A cash break even analysis is an integral analysis that businesses should use to reach their fixed costs. For example, the analysis may find that there's enough cash flow to continue operations, but below the break-even point, the business will need to do one of a few things:

- Obtain additional financing

- Liquidate assets

- Lower overhead costs

When trying to determine the point of breaking even, it's essential to have an analysis performed to understand a business's financial health. If the business fails to break even or have additional cash flow, it's doomed to fall.

How Do Break Even Analysis and Cash Flow Forecasting Work?

Before looking at how a break even analysis and cash flow forecast work together, it's important to define breakeven. What is the meaning of break even?

- Break even is the point at which your profits equal your costs.

In other words, it's the point at which your business's revenue is equal to its operating costs. Your business is generating enough sales to cover the cost of being in business.

A cash flow break even analysis can help you understand the financial health of your business by telling you:

- How much sales revenue do you need to cover your expenses

- When the money from these sales will be collected

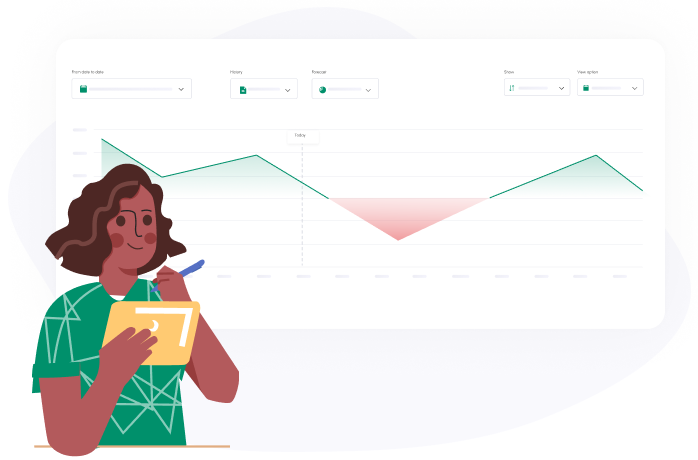

Break even point calculations often play an essential role in creating cash flow forecasts. Cash flow forecasts are used to help businesses predict slow periods and plan ahead for them to avoid negative cash flow (i.e., running out of money).

Break even points can be incorporated into cash flow forecasts to help create data-driven revenue and sales goals that ensure the business's core operating costs are covered.

Cash Flow Break Even Point Formula

Multiple factors are involved in the cash break even point formula. In fact, there's not a typical mathematical formula to follow to determine a business's cash break even ratio or perform a cash analysis.

What is cash analysis?

It's a sum of:

- Total fixed costs (rent, leasing, loans, wages), plus

- Total variable costs (new equipment purchases, supplies, materials), minus

- Cash in hand, plus

- Cash in bank accounts, plus

- Accounts receivable that are due

Once you have this sum, you'll need to subtract all of the cash flow from your costs. The break even point is right in the middle. You didn't make or lose any money if you hit the break even point. Instead, you have enough money to pay the bills and keep operations going.

You can also expand on the break even cash flow formula by including past data.

For example, you may be able to forecast next month's break even point by looking through the past 3 years of data for the month to understand variable costs and cash coming into the business.

Using a cash break even calculator can help you make these calculations more quickly and with a lower risk of errors.

For a more detailed explanation, check out this break even analysis video.

Business Essentials: Why Is It Important to Have a Cash Flow Forecast and Break Even Point?

Cash flow forecasts and break even points work together to help businesses understand where they stand financially, where their business is headed, and where to make changes to improve their company's profitability.

A cash flow forecast helps your business:

- Predict how much cash you'll have over a set period.

- Track client payments.

- Create budgets.

- Understand how much it's spending on administration, marketing and other expenses.

But how can you tell whether you're spending too much on operating costs, marketing, etc.? How can you create a sound budget?

That's where your break even point comes in. Your break even point is a threshold of sorts. Any activity that puts you below this point can be risky for your business because it means you're spending more than you're bringing in.

You can use this figure with your cash flow forecast to ensure:

- You don't go below your break even point.

- Your operating costs don't push your business below its break even point.

A break even point and a cash flow forecast will help you better understand your company's financial heal and allow you to make data-driven decisions thatltivate growth.

Examples Of Break Even Analysis In Healthcare

There are many benefits to conducting a break even analysis, such as:

Make Smarter Pricing Decisions

Knowing your break even point can help you price your products or services smartly. There are many factors that go into pricing, but you have to know your baseline.

If your prices aren't high enough to cover your operating costs, your business will never break even, let alone turn a profit. And if you're only breaking even with your pricing, you'll struggle to grow because you won't have any surplus cash.

Help You Reach Your Goals

A break even analysis can help your business reach its goals, whether that be increased revenue or growth.

For example, suppose cash flow neutrality was your goal. In that case, you could use a cash break even analysis to determine how much cash to move out of the business and back to investors through dividends or repurchases.

Set Revenue Goals

Once you understand your break even point, you'll know how much you need to generate in revenue to become profitable. It's much easier to set goals and follow through when you have concrete numbers in mind.

Make Better Business Decisions

A break even analysis can help you make smarter business decisions, especially when combined with a cash flow forecast.

Both will allow you to make decisions based on facts and figures rather than emotions. Additionally, forecasting and break even analysis will allow you to mitigate risks and better understand whether a business idea should be executed.

Fund Your Growth

A break even analysis is typically required if you want to take on debt to fund your business growth (or launch). Investors will also want to see this analysis before deciding whether to invest in your business.

Understanding your cash flow break even point will help you make decisions that support growth and sustainability. Used alongside a cash flow forecast, you can get a clearer picture of your business's financial health and how much revenue you need to generate to reach your goals.

Related posts:

You may be interested:

New: