations / CapEx). Filling in the numbers, you would have $1,000,000 / $100,000, or 10.

In this case, your cash flow is ten times your capital expenditures. You can also use capex depreciation to reduce these costs on your taxes. Under the above example, you can certainly invest more money in your business through a capex plan.

Even if you’re flush with cash, you should work with an accountant that knows how to forecast depreciation.

Reducing your tax burden through depreciation will help you keep more cash flow on hand and allow you to make smarter business decisions as a result.

What Is the Difference Between Capex and Opex?

Capex plans are very different from your operating expenses (Opex). Operating expenses are often static, or at the very least, the changes that they do incur are marginal. For example, most businesses have the following predictable Opex:

- Rent

- Utilities

- Payroll

How often do these payments go up? Lease and rent costs may go up annually, but you may have a long-term agreement where they do not change for several years. Workers may receive annual raises, but they do not receive frequent raises.

On top of this, capital expenditures are tax deductible.

You can write off many expenses, such as your rent or lease payments, utilities and payroll. However, you cannot write off your capital expenses in the same way. For example, you can depreciate a Capex, such as aging equipment, but you can fully deduct your Opex from your business’s income statement.

As a business owner or leader, it’s crucial for you to:

- Manage and understand your capital expenditures

- Manage your operating expenditures

If you realize that your operating expenditure is up 40% from the year prior due to market conditions, you may be able to find ways to tame these costs.

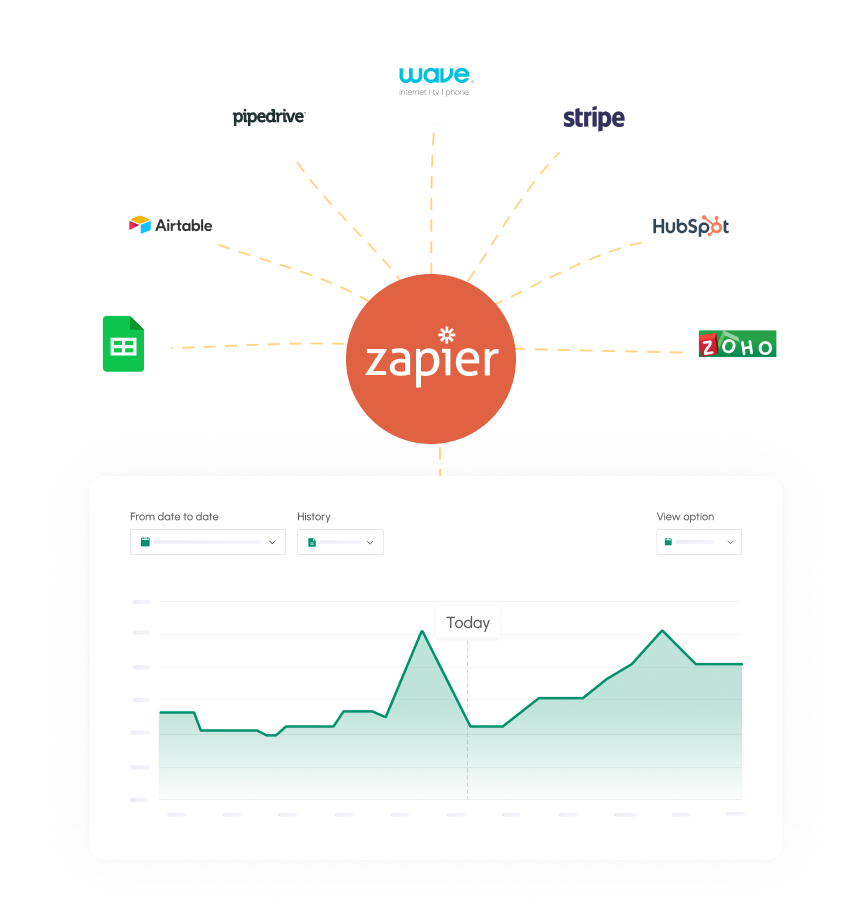

Streamline Capex Planning with Cash Flow Frog

Forecasting capital expenditures should be a part of your mid- and long-term financial plans. Your business needs to make smart decisions, and Cash Flow Frog can help. With this one powerful tool, you can run scenarios to better understand how scenarios will play out for your business.

For example, you can run a scenario of equipment A vs equipment B to understand:

- Which asset is the best to invest in

- When you’ll have the cash to invest in the asset

You can also use the depreciation method to help reduce your income in the process.

Cash Flow Frog makes it simple and easy to begin your capital expenditure planning with tools, integrations and features that will help you better manage your business. With the resources available, you can begin in-depth financial planning, forecast your cash flow for any reporting period you wish (up to three years) and run scenarios on the Capex plan that you have in place.

Click here to try Cash Flow Frog if you want to take the guesswork out of capital expenditure.

Related posts:

You may be interested:

New: